Logitech Struggles Amid Market Challenges But Champions Inclusivity with New Products

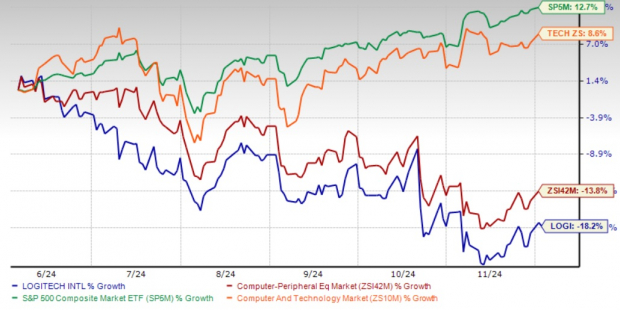

Logitech LOGI shares have lost 18.2% over the last six months, trailing behind the Zacks Computer and Technology Sector, which saw growth of 8.6%, and the S&P 500 index’s increase of 12.7%. Similarly, LOGI has underperformed the Zacks Computer – Peripheral Equipment Industry, which declined by 13.8% in the same time frame.

The company faces significant challenges, including a drop in demand for its peripheral products and delays in product refresh cycles due to reduced IT spending and economic uncertainty. Nonetheless, Logitech remains dedicated to its principles, introducing innovative products aimed at enhancing inclusivity.

Recent Initiatives Show Logitech’s Commitment to Inclusivity

Logitech recently teamed up with Airdrop Gaming to promote the Audio Radar system. This tool helps individuals who are deaf or hard of hearing by converting in-game sounds into visual alerts via LED light bars. Consumers will be able to purchase this solution through Logitech G’s website.

This collaboration reflects LOGI’s long-standing tradition of launching socially conscious products and kicks off its “Start-Up for Good” initiative. Earlier, Logitech released the G Adaptive Gaming Kit, which was designed for gamers with accessibility needs. This kit contains several helpful tools, including variable trigger controls and customizable gaming pads, showcasing Logitech’s focus on thoughtful design for all users.

Logitech’s Innovative Products Drive Market Presence

Despite current market challenges, Logitech is actively innovating its product lineup. In the past year, LOGI has introduced cutting-edge audio products, such as the EVERBOOM portable speaker with 360° sound and the Logitech G ASTRO A50 X LIGHTSPEED wireless headset, as well as software enhancements like the Streamline plugin for Loupedeck users.

The company has also expanded its offerings in consumer electronics, catering specifically to gamers and office workers. Notable additions include the LIGHTSPEED Gaming Mouse and the Logitech G515 gaming keyboard. Logitech continues to assert its presence in the webcam market with advancements such as the AI-powered USB conference camera MeetUp 2 and a range of webcams suited for business use.

Logitech Expands Its Reach with New Partnerships

Further broadening its customer base, Logitech has released products specifically designed for users of major brands like Apple (AAPL). Under the Logi for Mac brand, LOGI has enhanced compatibility with macOS and iPadOS by launching specialized keyboards and accessories such as the MX Anywhere 3S and MX Keys S combo.

In addition, Logitech has received certifications to ensure its peripherals work seamlessly with Microsoft and Intel products. For instance, the Sight AI Camera has been certified by Microsoft Teams, while various Logitech mice and keyboards are verified for Intel Evo laptops, meeting stringent reliability and security standards.

Looking Ahead: Logitech’s Financial Forecast

With these innovative developments, Logitech forecasts sales between $4.39 billion and $4.47 billion for fiscal 2025. The Zacks Consensus Estimate for fiscal 2025 revenues stands at $4.43 billion, reflecting a year-over-year increase of 3.11%.

For earnings, the Zacks Consensus Estimate for LOGI’s fiscal 2025 earnings is $4.63, indicating a projected growth of 8.9% from the previous year.

Investment Recommendations for Logitech

Logitech is working to mitigate economic pressures with its innovative products, positioning itself for a potential recovery. Currently, LOGI is fairly valued, carrying a Zacks Value Score of B.

Given these considerations, we recommend that investors hold onto this Zacks Rank #3 (Hold) stock for the time being. You can find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Research Highlights Potential High-Performing Stock

Our team has released a list of 5 stocks poised for significant growth, potentially doubling in value within the next few months. Among these, Zacks Research Director Sheraz Mian highlights one stock as likely to perform exceptionally well.

This leading stock comes from an innovative financial firm with a rapidly expanding customer base of over 50 million. Its broad range of cutting-edge solutions positions it for substantial gains. While not every pick is guaranteed, this one has the potential to far exceed previous Zacks Picks like Nano-X Imaging, which increased by +129.6% in less than 9 months.

Free: See Our Top Stock and 4 Runners-Up

Want the latest recommendations from Zacks Investment Research? Download the report on the 5 Stocks Set to Double today for free.

Intel Corporation (INTC): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Logitech International S.A. (LOGI): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.