IonQ Expands Quantum Horizons with $22 Million Acquisition of Qubitekk

IonQ has made a significant move in the quantum technology arena by acquiring Qubitekk’s operating assets for $22 million. This deal is pivotal for IonQ as it enhances its quantum networking capabilities. Key components of the acquisition include Qubitekk’s commercial operations, customer connections, executive leadership, and a noteworthy collection of 118 granted quantum networking patents.

Combining Forces for Quantum Success

By marrying Qubitekk’s quantum networking know-how with IonQ’s trapped-ion quantum computing technology, the company is poised to create a more integrated quantum ecosystem. This collaboration could speed up the development of quantum networking solutions and solidify IonQ’s competitive edge in the growing quantum technology market.

Competitive Landscape Grows Tougher

Despite IonQ’s promising outlook, it is not without challenges. It faces stiff competition from established tech giants like International Business Machines (IBM), Alphabet (GOOGL), and Microsoft (MSFT), which are pouring billions into quantum computing. New contenders from China, such as Baidu, alongside increased investments from Amazon and Rigetti Computing, add to the competitive pressure.

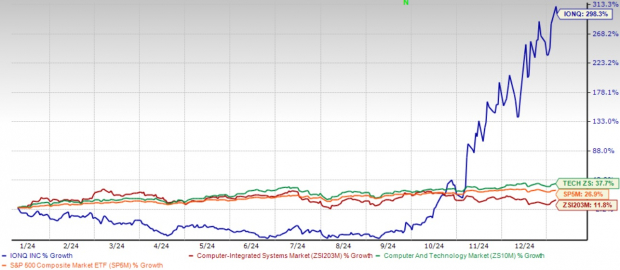

Strong Year but Caution Advised

Image Source: Zacks Investment Research

Mixed Financial Signals

IonQ’s financial performance shows a blend of progress and concern. In the third quarter of 2024, the company enjoyed a remarkable 102% revenue increase, totaling $12.4 million, alongside new bookings of $63.5 million—highlighted by a $54.5 million contract with the AFRL. However, its current valuation metrics raise red flags, with a forward 12-month price/sales ratio of 132.1 vastly exceeding the industry average of 3.34. Additionally, stock-based compensation has surged to $24.6 million, compared to $17 million the previous year, signaling potential dilution risks for investors.

Valuation Metrics Remain High

Image Source: Zacks Investment Research

Technical Milestones and Partnerships

IonQ has achieved key technical success, reaching 36 algorithmic qubits (#AQ) on its Forte system sooner than expected. Strategic partnerships with heavyweights like AstraZeneca for innovations in drug discovery and Ansys for computer-aided engineering simulations have been established. Collaborations with NKT Photonics and imec seek to push forward next-generation laser systems and integrated circuits, potentially lowering hardware costs and enhancing performance.

Navigating Opportunities and Challenges

The quantum computing sector holds substantial potential, with BCG estimating economic value creation of up to $850 billion by 2040 and McKinsey predicting the quantum networking segment could become a $36 billion market. Yet, the actual rollout of commercial solutions remains unpredictable, and as noted by CFO Thomas Kramer, the “lumpiness” of bookings may lead to fluctuations in revenue reporting. With $382.8 million in cash and investments, IonQ seems well-positioned to pursue its growth, but the route to profitability is still uncertain.

Focus on 2025

Looking ahead to 2025, investors must keep a close eye on IonQ’s integration of Qubitekk’s technology and efforts to harness quantum networking possibilities. Launching IonQ Tempo and achieving the 64-qubit milestone could significantly influence the company’s trajectory. Partnerships with AstraZeneca and Ansys may also validate the practical value of quantum computing.

The Zacks Consensus Estimate for 2025 projects revenues of $80 million, indicating a year-over-year growth of 97.53%. However, it also anticipates a loss of $1.15 per share, worse than the prior year’s loss of 86 cents, suggesting caution is warranted.

Image Source: Zacks Investment Research

Stay informed about all quarterly releases: Check Zacks Earnings Calendar.

Investment Considerations

For those eyeing IONQ, this stock represents a complex investment choice that requires thorough consideration. Although IonQ’s strategic vision and recent achievements are encouraging, the high valuation and fierce competition necessitate a cautious approach. Key indicators of success will be the integration of Qubitekk’s assets, progress in commercializing quantum solutions, revenue conversion from bookings, and positioning against larger tech rivals.

The stock may attract investors willing to accept higher risk while maintaining a long-term perspective. As 2025 approaches, it is essential to monitor IonQ’s implementation of its technical ambitions while managing cash burn and competitive challenges. Ultimately, success in the evolving quantum computing landscape will rely not only on technical prowess but also on effective market strategies and timing. Currently, IONQ holds a Zacks Rank #3 (Hold). Comprehensive lists of today’s Zacks #1 Rank (Strong Buy) stocks can be found here.

Explore Top Stock Picks for the Coming Month

Experts have handpicked 7 elite stocks from a pool of 220 Zacks Rank #1 Strong Buys, which they believe are “Most Likely for Early Price Pops.”

Since 1988, this list has outperformed the market more than double, boasting an average annual gain of +24.1%. Don’t miss out on these highly regarded selections.

For the latest recommendations from Zacks Investment Research, download 7 Best Stocks for the Next 30 Days. Click to access this free report.

Microsoft Corporation (MSFT): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

IonQ, Inc. (IONQ): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.