AMD Faces Challenges Amidst AI Growth; Can It Compete with Nvidia?

Advanced Micro Devices(NASDAQ: AMD) has long been recognized in the computing industry, historically playing second fiddle to many competitors. While it has made strides to compete with Intel in PC processors, the competition is fiercer with the rise of artificial intelligence (AI) computing. Currently, AMD is overshadowed by larger rival Nvidia, raising the question: can AMD regain its footing as a top choice for AI investment?

Mixed Results in AMD’s Q4 Performance

AMD’s business model is multi-faceted, with revenue split into four sectors: data center, client, gaming, and embedded. Each of these sectors has its specific focus, yet their performances vary significantly.

The gaming sector, which includes GPUs for gaming PCs and consoles like the Xbox Series X and PlayStation 5, struggled, reporting a sharp 59% decline in revenue to $563 million year-over-year in Q4. Similarly, the embedded processors segment, bolstered by AMD’s acquisition of Xilinx, also experienced decline, with revenue dipping 13% to $923 million. This segment focuses on low-power application-specific processors.

The lackluster performance in these divisions has impacted AMD’s overall growth rate. However, there were brighter spots: client revenue, which includes original equipment manufacturer (OEM) processors, surged 58% year-over-year to reach $2.3 billion, marking a significant improvement for AMD after several quarters of decline.

The most crucial driver for AMD is its data center sector, which competes directly with Nvidia to provide the necessary computing power for AI model training. Although the segment reported a substantial 69% growth in revenue, totaling $3.9 billion, it fell short of analyst expectations, which projected data center sales of $4.14 billion.

In total, AMD’s management forecasted $7.5 billion in sales for the fourth quarter. The actual figure came in at $7.66 billion, exceeding the company’s own projections, which is a point of focus for investors, especially in contrast to Wall Street’s estimates.

Despite beating expectations on overall sales, AMD’s stock fell over 6% after the earnings report, hitting its lowest price since late 2023. There appear to be limited indicators of AMD catching up with Nvidia in the competitive AI landscape, and the weaker divisions may not sufficiently buffer against this setback. Nevertheless, some investors may view the stock as a potential value opportunity if the price continues to decline.

Valuation Insights: Is AMD Stock a Buy?

Even with AMD’s current challenges and its recent stock price lows, its shares are not necessarily inexpensive.

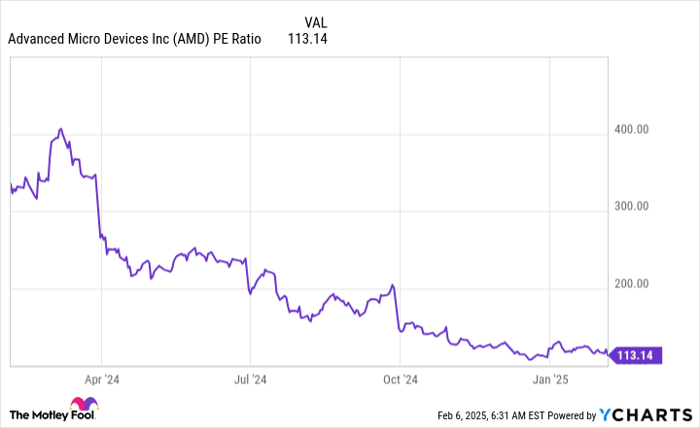

AMD PE Ratio data by YCharts

Currently, AMD’s trailing earnings yield a striking price-to-earnings (PE) ratio of 113, indicating a premium valuation. However, analysts predict significant earnings growth for AMD in 2025, estimating $3.31 in earnings per share (EPS) for the year. This would decrease AMD’s forward P/E ratio to a more palatable 34.

Yet, with Nvidia trading at a lower forward P/E of 28, one must question the wisdom of investing in AMD at a higher price compared to its competitor. This presents a dilemma for investors, as numerous leading companies offer superior investment opportunities over AMD at this time.

Seize Your Chance for Future Growth

Have you ever felt you missed out on investing in high-performing stocks? If so, now might be your moment to turn that around.

On rare occasions, our team of analysts identifies companies they believe are poised for significant gains. If you’re concerned about missing other investment opportunities, the time to consider buying is now. The statistics highlight compelling returns:

- Nvidia: if you invested $1,000 when we recommended it in 2009, you’d have $336,677!*

- Apple: if you invested $1,000 when we recommended it in 2008, you’d have $43,109!*

- Netflix: if you invested $1,000 when we recommended it in 2004, you’d have $546,804!*

Currently, we have “Double Down” alerts out for three exceptional companies, and opportunities like this may not arise again soon.

Learn more »

*Stock Advisor returns as of February 3, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, and Nvidia. The Motley Fool recommends the following options: short February 2025 $27 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.