“`html

Apple has experienced a 37% year-over-year increase in iPhone 17 sales in China as of October 2025, according to Counterpoint data. Although Greater China accounted for 15.5% of Apple’s fiscal 2025 net sales, this segment declined by 4% from fiscal 2024 to $64.38 billion, mainly due to reduced iPhone sales. However, overall iPhone sales for fiscal 2025 reached $209.59 billion, representing approximately half of total sales of $416.16 billion, showing a 4.2% rise from fiscal 2024.

Apple anticipates double-digit growth in iPhone sales for the December quarter (first-quarter fiscal 2026) and aims to leverage new features like Live Translation to enhance user experience. The company launched a new store in China during Q4 2025 and reported record Services sales in the September quarter for Greater China. Meanwhile, competition from companies like Alphabet and Microsoft in the AI space poses challenges for Apple as both companies show significant growth in their AI initiatives.

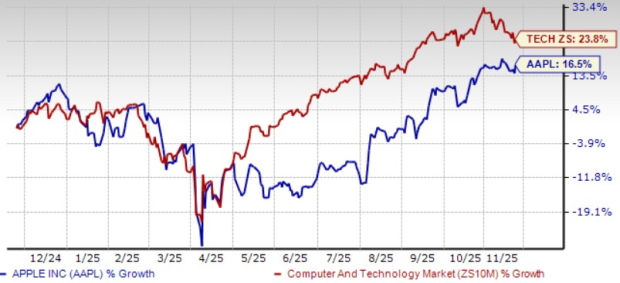

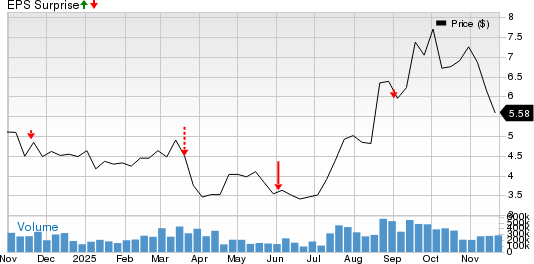

Apple shares have increased 16.5% year-to-date, below the broader tech sector’s growth of 23.8%. The current forward price-to-earnings ratio for AAPL is 32.72, higher than the sector’s 27.66, indicating potential overvaluation, with Zacks Consensus estimates predicting growth in fiscal 2026 earnings per share to $8.16.

“`