Arm Holdings Set to Report Q4 Fiscal 2025 Earnings with Growth Expectations

Arm Holdings plc (ARM) will report its fourth-quarter fiscal 2025 results on May 7, after the market closes.

Key Financial Estimates

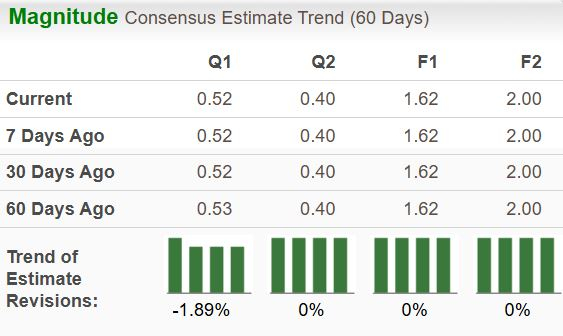

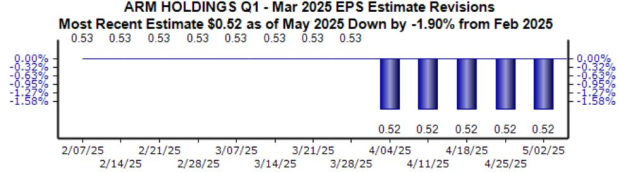

The Zacks Consensus Estimate for earnings in this quarter is 52 cents, reflecting a year-over-year growth of 44.4%. The consensus revenue estimate is set at $1.23 billion, indicating a 33% increase from last year.

In the past 60 days, there has been one downward revision of earnings estimates, while no estimates have been increased. Consequently, the Zacks Consensus Estimate for this quarter’s earnings has declined by 2%.

Image Source: Zacks Investment Research

Earnings Surprise History

Arm has a notable history of exceeding earnings expectations. The company has surpassed the Zacks Consensus Estimate in the last four quarters, with an average earnings surprise of 18%.

Image Source: Zacks Investment Research

Predictions and Model Insights

Currently, our model does not strongly predict an earnings beat for ARM during this quarter. A positive earnings surprise is more likely when a company has a positive earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold). However, ARM is not in this position. The company shows an earnings ESP of 0.00% and a Zacks Rank #3.

To find the latest EPS estimates and surprises, refer to the Zacks earnings Calendar.

Revenue Drivers

We project that the top line will improve year-over-year mainly due to increased Royalty and License revenues. The consensus estimate for License and other revenues is $665 million, reflecting a growth of 60.6% year-over-year. Conversely, Royalty revenues are estimated at $571 million, suggesting an 11.1% year-over-year decline.

Market Performance Analysis

In the past month, ARM’s stock has surged by 39%, leading to a higher valuation. The forward 12-month Price/earnings ratio shows that ARM shares are currently trading at 59.6X forward earnings, which is considerably above the industry average of 26.05X.

Image Source: Zacks Investment Research

Long-Term Outlook

Arm Holdings continues to hold a strong position in the semiconductor sector, particularly in mobile technology. Its low-power chip architecture is essential for smartphones and tablets. Major companies like Apple (AAPL), Qualcomm (QCOM), and Samsung depend on ARM’s designs, making it a cornerstone of mobile computing. As these tech giants expand their product lines, the demand for ARM’s technology remains robust.

Looking forward, ARM is well-positioned to benefit from advances in artificial intelligence and the Internet of Things. Its energy-efficient chips are increasingly utilized in smart devices, autonomous technology, and cloud infrastructure. The growing need for scalable and power-efficient solutions enhances ARM’s growth potential. As AI workloads and IoT applications accelerate, ARM’s initiatives in tailoring chip architecture for these areas present promising prospects.

Investment Recommendations

Considering the stock’s significant rise over the past month, a price correction may be impending. Thus, it may be prudent for investors to await a potential dip in price.

While ARM demonstrates fundamental strength, a more beneficial entry point could materialize should the stock undergo a price adjustment. The company’s solid position in the AI hardware market, coupled with strategic advancements in chip design, suggests long-term growth, underscoring the importance of precise market entry timing.

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.