Who doesn’t love a good bargain? On Wall Street, merger arbitrage offers a tantalizing opportunity to snatch up stocks at a discount. But recent events surrounding iRobot (NASDAQ: IRBT) and Spirit Airlines (NYSE: SAVE) serve as a stark reminder that this investing strategy is not for the faint of heart.

The Siren Song of Merger Arbitrage

Merge arbitrage sounds like a dream – buy low, sell high, and pocket the difference. But the reality is far more intricate. As one company swoops in to acquire another, the target’s stock price typically soars, closing in on the offer price but rarely matching it entirely.

Image source: Getty Images.

While the discount may seem negligible, the stakes are high. For every successful deal, there’s a looming threat that it could all come crashing down.

Lessons Learned the Hard Way

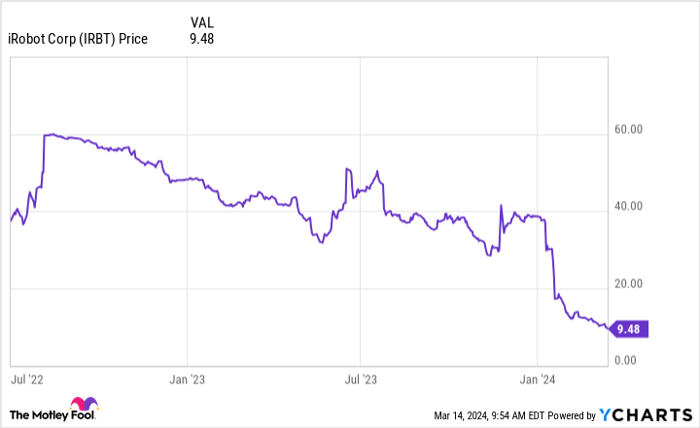

Recent history paints a cautionary tale for investors. iRobot, once envisioned as an Amazon acquisition, spiraled into chaos when regulatory hurdles quashed the deal. The telltale signs were there from the start, but many failed to heed the warnings.

IRBT data by YCharts.

Spirit Airlines’ ill-fated alliance with Jetblue faced a similar fate, plunging stocks into a tailspin as regulatory roadblocks emerged. And now, the specter of a failed deal looms over U.S. Steel, underscoring the precarious nature of mergers and acquisitions.

Deeper Waters of Merger Arbitrage

Behind the facade of easy profits lies a web of complexity. While successful arbitrage hinges on predicting deal closures, the risks are omnipresent. Regulatory snags, financial woes, or unforeseen industry shifts can all spell doom for investors.

Specialized funds like Merger Fund (MERFX) offer a diversified approach to mergers and acquisitions. But for the average investor, the allure of arbitrage may be more mirage than oasis.

Should you invest $1,000 in iRobot right now?

Before diving into iRobot, consider this:

The Motley Fool Stock Advisor team has identified top picks for the savvy investor. While iRobot didn’t make the cut, other stocks present tantalizing opportunities for growth.

Stock Advisor heralds a path to success, boasting returns that leave the S&P 500 in the dust since 2002*.

Explore the 10 stocks

*Stock Advisor returns as of March 20, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and iRobot. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.