What Wall Street Analysts Are Saying About Alibaba: Insights You Can Use

Investors commonly rely on Wall Street analysts’ recommendations to guide their decisions on whether to Buy, Sell, or Hold a stock. While changes in ratings from brokerage analysts can influence stock prices, are these recommendations truly valuable?

To answer this, we’ll examine the insights on Alibaba (BABA) and evaluate how brokerage recommendations should factor into your investment strategy.

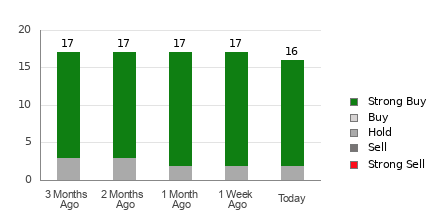

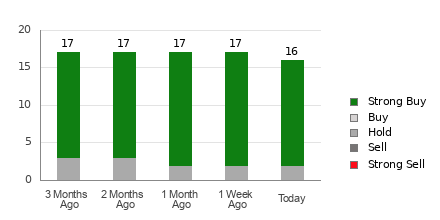

Currently, Alibaba has an average brokerage recommendation (ABR) of 1.25, which is rated on a scale from 1 to 5, where 1 represents a Strong Buy and 5 indicates a Strong Sell. This ABR reflects the recommendations from 16 brokerage firms and suggests a leaning toward the Strong Buy category.

Out of the 16 recommendations contributing to this ABR, a notable 14 are Strong Buy, making up 87.5% of the total recommendations.

Latest Brokerage Trends for BABA

For detailed price targets and stock forecasts for Alibaba, click here>>>

While a favorable ABR suggests potential for Alibaba, it’s prudent not to base investment decisions solely on this indicator. Research indicates that brokerage recommendations often do not lead investors to the stocks likely to rise the most in value.

You might wonder why that is. Brokerage firms’ interests can create a bias, leading analysts to issue overly positive ratings. Studies show that for every “Strong Sell” recommendation, there are five “Strong Buy” recommendations.

This indicates a disconnect between analysts and retail investors, often obscuring the real direction of a stock’s price. Thus, using this information to confirm your own research may be more effective.

Zacks Rank offers an alternative rating system, divided into five categories from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This system has demonstrated a solid record of predicting a stock’s price movements. Validating the ABR with Zacks Rank can help enhance investment decisions.

Understanding the Difference: ABR and Zacks Rank

Despite both measures using a 1-5 scale, ABR and Zacks Rank are fundamentally different. The ABR is based only on analyst recommendations and often includes decimals (e.g., 1.28), while Zacks Rank is a quantitative model founded on earnings estimate revisions, presented in whole numbers from 1 to 5.

Brokerage analysts tend to be optimistic in their ratings, often more favorable than warranted by research due to conflicts of interest from their employers. This can mislead investors rather than guide them.

Conversely, Zacks Rank focuses on earnings estimate revisions, which have a proven correlation with stock price movements in the short term.

Furthermore, Zacks applies grades proportionately across all stocks with current-year earnings estimates from brokerage analysts, maintaining balance among the rankings.

Additionally, timeliness separates the two measures. The ABR might not reflect the latest recommendations, while changes in earnings estimates are quickly incorporated into the Zacks Rank, making it a more relevant indicator of future trends.

Evaluating Alibaba as an Investment

Looking at earnings estimate revisions for Alibaba, the Zacks Consensus Estimate for the current year has risen by 7.2% over the last month to $9.52.

This increasing optimism among analysts highlights a consensus that could lead to significant stock performance. The magnitude of this recent estimate change, combined with other earnings-related factors, has earned Alibaba a Zacks Rank #1 (Strong Buy). You can explore the complete list of Zacks Rank #1 (Strong Buy) stocks here>>>>

Therefore, while the ABR for Alibaba offers a helpful guide, combining it with other analytical tools will strengthen investment choices.

Spotlight: Zacks Identifies Top Semiconductor Stock

This stock is only 1/9,000th the size of NVIDIA, which has surged over +800% since our recommendation. Although NVIDIA remains strong, our new leading semiconductor pick has substantial growth potential ahead.

With robust earnings growth and an expanding customer base, it is well-positioned to meet the growing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is forecasted to increase from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

For the latest stock recommendations from Zacks Investment Research, you can download our report on 5 Stocks Set to Double at no cost. Click here for details.

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

For the full article on Zacks.com, click here.

Zacks Investment Research

The views expressed here are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.