ANSYS, Inc. Maintains a Leading Edge Amidst Market Fluctuations

Canonsburg, Pennsylvania-based ANSYS, Inc. (ANSS) is renowned for its engineering simulation software and services tailored for engineers, designers, researchers, and students. With a market capitalization of $29.2 billion, ANSYS has a global footprint that includes operations across the Americas, Europe, Asia Pacific, the Middle East, and Africa.

Large-Cap Status and Product Portfolio

As a “large-cap” company, valued at $10 billion or more, ANSYS signifies robust stability and influence within the software application industry. The firm stands at the forefront of simulation technology, offering a sophisticated portfolio that caters to industries like aerospace, defense, and automotive.

Innovative Solutions and Strategic Growth

The company’s integrated multiphysics capabilities allow organizations to address complex challenges while driving innovation. ANSYS aims to bolster its market leadership through strategic growth initiatives that focus on expanding its product lineup, increasing its user base, and enhancing computational efficiency.

Current Stock Performance and Market Context

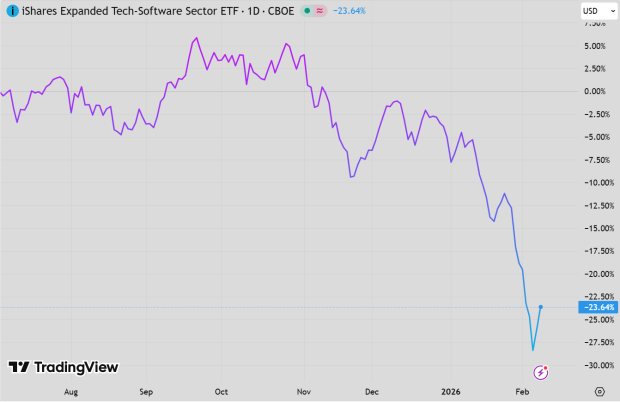

Currently, ANSS shares are trading 8.2% lower than their high of $364.31, reached on December 29. Despite this dip, the stock has climbed 3.8% in the past three months, outperforming the marginal gains of the Dow Jones Industrial Average ($DOWI) during the same period.

For the year-to-date (YTD), ANSS shares are down 7.8%, whereas they have gained 12.1% over the past 52 weeks. In comparison, the DOWI has seen a YTD increase of 12.3% and a total growth of 12.7% over the last year.

Technical Indicators and Recent Earnings

The stock has been trading below its 50-day and 200-day moving averages since mid-October, reflecting a bearish trend. However, shares of ANSS rose 6.6% following their Q3 earnings release on November 6, where the company reported earnings per share (EPS) of $2.58 and revenue of $601.9 million—both surpassing expectations, aided by strong multi-year lease performance and a significant $88 million high-tech contract in the Americas.

Competitive Landscape & Analyst Outlook

In the competitive software application sector, ANSYS faces tough competition from Autodesk, Inc. (ADSK). Meanwhile, Autodesk has outperformed ANSS with a YTD gain of 20.6% and a 23.3% return over the past year.

Given its recent performance, analysts are cautious regarding ANSS’s outlook. The stock holds a consensus rating of “Hold” from 12 analysts, with a mean price target of $352.89, indicating a modest 5.5% premium over current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here. More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.