AppLovin Prepares for Robust Q3 Earnings Report

AppLovin Corporation (APP) is set to announce its third-quarter 2024 earnings on November 6, after the market closes.

Stay informed about all quarterly releases: Check the Zacks Earnings Calendar.

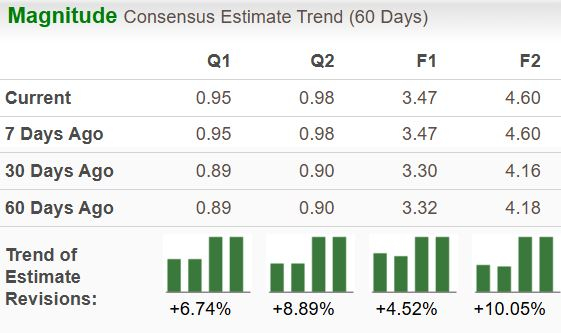

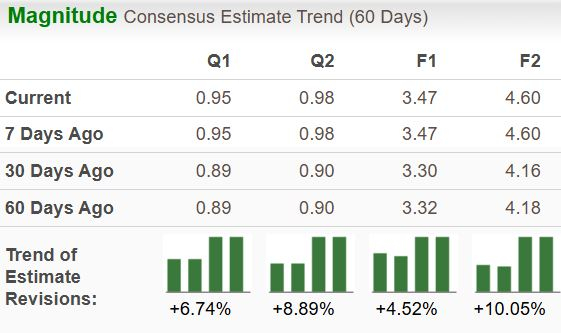

The Zacks Consensus Estimate anticipates earnings of 95 cents for the upcoming quarter, representing a substantial growth rate of 216.7% from the same quarter last year. Additionally, the revenue forecast stands at $1.13 billion, which would mark a 30.8% increase year-over-year.

In the last 30 days, one estimate for the upcoming quarter has been upgraded, while there were no downward revisions. Moreover, the consensus estimate for earnings in 2024 has risen by 6.7% during this period.

Image Source: Zacks Investment Research

AppLovin has a strong track record, having exceeded the Zacks Consensus Estimate in all of the last four quarters, with an average earnings surprise of 21.1%.

Current Earnings Outlook for AppLovin

Unfortunately, our model doesn’t guarantee an earnings beat for AppLovin this time. A positive Earnings ESP along with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically indicates better odds of an earnings surprise. However, APP currently has an Earnings ESP of -4.71% and a Zacks Rank #2.

For more insights on the best stocks to watch, check our Earnings ESP Filter.

Expectations for Q3 Performance

We anticipate an improvement in revenues as the company’s Software Platform and App income drive growth. The forecast for Software Platform revenues is $763.44 million, suggesting a 51% increase from last year. Meanwhile, revenue from Apps is expected to be $367.72 million, reflecting a modest 2.2% growth.

Adjusted EBITDA for the Software Platform is projected at $559.3 million, indicating a 53.6% year-over-year rise. Similarly, adjusted EBITDA for Apps is expected to climb by 50.8% compared to last year.

AppLovin’s Stock Performance in 2023

Year to date, AppLovin shares have surged by 299.2%, notably outpacing the industry average of 32.7%. Competitors in the in-game mobile advertising sector are also performing well, with Alphabet Inc. (GOOGL) up 21.2% and Meta Platforms (META) increasing by 58.5% this year.

Image Source: Zacks Investment Research

Despite this strong performance, APP stock remains undervalued. Trading at 34.11X based on the trailing 12-month EV-to-EBITDA ratio, it is below the industry average of 49.45X. In terms of the forward 12-month Price/Earnings ratio, APP stands at 35.92X, compared to the industry’s 38.13X.

Growth Opportunities and Risks for AppLovin

AppLovin’s growth has benefited from the introduction of the AXON 2.0 technology and its expansion into gaming studios. The company is also looking to broaden its software offerings beyond gaming. Recently, AppLovin launched a pilot program allowing e-commerce websites to purchase in-app video ad inventory for mobile games.

These ads direct gamers to e-commerce sites. Management believes the software segment could see 20-30% growth long-term, even as it ventures beyond gaming. This successful expansion could significantly enhance AppLovin’s growth trajectory.

However, challenges remain, such as potential slowdowns in the in-game advertising segment and the uncertainties associated with non-gaming initiatives. Nevertheless, AppLovin is well-positioned for sustained growth thanks to its technological advancements and strategic initiatives.

Is AppLovin Stock a Good Investment?

Considering AppLovin’s strong financial results, growth potential, and undervalued stock price, it may present a solid buying opportunity. The blend of revenue and earnings growth with increasing analyst confidence makes APP an attractive investment choice. Although the stock has increased significantly, its valuation implies there is still potential for further growth.

Explore Zacks’ Investment Opportunities

Get started for just $1.

Years ago, we surprised our members by offering them 30-day access to all our stock picks for only $1, with no strings attached.

Thousands seized this opportunity, while others hesitated, thinking there might be a catch. The reason behind this offer is to familiarize you with our portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and more, which closed 228 positions with double- and triple-digit gains in 2023 alone.

Discover Stocks Now >>

Want to stay updated with the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double today for free.

AppLovin Corporation (APP): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.