The Market’s Resilience

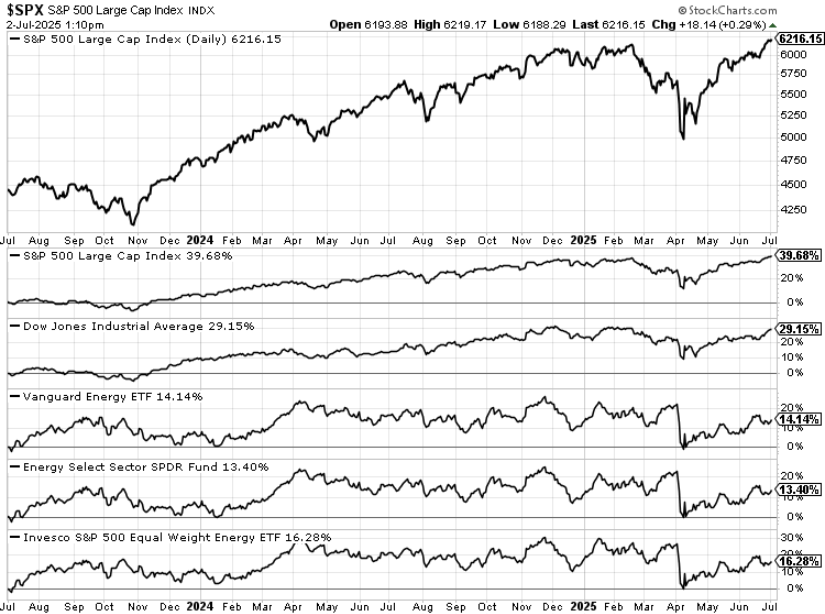

In a tremendous showcase of fortitude, the S&P 500 index, a crucial indicator for U.S. stocks, concluded February with a remarkable 5.3% surge, marking a fourth consecutive month of gains.

Since the tumultuous days of late October, the broader rally in the stock market has notched an impressive 25% increase, signaling a robust recovery.

The tech-heavy Nasdaq 100 has been a beacon of extraordinary resilience, breaching the 18,000-point milestone and ending the month at an all-time high. With a remarkable surge of 28% since late October, the Nasdaq’s performance underscores the persistent appetite for tech-focused investments.

Joe Biden’s take? “The stock market’s strength reflects confidence in America’s economy, a heartening sign of good news,” praising the market’s vigor.

As we navigate the captivating world of exchange-traded funds (ETFs), a select group has emerged as the magnets for financial inflows in the month of February.

The ETF Giants

Within this cohort, six ETFs offer access to broader equity indices, two pivot towards Treasury bonds, and one delves into the realm of cryptocurrencies such as Bitcoin.

The Top 10 US ETFs Receiving Inflows in February

| ETF | Fund Flows (1M) | AUM |

|---|---|---|

| Vanguard S&P 500 ETF VOO | 6.815B | 413.71B |

| iShares Core S&P 500 ETF IVV | 5.881B | 442.69B |

| Vanguard Information Technology ETF VGT | 5.786B | 69.413B |

| iShares Bitcoin Trust IBIT | 3.891B | 8.07B |

| Vanguard Intermediate-Term Treasury ETF VGIT | 3.1B | 24.816B |

| SPDR Portfolio S&P 500 ETF SPLG | 3.066B | 31.938B |

| Vanguard Total Stock Market ETF VTI | 2.819B | 374.803B |

| iShares Core U.S. Aggregate Bond ETF AGG | 2.348B | 101.583B |

| Invesco QQQ Trust, Series 1 QQQ | 1.874B | 252.624B |

| iShares 20+ Year Treasury Bond ETF TLT | 1.566B | 48.99B |

On the historic Friday of February 9, the S&P 500 index crossed the remarkable 5,000 milestone for the first time in its history.

This pivotal moment sparked a response from President Joe Biden, lauding the stock market’s performance as a signal of faith in America’s economic strength.

Curious to learn more? Roundhill demonstrates diverse ETF options with the ‘Magnificent 7’ lineup, entailing inverse and leveraged opportunities for astute investors.

Image: Shutterstock