By Frank Corva

Bitcoin’s current valuation is roughly 120% higher compared to the same period last year.

Those entrenched in the crypto world avidly believe that this might just be the tip of the iceberg for the forthcoming bitcoin bull market that could stretch well into 2025.

How do these stalwarts possess such unwavering conviction about bitcoin’s continual price surge?

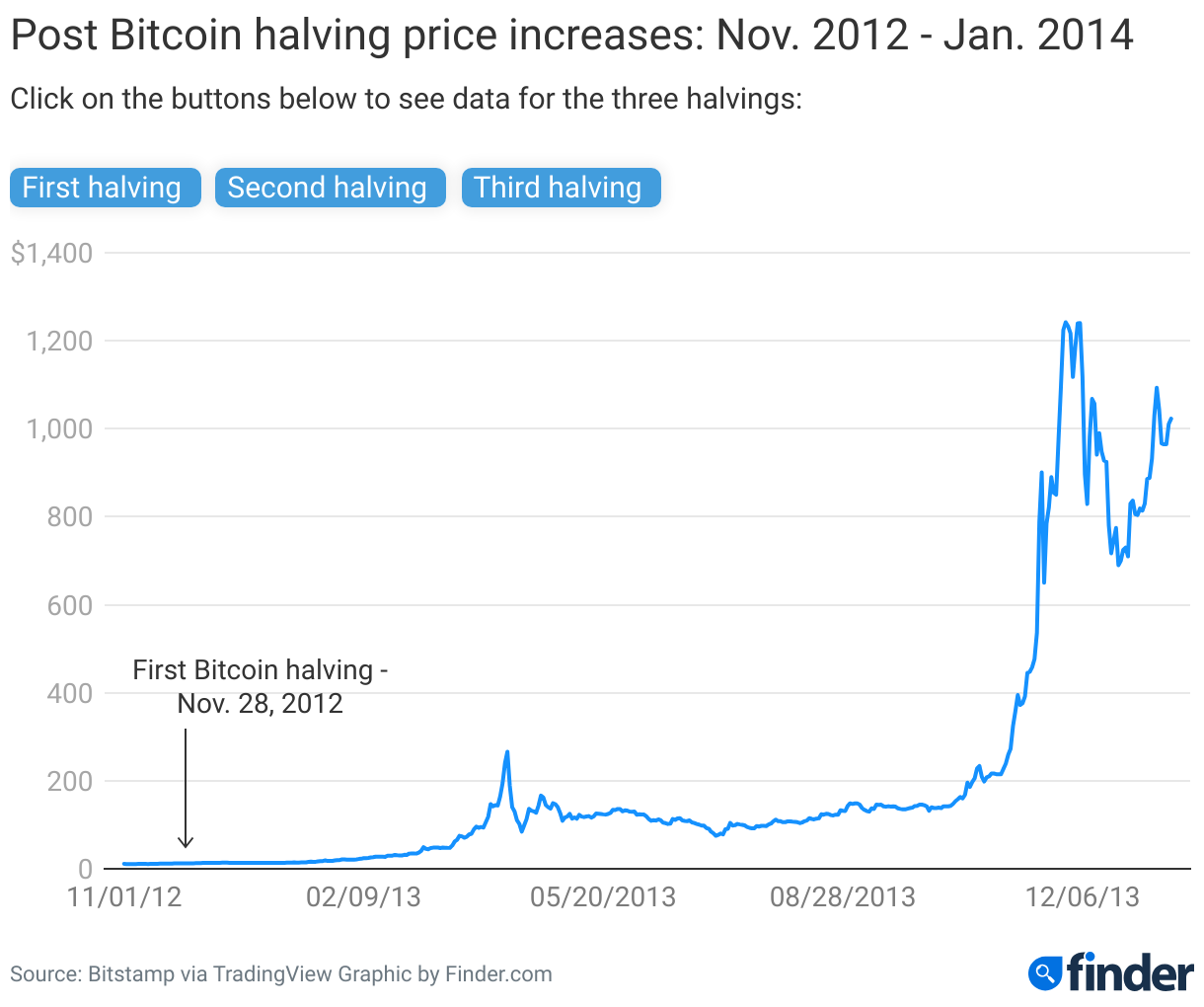

Simply put, history has shown that bitcoin’s value tends to soar post-Bitcoin halving events.

A Bitcoin halving, marking the moment when Bitcoin miner rewards are reduced by half, recurs every 210,000 blocks (approximately every four years). The upcoming event, the fourth halving, is slated for April 20, 2024, upon reaching block height 840,000 on the Bitcoin blockchain.

The substantial decline in the circulation of new bitcoins serves as a catalyst for the impending bullish market trend.

An undeniable fact when examining past post-halving bitcoin price performance.

Moreover, close to 60% of analysts surveyed by Finder anticipate that the upcoming halving will not only kickstart a bitcoin bull run but will also trigger a price surge across the wider crypto landscape.

Yet, is it all sunshine and rainbows for bitcoin through the next year and a half?

The Future Trajectory of Bitcoin

While it remains a feasibility that bitcoin could surpass its all-time high margin of around $69,000 before 2024 runs its course, it could also encounter significant bumps along the journey.

Throughout all bitcoin bull markets, 20-30% declines are deemed customary.

A grander correction could be looming if we are amidst a potential “melt-up”, where asset values skyrocket before plummeting.

If the $6 trillion parked in money market mutual funds flows back into the market before the current regional banking crisis worsens, a colossal market correction might ensue before the year ends.

Considering it’s an election year, it’s reasonable to assume that the U.S. Federal Reserve, alongside the U.S. government, will resort to printing money to sustain the market.

Even in such a scenario, predicting bitcoin’s year-end price would prove to be a Herculean task.

Strategic Investment Approaches for the Bitcoin Bull Market

So, what’s the optimal investment strategy when history indicates that bitcoin’s value usually climbs following Bitcoin halvings, but at a time of significant macroeconomic unpredictability?

Undoubtedly, no one holds a crystal ball to answer this question accurately, for the future remains inscrutable.

A reliable investing strategy in any asset class is dollar-cost averaging.

When you engage in dollar-cost averaging…禄

The Art of Investing: A Balanced Approach to Bitcoin

When considering investing in a volatile asset like bitcoin, employing a strategy of recurring purchases with fixed amounts of money can be a prudent move. For instance, committing to invest $200 in bitcoin on a monthly basis allows you to establish a position in bitcoin at various price points, mitigating the risk associated with market volatility.

Amidst a potential melt-up scenario, where bitcoin is traded at a premium, adopting a dollar-cost averaging strategy enables you not only to make purchases at the current price but also to take advantage of buying opportunities if the market experiences a downturn in the future.

If this investment approach resonates with you, it’s essential to conduct thorough research to determine the most suitable crypto exchange and consider setting up automated recurring buys through the platform of your choice. Additionally, remember the importance of transferring your bitcoin into self-custody once you have accumulated a substantial amount.

Appreciation Over Avarice

As you navigate the world of bitcoin investments in the upcoming months, it’s crucial to maintain a mindset of gratitude rather than greed. History has shown that major bull runs in bitcoin are often followed by significant pullbacks, with the price plummeting by as much as 93%.

Therefore, in the event that the value of your bitcoin holdings appreciates substantially, it is advisable to express gratitude for the wealth accumulation and consider capitalizing on some profits, rather than succumbing to the temptation of chasing greater financial gains or going all-in on bitcoin at what could potentially be the peak of the market cycle.

Seizing opportunities presented by bitcoin bull runs can undoubtedly contribute to wealth creation, but it necessitates a composed and strategic approach, devoid of emotional decision-making and greed-driven actions.

About the author:

Frank Corva is a writer and analyst for digital assets at Finder.com. With a penchant for exploring various corners of the world, he finds immense fascination in the concept of a globally interconnected society facilitated by Bitcoin (BTC) – an impartial, secure, and borderless digital currency.

The views and opinions presented in this article are solely those of the author and do not necessarily mirror those of Nasdaq, Inc.