To be a successful investor, staying updated on the opinions of industry leaders about artificial intelligence (AI) is crucial. One such leader is Nvidia‘s (NASDAQ: NVDA) CEO and founder, Jensen Huang. Nvidia produces the hardware that drives AI models, allowing Huang to gauge industry trends effectively. Recently, he has spotlighted a significant development: agentic AI.

Agentic AI marks a major step forward in applying AI for practical functions. But what exactly are AI agents, and how can investors take advantage of them? Investing in Nvidia could be a solid starting point.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The Rise of AI Agents by 2025

At the recent CES trade show in Las Vegas, Huang discussed the future of AI agents. He remarked, “I think this year we’re going to see it take off.”

AI agents can handle routine tasks that people typically perform, such as data entry, customer interactions, or inventory management. This evolution takes AI beyond simple chat responses, enabling agents to complete complex, multi-step tasks that involve reasoning rather than just basic knowledge.

Nvidia provides resources for developing AI agents, referred to as blueprints. By creating these agents on Nvidia’s platform, clients secure a long-term partnership, contributing to ongoing sales. Nvidia’s platform has been a standard in the AI field, and its recent move into agentic AI reinforces its strong position.

Despite a dominant performance by Nvidia’s stock in recent years, investors shouldn’t underestimate its potential for future growth. Nvidia remains a promising opportunity for solid profits.

Stock Growth Potential Remains Strong

For fiscal year 2026, which ends in January 2026, Wall Street analysts predict Nvidia’s revenue will soar by 52% year over year. This impressive growth rate could see Nvidia’s revenue leap from $129 billion to almost $200 billion. Given this trajectory, Nvidia stands out as one of the best options to invest in AI without needing to choose a direct winner. Many AI software developers will rely on Nvidia’s infrastructure to build their models.

Numerous companies will create AI agents using Nvidia’s platform. Some will utilize them internally, while others will market them to clients. This neutrality positions Nvidia as a strong investment choice, even after its remarkable growth over the past few years.

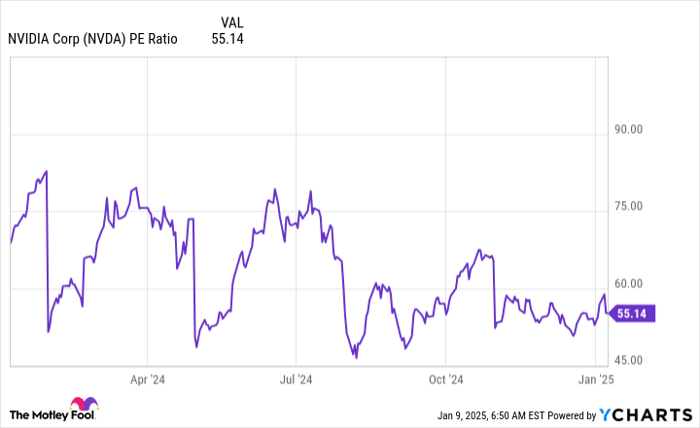

Looking at valuation, Nvidia is not as overpriced as it once appeared. Its growth is beginning to align with its stock valuation.

NVDA PE Ratio data by YCharts

Currently, Nvidia’s stock carries a price-to-earnings (P/E) ratio of 55, which seems reasonable when compared to big tech peers like Amazon at 48, Apple at 40, and Microsoft at 35. Nvidia’s valuation reflects its anticipated growth over the coming months.

With strong growth expected in 2025, powered in part by AI agents, Nvidia’s prospects look bright. Investors ought to maintain a forward-looking perspective, as dwelling on past performance won’t yield benefits. Nvidia remains a strong candidate for investment, and the AI growth narrative is far from complete.

Is Now a Good Time to Invest $1,000 in Nvidia?

Before making a decision to purchase Nvidia stock, keep the following in mind:

The Motley Fool Stock Advisor analyst team recently identified their picks for the 10 best stocks to buy now… and Nvidia did not make the list. The chosen stocks are expected to deliver substantial returns in the near future.

Reflecting on April 15, 2005, when Nvidia was included in a similar recommendation… an initial $1,000 investment would have grown to $858,668!*

Stock Advisor offers a straightforward guide for success in investing, with insights on portfolio building, regular analyst updates, and two new stock recommendations each month. The service has outperformed the S&P 500 by more than four times since 2002*.

See the 10 stocks »

*Stock Advisor returns as of January 6, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is on The Motley Fool’s board of directors. Keithen Drury has positions in Amazon and Nvidia. The Motley Fool has stakes in and recommends Amazon, Apple, Microsoft, and Nvidia. Additionally, The Motley Fool recommends long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. For details, refer to The Motley Fool’s disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.