Investors Eye Marvell Technology Amid AI Industry Challenges

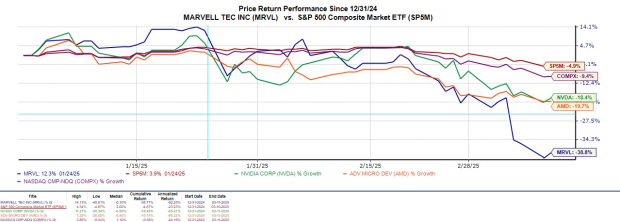

Chip stocks have historically been strong investments, but many have faced declines recently due to competition, particularly from China-based DeepSeek’s advancements in artificial intelligence at lower costs. This decline has sparked a selloff exacerbated by ongoing tariff concerns, impacting major players like Marvell Technology MRVL.

Marvell Technology, which we’ll focus on, has experienced significant fluctuations despite previously delivering impressive gains. The company is now considered a high-risk, high-reward play in the AI sector, especially following a 48% drop from its 52-week peak of $127 a share reached just two months ago in January.

Image Source: Zacks Investment Research

Marvell Technology’s AI Innovations

Based in Wilmington, Delaware, Marvell Technology plays a pivotal role in the AI landscape by delivering advanced semiconductor solutions essential for data infrastructure. Their offerings consist of custom AI chips, connectivity solutions, and innovations for data centers, all critical for supporting the demands of AI applications.

Insights from CNBC’s Jim Cramer on Marvell

During a recent segment of CNBC’s Mad Money, Jim Cramer discussed Marvell Technology after a viewer described their investment experience in the current market downturn as being in a “house of pain.” Despite this, the viewer doubled their MRVL positions ahead of the quarterly report last Wednesday. Cramer expressed support for staying invested, stating he sees opportunity rather than risk at these levels.

Cramer has praised Marvell’s management, specifically CEO Matt Murphy, highlighting the company’s potential as its semiconductor technologies are vital for advancing AI technology.

Despite exceeding earnings expectations, Marvell Technology’s stock suffered a post-earnings selloff. The company reported Q4 EPS of $0.60, a considerable increase from $0.46 in the same quarter one year prior, and surpassing the Zacks EPS consensus of $0.59.

Image Source: Zacks Investment Research

Analyzing the Zacks Rank

The Zacks Rank reinforces Jim Cramer’s perspective, suggesting that investors could see substantial returns by purchasing or maintaining their positions in MRVL. This outlook is primarily supported by a trend of positive earnings estimate revisions, which have a significant influence on stock prices.

According to Zacks projections, Marvell Technology’s earnings are expected to surge 75% in fiscal 2026, reaching $2.75 per share compared to $1.57 in fiscal 2025. Additionally, FY27 EPS estimates show a projected increase of 28% to $3.52. Notably, both FY26 and FY27 EPS estimates have seen upward revisions in the past week, rising over 2% and 1%, respectively, in the last 60 days.

Image Source: Zacks Investment Research

Conclusion

Currently, Marvell Technology holds a Zacks Rank #1 (Strong Buy), reflecting the upward trend in EPS estimates. Furthermore, the stock trades at a more reasonable forward earnings multiple of 24.2X compared to its peak of 151.4X and a median of 95.6X over the past year.

Investors may perceive the recent pullback in MRVL as a healthy correction, particularly for those with long-term aspirations. The average Zacks price target of $121.73 indicates a potential upside of 85%.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our expert team has identified five stocks with a high likelihood of gaining more than 100% in the coming months. Among these, Director of Research Sheraz Mian highlights one stock poised for significant growth.

This top pick stands out as one of the most innovative financial firms, boasting a rapidly expanding customer base of over 50 million and a diverse array of cutting-edge solutions. While not every elite pick is guaranteed success, this particular stock could greatly outperform previous Zacks’ Stocks Set to Double, such as Nano-X Imaging, which surged 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.