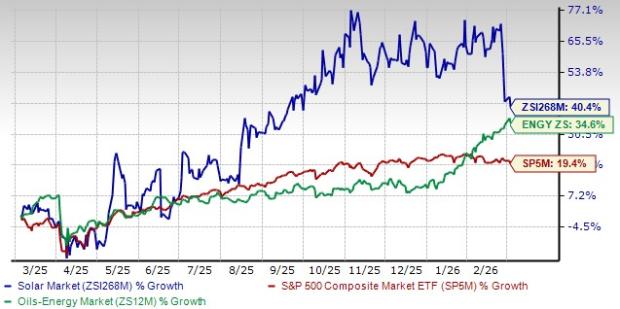

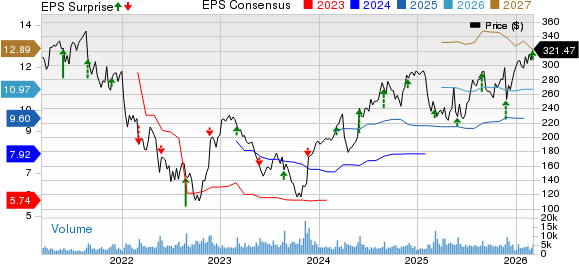

First Solar’s stock (NASDAQ: FSLR) has declined nearly 50% from approximately $300 to around $150, raising concerns about whether this represents a buying opportunity or if further declines are possible. The company’s earnings per share for the past year stand at about $11.80, leading to a price-to-earnings (P/E) ratio of close to 13. However, with net margins decreasing from 30% to below 25% and guidance suggesting single-digit revenue growth through 2026, investor confidence is waning.

In a bearish scenario where First Solar’s revenues drop by 20% over the next two years and net margins compress to 20%, earnings could fall to around $5.00 by 2026, leading to a potential stock price decline to approximately $55—representing over 65% downside from current levels. Conversely, if revenues stabilize or grow slightly, earnings could hold around $8 per share, suggesting a fair value between $175 and $200 per share. The outcomes hinge on overall market demand and pricing stability in the solar industry.