AI Stocks Surge, but Investors Should Prepare for Future Challenges

Big tech companies began investing in artificial intelligence (AI) over a decade ago. However, advancements in the field have dramatically boosted returns for AI stock investors in the past three years, leading to a robust bull market for AI stocks.

Nvidia (NASDAQ: NVDA) has been a key player in this surge. The company’s graphics processing units (GPUs) are essential for meeting the substantial computing demands that AI entails.

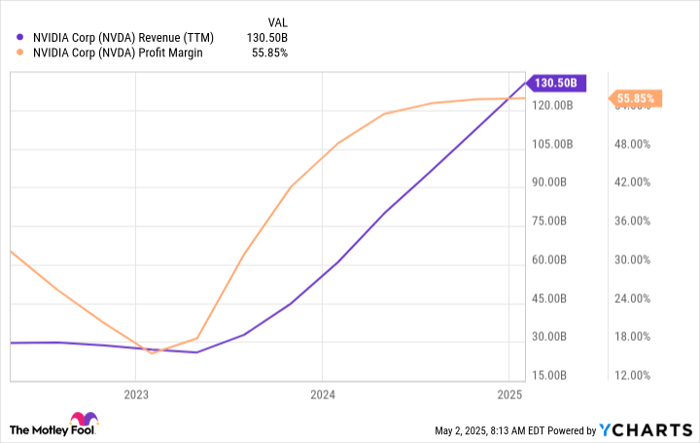

Strong demand for GPUs has led to two significant outcomes. Firstly, Nvidia’s revenue has increased significantly. Secondly, its profit margins have surged, as demand greatly exceeds supply. Nvidia can set high prices without deterring customers.

NVDA Revenue (TTM) data by YCharts

As the AI bull market continues to grow, a pertinent question arises: Should investors brace for a bear market in 2025?

Initially, this question may seem far-fetched. Many view the AI trend as one of the major growth opportunities for the upcoming decade. According to the International Data Corporation, annual spending on AI infrastructure is expected to exceed $200 billion by 2028, far surpassing the nearly $50 billion projected for 2024. This indicates a massive shift in the market.

That said, it is wise for AI stock investors to prepare for the possibility of a bear market in 2025. Adjusting for market realities does not necessarily spell doom for investors.

Reasons to Prepare for a Bear

The future remains uncertain, and the stock market often reflects this unpredictability. Investors can never fully anticipate market behavior; otherwise, valuations would always be correct. In reality, stocks tend to oscillate between overvalued and undervalued states, influenced by investor sentiment.

Currently, investor sentiment is positive regarding AI. However, several factors could lead to shifts in perception. For instance, U.S. export restrictions to China hinder Nvidia’s operations in that market, giving opportunities to competitors like Huawei.

If a company like Huawei can create AI hardware that rivals Nvidia’s offerings, it could mitigate the current supply-demand imbalance, thus impacting Nvidia’s profit margins.

While China lacks access to cutting-edge U.S. technology, innovation often arises from necessity. For example, the Chinese start-up DeepSeek is reportedly developing AI models that optimize performance with fewer resources. Such innovations could alter projected spending on AI infrastructure and electricity consumption.

The key takeaway is not whether the AI market will crash but rather that the future is laden with uncertainties. Unexpected developments can swiftly shift investor expectations, leading to market enthusiasm turning into despair.

How to Prepare

Given the unpredictable future of the AI market, unforeseen challenges could lead to substantial declines in AI stock prices.

Some may argue that such volatility is typical in any sector of the stock market, and this criticism holds weight. The fluctuations I suggest may happen with AI stocks but can also occur across various market sectors.

I do not advocate completely overhauling a stock portfolio in anticipation of a potential bear market. Instead, maintaining solid investment principles is the best course of action.

Investors should consider building a diversified AI portfolio. While Nvidia remains a compelling choice for believers in the long-term AI trend, exploring other avenues is advisable. Investing in infrastructure through a real estate investment trust (REIT) such as Digital Realty Trust (NYSE: DLR) might be beneficial, as the demand for data centers remains high as tech companies advance in AI.

Additionally, keeping some cash available for regular investments is wise. A steady investment strategy allows projects to be pursued at various price points without attempting to accurately time the market.

The AI trend is undoubtedly thrilling, and while certain companies are better positioned for growth, it is prudent to take a balanced investment approach. Understanding the potential for a bear market while regularly diversifying investments will be essential in navigating possible downturns.

Investment Opportunities

If you worry about missing out on successful stock investments, you are not alone. On rare occasions, our analysts recommend a “Double Down” Stock that could yield impressive returns.

For instance:

- Nvidia: Investing $1,000 when we doubled down in 2009 would now be worth $295,164!

- Apple: A $1,000 investment from 2008 would result in $37,708!

- Netflix: An investment of $1,000 in 2004 would have grown to $611,589!

Currently, “Double Down” alerts are available for three promising companies, which you can access by joining Stock Advisor.

*Stock Advisor returns as of May 5, 2025

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.