Southwest Airlines Co. (LUV) is gearing up for its first-quarter 2024 earnings report on Apr 25, with the anticipation of investor sentiments hanging high in the air.

Upcoming Earnings Projection

The Zacks Consensus Estimate expects Southwest Airlines to report a revenue of $6.45 billion in Q1 2024, showcasing a 13.08% growth trajectory compared to the previous year. The airline giant is expected to benefit from a surge in leisure demand, robust yields, and a host of ancillary revenue streams – all underpinning a backdrop of stable demand and operational efficiency.

Despite these promising signs, an increase in economic fuel costs per gallon, now ranging from $2.95 to $3, is set to cast a shadow over Southwest Airlines’ financial performance this quarter. The surge in fuel prices due to heightened oil costs looms large, potentially creating headwinds that may tug at the airline’s profits.

Earnings Outlook and Market Mood

Yet, amidst these challenges, market watchers remain cautiously optimistic about Southwest Airlines’ ability to soar above expectations. The company’s recent adjustments to its first-quarter capacity outlook and revenue per available seat mile paint a picture of adaptability in the face of adverse conditions.

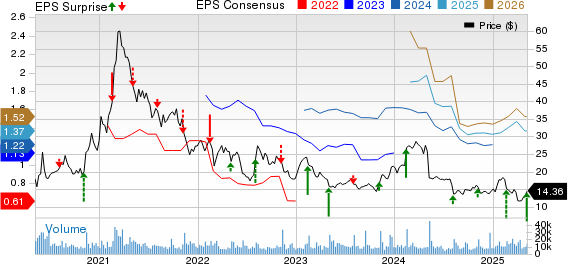

Moreover, the revised first-quarter 2024 economic fuel costs per gallon and other operational metrics inject a note of uncertainty into the earnings projection. Nevertheless, with an Earnings ESP of +2.14% and a Zacks Rank #3, Southwest Airlines stands poised for a potential earnings surprise as per market models.

Recap of Previous Quarter

In the last quarter, Southwest Airlines defied expectations by recording earnings of 37 cents per share, a stark improvement from the loss incurred in the year-ago quarter. Revenues also showcased a healthy uptick, exceeding projections and expanding by 10.5% year over year.

Peer Comparison and Sectoral Prospects

Following the trend of favorable market conditions, several other companies in the transportation sector, such as American Airlines (AAL), Westinghouse Air Brake Technologies (WAB), and Expeditors International of Washington (EXPD), also show promise in their earnings reports for Q1 2024. The combination of strategic factors underpinning these entities places them in a favorable position to deliver strong performances.

As the industry braces for an impactful earnings season, all eyes are on Southwest Airlines and its fellow carriers, watching keenly for signs of resilience and adaptability in the face of turbulent market conditions.

Top 5 Dividend Stocks for Your Retirement

Zacks identifies 5 companies with a solid dividend history and financial robustness that may bode well for the future. For more insights and unconventional wisdom, explore the free Special Report here.

Get a detailed analysis of Southwest Airlines Co.’s performance