When pondering whether to Buy, Sell, or Hold a stock, the natural inclination for investors is to lean on the wisdom of Wall Street analysts. The recent buzz around Alibaba (BABA) paints a picture of optimism. But before diving into the depths of this analysis, let’s scrutinize the reliability of brokerage recommendations and how investors can leverage them to their advantage.

Decoding the Trend in Brokerage Recommendations for BABA

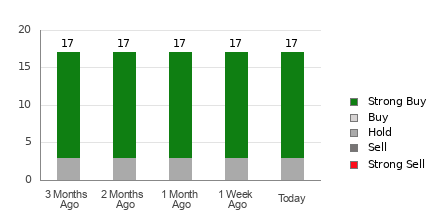

Per current data, Alibaba boasts an average brokerage recommendation (ABR) of 1.35, hovering between Strong Buy and Buy territory. Out of a pool of 17 brokerage firms, a striking 82.4% of the recommendations shine as Strong Buys.

Conversely, research indicates that relying solely on such recommendations might not be the soundest strategy. Brokerage firms, inherently inclined towards generosity due to vested interests, often overlook the true landscape when evaluating a stock.

In stark contrast, Zacks Rank, our trusted stock rating tool, assigns stocks a ranking from 1 (Strong Buy) to 5 (Strong Sell) based on historical earnings estimate revisions. The Zacks Rank stands tall as a robust yardstick for projecting a stock’s future price performance. Validating ABR against Zacks Rank could pave the way to better investment decisions.

Debunking the Dichotomy Between ABR and Zacks Rank

While both ABR and Zacks Rank may span a 1-5 range, their essence diverges profoundly. ABR hinges solely on broker recommendations in decimal form, while Zacks Rank draws strength from the quantitative analysis of earnings estimate revisions in whole numbers.

Broker analysts’ optimistic bias, a common pitfall, underscores the importance of relying on Zacks Rank. Empirical data underscores a strong correlation between earnings estimate trends tracked by Zacks Rank and subsequent stock price movements.

Unlike ABR, Zacks Rank maintains timeliness and objectivity in its assessments. This tool thrives on the freshness of analysts’ continuous earnings estimate revisions, ensuring swift and responsive insights into stock price movements.

Is Alibaba a Golden Nugget for Investors?

The Zacks Consensus Estimate for Alibaba stands at $8.68 for the current year, unscathed by any recent alterations indicating analysts’ unwavering confidence in the company’s earnings trajectory. This, coupled with other factors, cements Alibaba’s Zacks Rank at #3 (Hold).

While the Buy-equivalent ABR for Alibaba might paint a rosy picture, a cautious stance aligned with the Zacks Rank could prove prudent in navigating this investment landscape.

5 Stocks Poised for a Leap

Handpicked by Zacks experts as potential gainers surpassing +100% in 2024, these stocks offer a springboard to capitalize on uncharted territories. Delve into these hidden gems overlooked by Wall Street for a shot at ground-floor opportunities.

For the latest investment insights from Zacks Investment Research, grab your copy of 5 Stocks Set to Double today for a dive into promising prospects. Harness the power of informed decision-making to unlock the full potential of your investments.

For more on this article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.