IonQ and Microsoft Race Ahead in Quantum Computing Investment Landscape

IonQ, Inc. (IONQ) and Microsoft Corporation (MSFT) are significant players in the quantum computing space, albeit from different angles. IonQ specializes in developing quantum computers, while Microsoft integrates quantum technology into its Azure cloud platform.

Both companies focus on “quantum cloud” services, granting access to quantum capabilities through the cloud, attracting investor interest. IonQ’s stock has risen due to its latest breakthroughs and strategic deals, whereas Microsoft continues to post strong cloud results alongside its quantum R&D investments. This raises the question of which stock offers better investment potential.

Let’s analyze the fundamentals of both companies to see where they stand as investment options.

IonQ’s Strengths and Challenges

IonQ leads in trapped-ion quantum computing, hitting key technical milestones. In Q1 2025, IonQ made its first commercial sale, a $22 million deal with EPB in Tennessee for its Forte Enterprise quantum computer and network. This marked a significant first step in real-world applications for quantum tech. The company boasts nearly 900 patents covering various aspects of quantum technology, reinforcing its position as an industry pioneer.

Strategically, IonQ is expanding through partnerships and acquisitions, establishing a presence in Asia and investing in quantum networking firms, including ID Quantique and Qubitekk. This expansion broadens its market into quantum-safe networking and secure satellite communications.

IonQ is building a complete quantum ecosystem, with its systems accessible via major cloud platforms such as Amazon’s AWS Braket and Azure Quantum. The U.S. government’s recognition of IonQ, as seen in its selection by DARPA for quantum initiatives, enhances its credibility.

For 2025, IonQ projects revenues between $75 million and $95 million, representing about 97% growth at the midpoint driven by new contracts and an expanded product lineup.

Despite this promise, IonQ faces challenges including ongoing financial losses, with a reported net loss of $32.3 million in Q1 2025. Its high operational costs hinder its path to profitability, as its adjusted EBITDA loss widened with a 38% increase in expenses year-over-year.

The sector is fiercely competitive, with giants like IBM, Google’s Alphabet, and Microsoft investing heavily. Competitors like Quantinuum and Rigetti aim to capture their market share as well, creating a dynamic landscape for IonQ.

Microsoft: A Broader Approach to Quantum

Microsoft stands as one of the world’s most valuable companies, deeply entrenched in enterprise software and cloud computing. Its financial stability and scale give it an advantage in quantum investments compared to IonQ. Microsoft’s Azure platform serves as a crucial part of its quantum strategy, offering various hardware and software tools.

In early 2025, Microsoft introduced its Majorana 1 quantum processing chip, a significant advancement in topological qubit research, indicating progress toward fault-tolerant quantum computing. With $80 billion in cash reserves (as of Q3 2025), Microsoft is well-positioned to invest in quantum without affecting its core operations.

Through strategic partnerships, Microsoft is advancing its quantum initiatives. Its Azure Quantum services are rolling out to assist industries such as chemistry and drug discovery, leveraging its cloud strength for future quantum computing applications.

However, Microsoft’s quantum ambitions are tempered by challenges. Quantum computing currently contributes minimally to its approximately $70 billion quarterly revenue, meaning significant impacts from quantum advancements may take time. For investors focused solely on quantum exposure, Microsoft’s diverse business model might dilute the appeal of its quantum prospects.

Additionally, competitors like IBM have quickly developed over 100 quantum processors, whereas Microsoft’s progress is still largely in research phases with the Majorana 1 chip as a prototype.

Recent Stock Performance Analysis

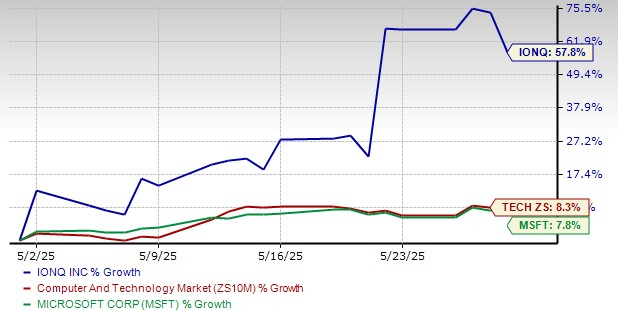

IonQ has recently seen a notable 57.8% spike in its stock price over the last month, despite a modest 3.4% year-to-date gain, reflecting heightened investor confidence. Microsoft continues to establish its stronghold in the tech sector.

IonQ and Microsoft Show Divergent Stock Trends Amid Tech Rally

IonQ’s stock has increased by 8.8% year-to-date and 7.8% over the past month. Microsoft is driving broader tech market performance, with IonQ’s recent surge standing out. Microsoft’s stock movements are less volatile, reflecting its stability as a large-cap company. The Zacks Computer and Technology sector has gained 8.3% in the past month but is down 1.7% year-to-date.

Image Source: Zacks Investment Research

Valuation Concerns for IONQ and MSFT

IONQ faces significant valuation challenges. Its forward 12-month price-to-sales ratio is 91.76, far above the sector average of 6.22. This ratio has varied widely over the past two years, indicating the high expectations priced into its shares.

Although IONQ is currently trading 21.1% below its 52-week high, it has risen 594.5% from its 52-week low. This volatility reflects speculative market behavior. With limited revenue and ongoing losses, IONQ’s high valuation relies on successfully establishing itself in the emerging quantum market.

Microsoft, while also experiencing elevated valuation metrics, trades at a lower 10.99X compared to IONQ, signifying a more measured risk profile.

Image Source: Zacks Investment Research

Earnings Estimates and Growth Projections for IONQ and MSFT

IONQ’s Zacks Consensus Estimate for 2025 shows a reduced loss per share compared to last year’s loss of $1.56. Analysts forecast a year-over-year revenue growth of 97.3%.

In contrast, Microsoft’s EPS estimate has increased recently. The consensus now anticipates 13.7% revenue growth and 13% EPS growth for fiscal 2025.

For IONQ

Image Source: Zacks Investment Research

For MSFT

Image Source: Zacks Investment Research

Conclusion

IonQ and Microsoft represent different investment opportunities within the quantum cloud sector. IonQ, as a dedicated quantum computing firm, presents high-risk, high-reward potential backed by its patent portfolio and growth forecasts. However, its heavy losses and speculative valuation lead to higher volatility.

On the other hand, Microsoft provides a more stable investment with its strong foothold in cloud and AI markets, although its quantum initiatives presently contribute minimally to overall revenue. With IONQ rated #2 (Buy) and its rapid growth, it appeals to risk-tolerant investors. Microsoft, rated #3 (Hold), offers a safer investment profile. Therefore, IonQ may yield greater upside potential for those open to market fluctuations.

This article originally published on Zacks Investment Research.

The views expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.