“`html

Bitcoin Hits All-Time High; Gold and Altcoins Poised for Gains

Bitcoin has reached a new all-time high, surpassing $111,000 for the first time. Currently, it is trading at $111,144.

Several macroeconomic factors are contributing to this surge:

- Increasing institutional ownership and corporate adoption

- Recent softer inflation data

- Positive developments in the U.S.-China trade war

- Moody’s downgrade of U.S. debt, raising concerns about dollar debasement

- President Trump’s proposed fiscal measures that may challenge national finances

- Advancements in the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act

Crypto expert Luke Lango predicted this all-time high. At the beginning of the month, he noted:

If April was marked by uncertainty and volatility, May is set to launch one of the biggest rallies in recent crypto history.

We believe that Bitcoin will reclaim $100,000 within the next week or two, aiming for $120,000 shortly thereafter.

Luke was correct in his forecast to reach $100,000. Now, he sees $120,000 on the horizon.

Source: TradingView

In a recent update, Luke emphasized:

The rally is just beginning. As macroeconomic chaos fades and hopes for crypto deregulation rise, the market should surge over the next few months.

We foresee Bitcoin reaching $150,000 by late summer and potentially hitting $200,000 by the year’s end.

A rise to $200,000 would represent an 80% increase from its current level. Historically, leading altcoins tend to outperform during such gains.

Luke expects this altcoin rally could start soon, based on his research indicating that once Bitcoin breaks major resistance, altcoins typically follow suit within two weeks.

Investors should consider holding assets like Solana, Cardano, Ripple, and Chainlink as market conditions improve.

Our long-standing view remains that Bitcoin and premier altcoins are essential components of a well-rounded portfolio. Keep holding.

Gold Prices Surging Amid Economic Concerns

Bitcoin’s recent rise is partly due to concerns over national debt and deficit, which is also favorable for gold. In 2025, gold has hit new all-time highs, and macro expert Eric Fry suggests this trend is likely to continue:

When a nation’s finances fall apart, its currency typically declines sharply. This scenario boosts gold prices, as they inversely relate to currency value.

While gold and gold shares have performed admirably in recent months, a significant correction may be on the horizon. Nevertheless, gold remains a strong hedge against uncertainty.

Historically, gold stocks are undervalued, currently around 30% below their 20-year average, despite profit margins rising due to higher gold prices.

In January, Eric recommended his subscribers invest in Westgold Resources (WGXRF), which is already up nearly 40%, with further gains anticipated.

If you haven’t considered investing in gold and gold mining stocks yet, the current macroeconomic volatility may offer an opportune moment.

Eric observes:

Investors frequently overlook gold stocks, but they have the potential to deliver significant returns, especially when other investments may falter.

Recent Successes for Eric’s Subscribers

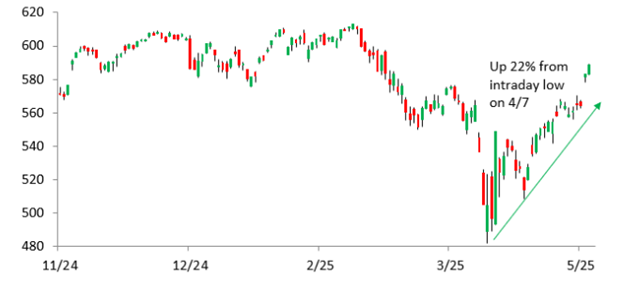

On April 7, while the S&P was experiencing a significant decline, Eric sent a flash alert to his subscribers recommending a strategic buy.

His thoughtful approach combined with market insights underscores the importance of timing in investment decisions.

Source: TradingView

“`# Market Update: Canada Goose Surges Amid Recovery Predictions

The current market selloff raises questions about its duration and depth. However, a consistent strategy of investing in strong companies at favorable prices is crucial for long-term wealth. As the market fluctuates, I will continue to identify select “Buy” opportunities during this downturn.

Subscribers to the Investment report experienced significant gains yesterday with Canada Goose Holdings Inc. (GOOS) rising by 20% following better-than-expected earnings.

Today, the stock continued its upward trend, leading to a remarkable 53% return over just six weeks.

Source: TradingView

In connection with this, Eric’s options service, Leverage, advised subscribers to purchase call options for GOOS on the same day the stock was bought. Yesterday, he suggested that Leverage subscribers take profits, which at that time had reached 200%. Currently, gains have increased to 215%.

As Eric noted:

It’s prudent to secure some of these gains by selling half of the position while keeping the other half to potentially capture greater profits.

By selling half at a 200% gain, investors ensure a minimum profit of 50% even if the remaining half declines to zero.

This situation serves as a reminder of a key investment principle: volatility can be beneficial for prepared investors, while it poses challenges for those who react impulsively.

Famed investor Jeremy Grantham emphasized this idea, stating:

Volatility reflects uncertainty regarding underlying value.

Let’s strive to remain informed and cautious. Preparation can be the deciding factor in achieving or surpassing investment goals.

Congratulations to Eric and his subscribers for recognizing the value in GOOS; their timely decisions are yielding substantial returns.

Market Experts Urge Readiness Amid Recent Selloff

Other experts have encouraged investors to remain engaged following the market volatility observed during the recent “Liberation Day” selloff. Since the market bottomed in early April, the subsequent recovery has been exceptional, which was anticipated by legendary investor Louis Navellier.

In his analysis following the rebound, Louis stated:

The media implies that this rally was unexpected, but I had predicted a significant recovery immediately after the April 3 collapse.

Our expectations came true.

Louis recently revealed insights on upcoming market changes aligned with trade war developments. He refers to these changes as Liberation Day 2.0.

Here’s what Louis identifies as pivotal elements:

- Tax Liberation

President Trump’s proposal to use tariff revenues for income tax cuts could stimulate consumer spending significantly. - Tech Liberation

Investment in AI, cryptocurrency, and cloud technologies is exceeding $2 trillion, signaling renewed regulatory support for innovation. - Energy Liberation

The U.S. possesses over $100 trillion in untapped energy resources, with recent executive directives facilitating exploration and development.

Action Steps for Investors

As for immediate recommendations, Louis highlights Nvidia as a significant investment. He originally placed his subscribers into Nvidia back in 2019, resulting in a staggering 3,043% increase.

Critics may express concern over the current price, but Louis argues that potential future gains far outweigh past performance.

Nvidia is just one suggestion; an additional recommendation will be revealed in Louis’s upcoming issue of the Digest, where he will outline strategies connected to Liberation Day 2.0.

For further insights, tune in to Louis’s live broadcast on May 28 at 1 p.m. Eastern, where he will discuss the full framework for Liberation Day 2.0 and reveal ticker symbols for three stocks flagged with “buy” ratings.

This approach reflects Louis’ proven strategy that underpins his long-standing successful market participation.

Best,

Jeff Remsburg