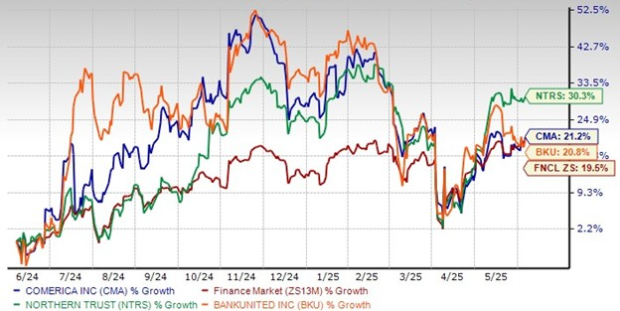

Investors are eagerly eyeing the forthcoming earnings report of KeyCorp (KEY), as the stage is set for a potential surprise. The company’s recent earnings estimate revisions have been notably favorable, signaling a promising outlook for the upcoming report.

Analysts have revised their estimates upward, with the Most Accurate Estimate for the current quarter standing at 23 cents per share, compared to the broader Zacks Consensus Estimate of 22 cents per share. This tangible upward adjustment points to a Zacks Earnings ESP of +4.89% for KEY as it heads into the earnings season.

KeyCorp Price and EPS Surprise

KeyCorp price-eps-surprise | KeyCorp Quote

Significance of Positive Zacks Earnings ESP

A positive reading for the Zacks Earnings ESP has historically been a robust indicator, often leading to positive surprises and market outperformance. Over the past decade, stocks with a positive Earnings ESP and a Zacks Rank #3 (Hold) or better have displayed a positive surprise nearly 70% of the time, with an average annual return of over 28% (refer to more Top Earnings ESP stocks here).

Given KEY’s Zacks Rank #3 and a positive ESP, investors may find the stock worth considering in anticipation of its earnings release. To explore the complete list of today’s Zacks #1 (Strong Buy)Rank stocks, click here.

The recent earnings estimate revisions suggest a favorable trajectory for KeyCorp, potentially paving the way for a positive surprise in the imminent report.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services likeSurprise Trader, Stocks Under $10, Technology Innovators,and more. They’ve already closed 162 positions with double- and triple-digit gains in 2023 alone.

KeyCorp (KEY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.