Should Investors Trust Wall Street’s Take on Advanced Micro Devices?

When investors consider whether to buy, sell, or hold a stock, they often turn to advice from Wall Street analysts. Recent upgrades or downgrades from these analysts can significantly sway a stock’s price. But how reliable are their recommendations? Let’s take a closer look at what analysts think of Advanced Micro Devices (AMD).

Understanding Advanced Micro Devices’ Analyst Ratings

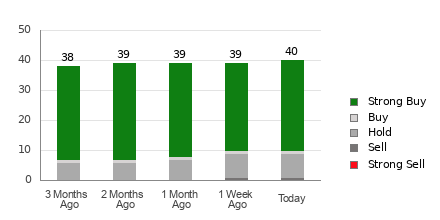

Advanced Micro currently holds an average brokerage recommendation (ABR) of 1.50 on a scale from 1 to 5 (Strong Buy to Strong Sell). This figure reflects recommendations from 40 brokerage firms. An ABR of 1.50 leans towards Strong Buy, suggesting strong support for the stock.

Breaking down the recommendations: 30 of the analysts rate it as Strong Buy, while one considers it a Buy. Thus, Strong Buy and Buy account for 75% and 2.5% of total recommendations, respectively.

Trends in Analyst Recommendations for AMD

For those looking to understand price targets and forecasts for Advanced Micro, further information can be found here>>>

While the ABR suggests buying AMD, investors should exercise caution when making decisions based solely on these ratings. Studies indicate that brokerage recommendations often do not provide a reliable indication of which stocks will yield the best price increases.

The reason is simple: brokerage firms tend to have a vested interest in the stocks they cover. Research suggests that for every “Strong Sell,” firms issue five “Strong Buy” recommendations. This discrepancy can mislead retail investors regarding a stock’s potential future performance.

Health of Zacks Rank vs. Brokerage Ratings

Zacks Rank is a proprietary stock rating tool that categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). It serves as a stronger indicator of a stock’s near-term price performance compared to the ABR. Combining the ABR with Zacks Rank can enhance investment decisions.

Clarifying the Difference: Zacks Rank vs. ABR

It’s essential to note that Zacks Rank and ABR, though measured on a scale of 1-5, serve different purposes. ABR is based strictly on brokerage recommendations and can be presented in decimal form (like 1.28). In contrast, Zacks Rank derives from earnings estimate revisions and uses whole numbers.

Analysts often display an overly optimistic approach in their ratings, influenced by their firms’ interests. This leads to more favorable ratings that do not always reflect reality. Zacks Rank relies on earnings estimates, which historically correlate well with stock price trends.

The balance of Zacks Rank categories applies uniformly across stocks with available earnings estimates. This equilibrium contributes to its reliability.

Another distinction relates to timeliness; the ABR might not be current, while Zacks Rank updates quickly to capture shifts in earnings estimates, providing more relevant data for investors.

Is AMD a Good Investment?

Regarding AMD’s earnings estimates, the Zacks Consensus Estimate has remained steady at $3.31 for the current year. Analysts’ stable outlook may indicate that AMD could perform similarly to the broader market shortly.

The lack of change in the consensus estimate, combined with other specific factors about its earnings estimates, has resulted in a Zacks Rank #3 (Hold) for AMD. A complete list of today’s Zacks Rank #1 (Strong Buy) stocks is available here>>>>

In light of this, investors should approach the Buy-equivalent ABR for Advanced Micro with some caution.

Zacks Unlocks the Top Semiconductor Stock

This stock ranks just 1/9,000th the size of NVIDIA, which has surged over +800% since our recommendation. While NVIDIA remains strong, our new top semiconductor stock has greater growth potential.

With robust earnings growth and an expanding customer base, it stands ready to meet the increasing demand for Artificial Intelligence, Machine Learning, and Internet of Things technologies. Global semiconductor manufacturing is projected to surge from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

For the latest insights from Zacks Investment Research, you can download our report on 7 Best Stocks for the Next 30 Days. Click here for this free resource.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.