Amazon vs. Walmart: A Close Race for Sales Supremacy

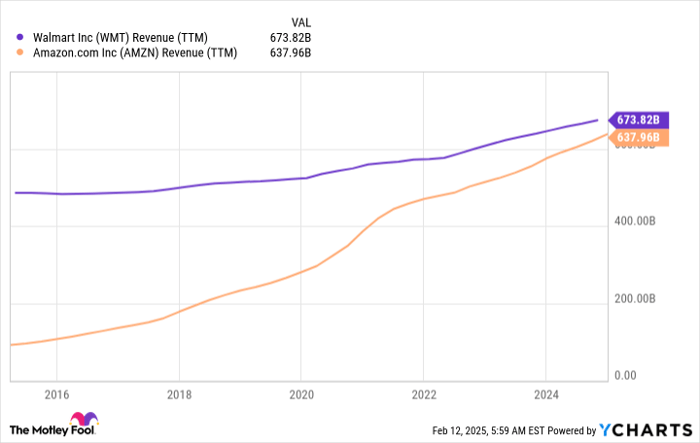

After years of rivalry, Amazon (NASDAQ: AMZN) is narrowing the gap with Walmart (NYSE: WMT) in the battle for the title of largest company in the world by sales. Amazon has consistently outpaced Walmart in sales growth, but Walmart’s robust performance has kept it in the lead—until now. Following an impressive fourth quarter, Amazon might be ready to take the lead.

Amazon’s Strong Sales Surge

Betting against Amazon has often proven unwise, and recent developments reinforce this perspective. The company reported a remarkable 10% year-over-year sales growth in its fourth quarter, a significant achievement for a company of its size. It’s worth noting that the only other company of comparable size, Walmart, hasn’t reported double-digit quarterly growth since 2007.

During the fourth quarter, Amazon generated $187.8 billion in total revenue. Here’s how that revenue is broken down:

- $75.6 billion from online stores

- $47.5 billion from third-party sellers

- $28.8 billion from Amazon Web Services (AWS)

- $17.3 billion from advertising

- $11.6 billion from subscription services

- $5.6 billion from physical stores

- $1.6 billion from “other”

Despite this strong quarter and a 61% increase in total operating income, Amazon’s first-quarter guidance disappointed some investors. The company anticipates revenue growth of 4% to 8% year over year, which falls short when compared to its usual performance. Management noted potential foreign exchange challenges that may affect the company’s results.

Amazon is also heavily investing in artificial intelligence (AI), expecting to spend $100 billion by 2025. This investment is viewed as crucial for future growth, with analysts forecasting first-quarter sales around $155 billion and total sales in 2025 reaching $699 billion, indicating a nearly 10% increase year over year.

Walmart’s Consistent Performance

Walmart is set to release its fiscal 2025 fourth-quarter and full-year results next week, with analysts projecting $179 billion in fourth-quarter sales. If these estimates prove accurate, they would still come in below Amazon’s impressive figures for the same period.

For the full fiscal year, Walmart is expected to report $677 billion in sales, ahead of Amazon’s projected $638 billion for 2024. Predictions for Walmart’s fiscal 2026 place its revenue at around $695 billion, slightly trailing Amazon’s expected results for 2025. This trend presents a competitive landscape, as illustrated in the accompanying revenue chart.

WMT Revenue (TTM) data by YCharts

Assessing the Impact for Investors

Walmart remains an attractive option for investors due to its reliable business model and consistent dividend growth. The company continues to expand its store network and enhance customer engagement through its omnichannel strategy, allowing it to compete effectively. In the third quarter, Walmart’s e-commerce sales surged 27% year over year, providing it with an advantage over Amazon in some areas.

While Walmart may soon lose its title as the largest retailer by sales, its stable growth trajectory suggests it will continue to be a solid investment. Amazon’s growth potential is also substantial, particularly in the AI sector where its AWS services currently contribute only 14% of total revenue.

Is This a Good Time to Invest?

If you’re considering investments, now may be an opportune moment for Amazon. For those seeking a dependable dividend stock, Walmart remains a viable choice.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has positions in Walmart. The Motley Fool has positions in and recommends Amazon and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.