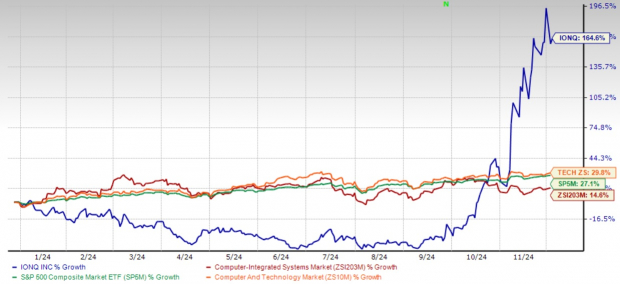

IonQ Faces Challenges Despite Impressive Stock Surge

IonQ’s IONQ stock has soared 164.6% this year, far exceeding the Zacks Computer and Technology sector’s return of 29.8%. However, financial sustainability concerns and valuation issues raise alarms for investors considering profit-taking. The company reported third-quarter revenue of $12.4 million, surpassing its guidance, but widening losses and deepening fundamental issues could indicate risks ahead. IonQ’s net loss expanded to $52.5 million in the third quarter of 2024, compared to a $44.8 million loss in the same quarter of the previous year, emphasizing ongoing challenges to achieving profitability.

Year-to-Date Performance Overview

Image Source: Zacks Investment Research

Rising Operational Costs Cause Concern

Though management celebrates $63.5 million in new contracts—including a notable $54.5 million agreement with the U.S. Air Force Research Lab—rising operational expenses are concerning. Operating costs jumped 36% year-over-year to $65.5 million, with research and development expenses increasing by 35% to $33.2 million. Despite having $382.8 million in cash and investments, the $23.7 million adjusted EBITDA loss for the quarter raises alarms about IonQ’s cash management and its implications for future operations.

Balancing Ambitious Expansion and Financial Reality

IonQ’s recent acquisition of Qubitekk for quantum networking and new partnerships with companies like AstraZeneca and Ansys illustrate growth ambitions. Nevertheless, these initiatives require substantial funding as the company faces ongoing cash burn. Plans for collaboration with NKT Photonics and imec to develop next-generation laser systems add to financial strain. While such ventures may yield long-term benefits, they introduce immediate risks in an uncertain industry landscape.

Competitive Pressures Amplify Challenges

IonQ must contend with fierce competition from major tech firms like International Business Machines (IBM), Alphabet (GOOGL), and Microsoft (MSFT), who are investing heavily in quantum computing. Even though the Qubitekk acquisition could bolster IonQ’s networking capabilities, its limited resources compared to better-funded rivals may impede its technological advancement. The rise of competitive players from China like Baidu and increased investments from companies like Amazon and Rigetti Computing only intensify these pressures and challenge IonQ’s growth prospects.

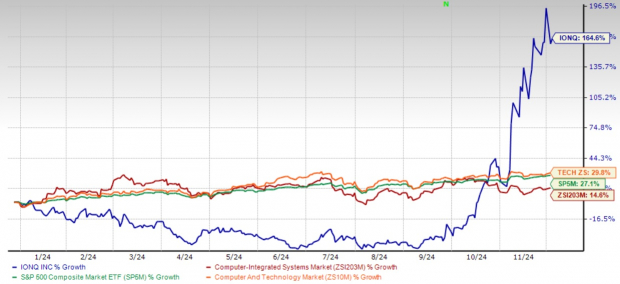

Valuation and Possible Dilution Concerns

Investor concerns mount as IonQ’s stock valuation appears inflated relative to its current financial performance. The price-to-sales (P/S) ratio of IonQ significantly exceeds the industry average, indicating risks for potential investors. The stock is currently trading at a one-year premium, with a forward 12-month price/sales ratio of 92.06, a stark contrast to the Zacks Computer – Integrated Systems industry’s average of 3.23.

Stretched Valuation Indicated by P/S Ratio

Image Source: Zacks Investment Research

IonQ expects to achieve full-year 2024 revenues ranging from $38.5 million to $42.5 million, a target that seems modest compared to its market cap. The increase in stock-based compensation, up to $24.6 million in the third quarter from $17 million last year, raises concerns about potential shareholder dilution. This escalating cost, coupled with IonQ’s ambitious growth plans and ongoing losses, may further pressure its stock price.

Unclear Paths to Commercialization

As a nascent industry, quantum computing’s commercialization timelines remain unpredictable. Although management expresses optimism with a bookings target of $75-$95 million for 2024, CFO Thomas Kramer acknowledges “lumpiness” in bookings that complicates future revenue projections. The Zacks Consensus Estimate for 2024 predicts revenue of $40.5 million, representing an impressive year-over-year growth of 83.74%. However, projected earnings indicate a loss of 86 cents per share, with estimates widening by 2 cents in the last month, stirring caution among analysts.

Image Source: Zacks Investment Research

Investment Outlook

For investors reaping substantial gains from IonQ’s impressive stock performance this year, signs of widening losses, elevated spending, and valuation pressures suggest that taking profits could be wise. Even though quantum computing has vast potential, the road to profitability currently appears unclear. The stock’s high valuation operates with limited margin for error, thus prudent investors might consider scaling back their holdings in IonQ while awaiting clearer indications of sustainable profitability and more favorable valuations. Currently, IonQ stock holds a Zacks Rank #4 (Sell).

You can view the complete list of Zacks #1 Rank (Strong Buy) stocks here.

Zacks Research Chief Identifies “Stock Most Likely to Double”

Experts have just unveiled five stocks poised for potential gains of 100% or more in the upcoming months. Among these, Director of Research Sheraz Mian highlights a single stock likely to see the most significant increase. This top pick is from one of the most innovative financial firms and boasts a rapidly growing customer base of over 50 million, alongside a diverse array of cutting-edge solutions. While not all selections yield positive results, this one could outperform prior successful Zacks picks such as Nano-X Imaging, which surged 129.6% in just over nine months.

Free: Discover Our Top Stock and Four Runners-Up.

Are you interested in the latest recommendations from Zacks Investment Research? Download the report “5 Stocks Set to Double” for free now.

Microsoft Corporation (MSFT): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

IonQ, Inc. (IONQ): Free Stock Analysis Report

For the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein belong to the author and do not necessarily represent those of Nasdaq, Inc.