As earnings season approaches, investors are eagerly scouting for stocks with the potential to outperform, and Seagate Technology Holdings plc (STX) seems to have entered the spotlight. With its earnings report on the horizon, the company’s fortune appears to be on an upswing.

Seagate is currently experiencing an encouraging trend in its earnings estimates. This shift often foreshadows a positive earnings surprise. Analysts have recently raised their estimates for Seagate, indicating a favorable underlying sentiment for STX as it approaches its next report.

The Most Accurate Estimate for the current quarter stands at breakeven earnings per share for STX, in contrast to the broader Zacks Consensus Estimate of a loss of 8 cents per share. This recent adjustment points to a striking 100% Zacks Earnings ESP for Seagate heading into the earnings season.

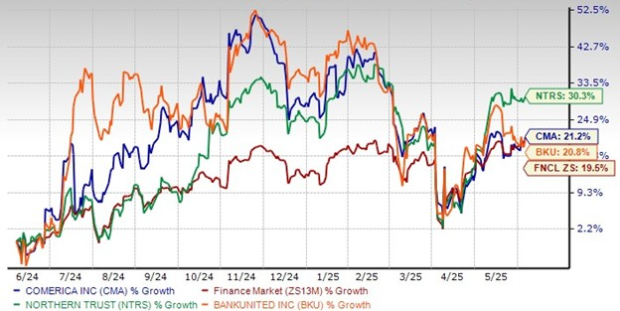

Seagate’s Price and EPS Performance

Seagate Technology Holdings PLC price-eps-surprise | Seagate Technology Holdings PLC Quote

The Significance of These Findings

The Zacks Earnings ESP has demonstrated a strong correlation with positive surprises and market outperformance. Over the past decade, stocks with a positive Earnings ESP and a Zacks Rank #3 (Hold) or better have recorded a positive surprise close to 70% of the time, delivering average annual returns exceeding 28% (view more Top Earnings ESP stocks here).

Given STX’s Zacks Rank #3 and a positive ESP, investors may want to weigh the prospects of this stock before the earnings release. The complete list of today’s Zacks #1 (Strong Buy)Rank stocks is available here.

The recent uptick in earnings estimates indicates a favorable trajectory for Seagate, potentially indicating an upcoming earnings beat.

Seagate Technology Holdings PLC (STX) : Free Stock Analysis Report

Read this article on Zacks.com by clicking here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.