AMD’s Stock Faces Challenges Amid AI Market Dynamics

Advanced Micro Devices (NASDAQ: AMD) has navigated a turbulent environment characterized by a downward trend in AI stock performance. The chip manufacturer peaked in March 2024 and has since dropped nearly 50% from its highest value.

Nevertheless, many analysts on Wall Street maintain bullish price targets for AMD, labeling it a potential buy here. Hans Mosesmann of Rosenblatt Securities leads the sector with a price target of $225. With AMD shares currently around $100, this suggests a possible upside of approximately 125% over the next 12 months.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Investors might be tempted by such promising returns, but is this expectation realistic?

AMD’s Market Position Compared to Rivals

Despite its reputable hardware, AMD has frequently lagged behind competitors in key market segments. In the early 2000s, Intel dominated the processor market, with AMD remaining relevant primarily due to regulatory factors restricting Intel’s monopoly. This pattern has been echoed in the AI chip industry, where Nvidia is currently the leader in the crucial data center space.

In the fourth quarter, AMD’s data center segment brought in $3.9 billion, reflecting a 69% year-over-year increase. In contrast, Nvidia’s data center revenue soared by 93% to $35.6 billion during its fiscal 2025 fourth quarter. Not only is AMD’s data center revenue significantly smaller than Nvidia’s, but it is also experiencing a slower growth rate, a combination that has adversely affected AMD’s Stock performance.

The initial investment rationale for AMD in early 2024 was based on the expectation that it would gradually challenge Nvidia, particularly as leading AI chip buyers shifted their focus from training to inference hardware. This shift has not materialized, and Nvidia has maintained its lead, unveiling its new Blackwell architecture graphics processing units (GPUs) without conceding ground in inference.

AMD has also faced setbacks in other markets. Its gaming revenue decreased by 59% year-over-year in Q4, while embedded processor income fell by 13%. Client revenue did increase by 58% to $2.3 billion, but this growth is somewhat misleading, as the broader PC market remains stagnant, leading to cyclicality in revenue.

Despite AMD’s disappointing fourth-quarter results, its overall revenue grew by 24%, and profits increased by 42%. Most companies would view these figures positively; however, AMD’s inability to gain traction against its key rival has continued to pressure its stock price.

Evaluating AMD’s Stock Valuation

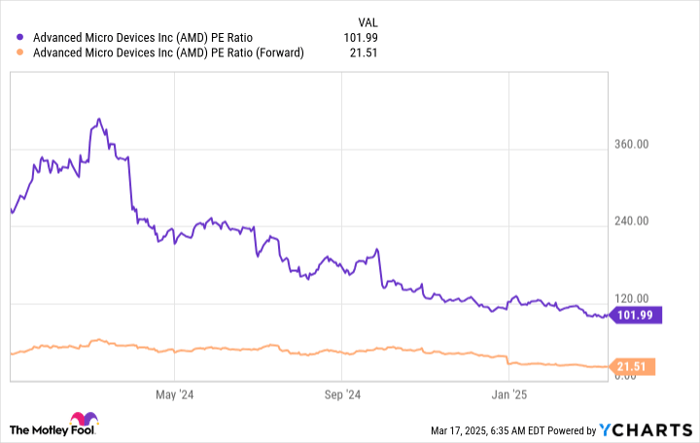

From a valuation perspective, AMD’s Stock is not considered overly cheap based on trailing earnings. Recent quarters indicate the business was not optimized for profitability, which may inflate its trailing earnings multiple. Rather, investors should focus on the forward price-to-earnings (P/E) ratio, a metric less skewed by past anomalies affecting trailing earnings.

AMD PE Ratio data by YCharts.

Currently, AMD trades at a forward P/E of 21.5, slightly above the S&P 500‘s ratio of 20.5. As AMD is projected to grow its revenue by 23.4% in 2025 and 20.7% in 2026, this premium valuation appears justified.

Could AMD’s Stock really experience a 125% rally in the next year, as suggested by Mosesmann? This seems unlikely, as it would imply an unsustainable valuation for a company that lacks a clear competitive edge. However, substantial market-beating returns are within reach for those who hold AMD shares over the next three to five years.

Is Now the Right Time to Invest $1,000 in Advanced Micro Devices?

Before making a decision to invest in AMD, consider the following:

The Motley Fool Stock Advisor team has recently highlighted the 10 best stocks to buy today—none of which included Advanced Micro Devices. The selected stocks offer significant potential for returns in the coming years.

Recall that when Nvidia was recommended on April 15, 2005, a $1,000 investment would now be worth $720,291!*

Stock Advisor provides a comprehensive strategy for investment success, which includes portfolio development guidance, regular market updates, and two new Stock suggestions monthly. The Stock Advisor service has outperformed the S&P 500 by more than four times since its inception in 2002*. Join now to stay informed on the latest top 10 stocks!

See the 10 stocks »

*Stock Advisor returns as of March 18, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, and Nvidia. The Motley Fool also recommends shorting May 2025 $30 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.