“`html

IonQ’s Stock Surges Amid Mixed Financial Results and Growth Strategy

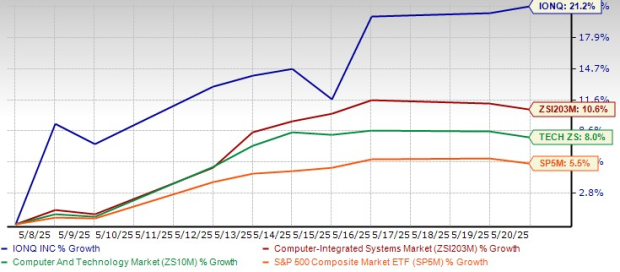

IonQ, Inc. (NYSE: IONQ) has caught the attention of investors with a striking 21.2% increase in its stock price following the release of its first-quarter 2025 earnings on May 7. This rise outperformed gains in both the Zacks Computer – Integrated Systems industry and the broader Zacks Computer and Technology sector, as well as the S&P 500. The surge underscores renewed interest in the company’s ambitious expansion into commercial quantum systems and secure communication infrastructure. However, a question looms: is this uptrend sustainable or merely a temporary spike?

Despite this momentum, IonQ’s stock still trades at a significant 35.5% discount from its 52-week high. This raises an important query for prospective investors: Is the post-earnings rally just the start, or has the potential upside already been factored into the stock price?

IONQ Share’s Price Performance Post Q1

Image Source: Zacks Investment Research

Mixed Results in First Quarter of 2025

The first-quarter results for 2025 reveal a mixed yet promising outlook for IonQ, a leader in quantum computing. Revenues stood at $7.57 million, which remained largely unchanged year-over-year but slightly surpassed estimates. The company noted a net loss of $32.3 million, an improvement from last year’s loss of $39.6 million, largely due to a non-cash gain of $38.5 million associated with warrant liabilities.

Nevertheless, adjusted EBITDA losses widened to $35.8 million, compared to $27 million a year earlier, reflecting increased R&D and acquisition-related expenditures. Operating costs surged by 38% to $83.2 million, highlighting IonQ’s aggressive strategy to enhance its quantum capabilities.

Despite the losses, the company reiterated its full-year guidance and displayed solid momentum in areas such as commercialization, government partnerships, and mergers and acquisitions.

Strategic Advances Strengthen IonQ’s Market Position

A pivotal factor in IonQ’s first-quarter performance was a $22-million sale of its Forte Enterprise system to EPB in Tennessee. This transaction represents the first successful deployment of both a quantum computer and a quantum network by a commercial customer. It not only contributed meaningfully to revenues but also validated IonQ’s dual-platform approach, positioning it at the forefront of quantum computing and networking.

IonQ has also expanded its global reach through partnerships in Japan and South Korea, alongside its recent acquisitions—Lightsynq, Capella, and ID Quantique. These initiatives enhance its capacity in quantum internet infrastructure and secure communications, areas experiencing rapid growth amid escalating competition.

Building a Comprehensive Quantum Ecosystem

IonQ is dedicated to creating a full-spectrum quantum ecosystem that extends beyond hardware and acquisitions. Recent advancements include cloud-based accessibility of its systems via AWS, progress in quantum machine learning, and photonic interconnect technologies for scalability. Furthermore, its selection by DARPA for a national quantum benchmarking initiative underscores its credibility with the U.S. government.

A noteworthy aspect of IonQ’s strategy is its focus on advancing the quantum internet in addition to computational power. The company’s implementation of Lightsynq’s quantum repeater technology enables photon transmission over 100 kilometers, while Capella’s satellite-based quantum key distribution capabilities lay the foundation for a global, secure quantum network.

Strong Financial Foundation Fuels Future Growth

At the close of the first quarter of 2025, IonQ held nearly $700 million in cash and equivalents, providing substantial leverage to execute its strategic plans without needing to dilute equity or accrue debt. This financial cushion allows IonQ to pursue aggressive R&D initiatives and acquisitions, even while near-term revenues remain modest. A robust balance sheet provides the flexibility to absorb temporary losses as the company works towards long-term monetization.

Positive Estimate Revisions For 2025

The Zacks Consensus Estimate for IonQ’s loss per share for 2025 has narrowed over the past month, suggesting a positive outlook from analysts. The latest projections indicate a significantly reduced loss compared to last year’s reported figure of $1.56. Additionally, the Zacks Consensus Estimate for 2025 revenues suggests remarkable year-over-year growth of 97.3%.

Image Source: Zacks Investment Research

Valuation Challenges Persist

Valuation concerns remain significant for IonQ. The forward 12-month price/sales ratio stands at an extraordinary 75.86, considerably higher than the industry average of 3.34. Although this ratio has fluctuated between 20.55 and 229.06 over the past two years, it indicates the high expectations currently embedded in the stock price.

While IONQ shares trade at a 35.5% discount from their 52-week high, they have ascended 467.7% from their 52-week low, underscoring the speculative nature of this volatility. With limited revenue and notable losses, this premium valuation relies heavily on IonQ’s ability to deliver success and capture market opportunities ahead of its competitors.

Image Source: Zacks Investment Research

Challenges Ahead for IonQ

In the near term, IonQ faces significant challenges related to its cost structure. The company’s substantial investments in talent, R&D, and integrations have led to soaring expenses that overshadow stagnant revenue growth. Any delays in revenue generation or unexpected integration challenges from its various acquisitions could negatively impact investor sentiment.

Competition is also heating up on a global scale. Notably, Chinese initiatives in satellite-based quantum communications are advancing rapidly. IonQ must demonstrate not only its technical prowess but also its ability to effectively commercialize its advances faster than its rivals.

The quantum computing landscape is competitive, with major players such as IBM, Google (Alphabet Inc.), and Microsoft committing substantial resources to advance the technology. Additionally, emerging entrants like Baidu, Amazon, and Rigetti Computing are aggressively pursuing opportunities in this rapidly changing market. Comparatively, Quantinuum, a Honeywell-backed joint venture, stands as IonQ’s closest rival in the trapped-ion space, showcasing high fidelity and readiness for commercialization. In contrast, Rigetti operates a full-stack superconducting platform but remains at an early commercialization stage with limited revenue, while D-Wave Quantum Inc. focuses on quantum annealing for optimization problems with over 1,200 qubit systems.

“`

IonQ’s Strategic Moves Position It for Quantum Computing Dominance

The Quantum AI sector is experiencing rapid advancements, particularly in superconducting qubit development. Major players are setting benchmarks in scalability and quantum supremacy. IonQ must navigate this competitive landscape as it carves out its niche.

Current Insights on IonQ’s Stock

IonQ stands at a critical crossroads in the technological revolution, with its emphasis on quantum computing and networking putting it in a favorable position for long-term impact. Recently, the company’s stock saw a 21% increase after reporting first-quarter 2025 earnings, a signal of meaningful strategic progress.

The $22 million commercial agreement with EPB, along with expanding partnerships like DARPA’s benchmarking initiative and strategic acquisitions aimed at enhancing quantum internet infrastructure, highlight IonQ’s leadership in this evolving field.

Although the company faces high research and development costs and integration challenges, its near $700 million cash reserve offers significant financial flexibility. This enables IonQ to pursue innovation aggressively while maintaining a clear long-term vision. Despite a lofty valuation, the narrowing consensus on loss estimates and reaffirmed guidance reflect increasing confidence in the company’s execution.

For long-term investors prepared to accept some volatility, IonQ, rated Zacks Rank #2 (Buy), presents a unique opportunity to invest early in a company poised to shape the future of computing and secure communications.

Additional Insights on Semiconductor Stocks

A recent analysis by Zacks highlighted a top semiconductor stock that is only 1/9,000th the size of NVIDIA, which has surged over 800% since its recommendation. While NVIDIA continues to perform well, this emerging stock has substantial growth potential in the face of surging demand for artificial intelligence (AI), machine learning, and the Internet of Things (IoT).

The global semiconductor manufacturing market is forecasted to skyrocket from $452 billion in 2021 to $803 billion by 2028, emphasizing the industry’s explosive growth prospects.

Stay informed on the best investment opportunities as the sector evolves. Zacks Investment Research regularly provides important analysis and insights for investors looking to navigate this dynamic landscape.

This article includes insights from Zacks Investment Research.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.