Apple Manufacturing Programme and Market Valuation

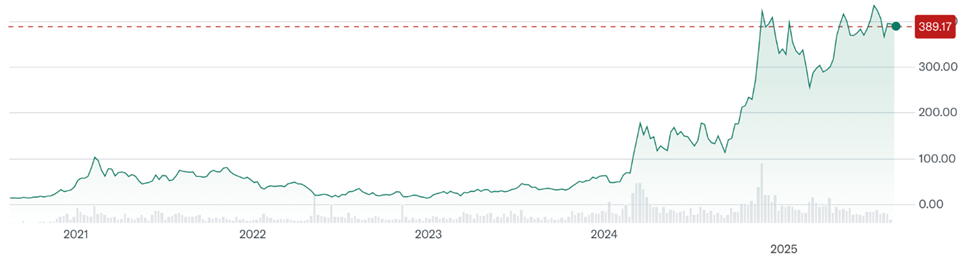

Apple Inc. announced a $100 billion manufacturing program aimed at creating American jobs and onshoring parts of its supply chain, which may lead to a significant reduction in tariff expenses. Following this news, Apple’s stock surged from $202.69 on August 5 to $229.09 by August 8, boosting its market capitalization to $3.404 trillion, a gain of $394 billion.

CEO Tim Cook’s visit to the White House was pivotal in securing a 100% tariff exemption on imported semiconductors. Although the company is improving financially—with Q3 fiscal 2025 revenue up 10% and EPS up 12%—its ability to justify its valuation remains in question, particularly as growth in its core product segments stagnates. As of now, Apple needs to grow its earnings substantially to reach a market cap of $4 trillion, currently valued at $3.418 trillion, which will require a 17% increase.

Despite recent improvements, analysts caution that Apple’s growth trajectory in artificial intelligence is not sufficient to maintain investor interest, especially when compared to rivals like Nvidia and Microsoft. Apple’s future success may depend on effectively integrating AI functionalities across its product lineup while managing rising operational costs from its manufacturing initiatives.