Starbucks Prepares for Q2 Earnings Amid Sales Challenges

As investors await quarterly earnings from major tech firms next week, Wall Street is particularly focused on Starbucks SBUX releasing its fiscal second-quarter results on Tuesday, April 29.

Anticipation surrounds the report as investors hope for a rebound. Starbucks stock remains down 10% year-to-date and has plummeted 28% from its 52-week high of $117.

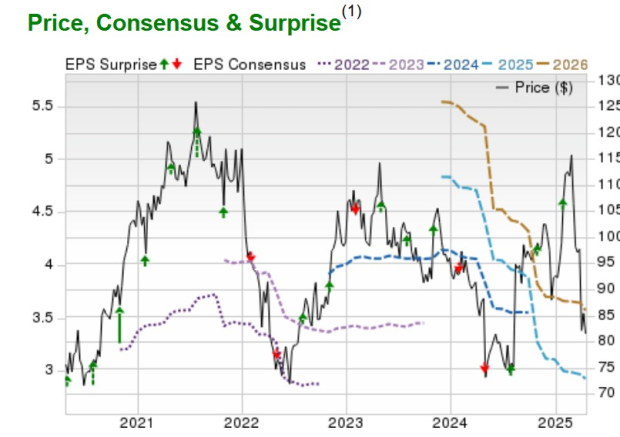

Image Source: Zacks Investment Research

Q2 Preview and Expectations

Wall Street will closely examine how rising tariffs impact Starbucks, which has already experienced slower same-store sales globally, especially in China. Projections indicate Q2 sales could reach $8.79 billion, marking a 2% increase from $8.56 billion in the same quarter last year. Optimistically, international revenue might rise 5% to $1.84 billion compared to $1.75 billion previously.

However, earnings per share (EPS) estimates suggest a decline, with Q2 projections at $0.49, down from $0.68 last year. Starbucks recently exceeded Q1 EPS estimates by 4%, but its average earnings surprise over the past four quarters has been -2.34%.

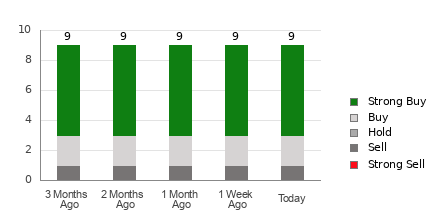

Image Source: Zacks Investment Research

Stock Performance Analysis

While Starbucks has historically posted gains, the stock has declined 24% over the last two years, posting only an 11% increase over the last three years. This performance lags behind the broader market, which has seen gains exceeding 30% during the same timeframe.

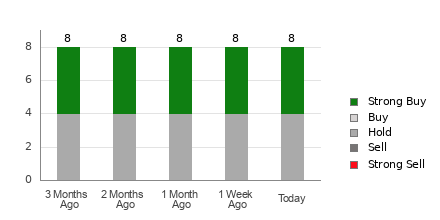

Image Source: Zacks Investment Research

Valuation Insights

Long-term investors may find it noteworthy that Starbucks is trading at 28.6X forward earnings. This level is consistent with its median over the past decade, significantly below its peak of 95.8X during that time. Additionally, SBUX is nearly aligned with the S&P 500’s forward earnings multiple of 21.2X and below the Zacks Retail-Restaurants Industry average of 26.2X.

Image Source: Zacks Investment Research

Conclusion and Insights

Currently, Starbucks holds a Zacks Rank #3 (Hold). While there are expectations of improved profitability next year, it may be premature to consider SBUX a strong buy for long-term gains.

The potential for significant recovery will largely hinge on Starbucks’ ability to meet or surpass Q2 expectations and provide guidance that signals a return to growth.