When it comes to high-performance graphic processing units (GPUs) and data center hardware and software, Nvidia (NASDAQ: NVDA) is the undisputed champion, reigning supreme over its competitors. Enter Arm Holdings (NASDAQ: ARM), a company stirring excitement in the market after its stock soared over 100% in February (as of Feb. 12). While Arm may not hold the same clout as Nvidia, it’s making impressive strides of its own.

What’s Arm Holdings All About?

Unlike some of its peers, Arm Holdings doesn’t manufacture semiconductors. Instead, it sells the “architecture” to numerous industry giants like Nvidia, Apple (NASDAQ: AAPL), Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), Qualcomm (NASDAQ: QCOM), Microsoft (NASDAQ: MSFT), Taiwan Semiconductor (NYSE: TSM), and Samsung (OTC: SSNL.F). Chances are high that you’ve interacted with an Arm-based product today – with 99% of all smartphones housing CPUs built with Arm technology.

Arm’s role involves designing chip specifications that are energy-efficient, high-powered, and aligned with its clients’ market requirements. The companies then purchase the designs from Arm, saving them millions or even billions in research and development costs. Additionally, Arm receives a license fee and royalties for each unit sold, amassing a staggering 280 billion units shipped since its inception, with 7.7 billion in the last quarter alone.

The prowess of Arm chips is apparent in their low-power, high-performance nature, seen in Apple’s replacement of Intel (NASDAQ: INTC) chips in Macs with Arm-based chips and in the use of Arm by Amazon Web Services (AWS) (NASDAQ: AMZN) for server chips. As the adoption of Arm technology expands, especially in thriving markets like Automotive, investors are agog at the company’s potential.

Is Arm Holdings Stock Worth Acquiring?

As with any investment, Arm stock carries its own set of risks. Notably, the company derives 20% of its revenue from China, creating geopolitical concerns. Furthermore, the industry is fiercely competitive, and economic slowdowns could potentially impact Arm, given that over half of its sales come from mobile phones and consumer electronics. Nonetheless, recent results paint an encouraging picture.

The third quarter of fiscal year 2024 saw total revenue reach $824 million, marking a robust 14% year-over-year (YOY) increase, with an impressive operating income of $338 million at a 41% margin. Arm boasts an enviable business model – owing to its lack of chip production, its capital expenditures are minimal, resulting in greater free cash flow (FCF) where 30 cents of every revenue dollar translates into profit.

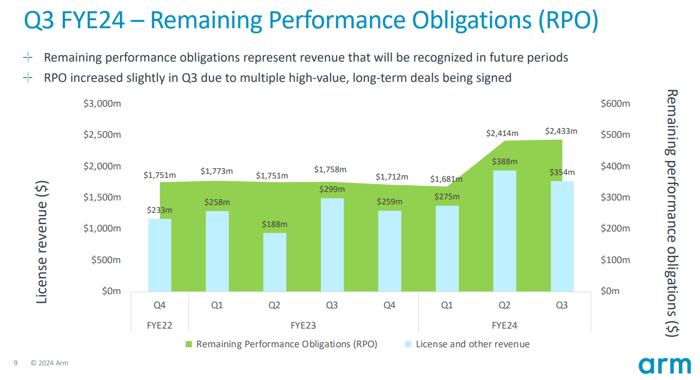

However, what truly set investors’ hearts racing last quarter wasn’t just the 14% boost in sales; it was the $2.4 billion remaining performance obligation (RPO). This is akin to a backlog and represents contracted revenue for future quarters. Notably, the RPO surged 38% YOY in the last quarter, following a significant increase in the preceding quarter, showcasing the heightened adoption of Arm technology.

Following its stellar performance in the third quarter, Arm stock skyrocketed, sending valuation metrics through the roof. With price-to-sales (P/S) and forward price-to-earnings (P/E) ratios standing at 124 and 52, respectively, it’s evident that the stock has reached lofty heights. When comparing these figures to Nvidia’s 40 and 35, it’s reasonable to anticipate that Arm’s stock may experience a correction. Consequently, potential investors should exercise caution at these levels and focus on identifying a more favorable entry point. Despite the current valuation concerns, Arm undoubtedly holds immense promise for the future.

Should an Investor Consider Putting $1,000 into Arm Holdings Now?

Prior to investing in Arm Holdings, it’s worth noting that the Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks for investors to buy now, with Arm Holdings failing to make the cut. The 10 selected stocks are anticipated to yield substantial returns in the years to come.

Stock Advisor equips investors with a user-friendly blueprint for success, offering guidance on portfolio construction, regular updates from analysts, and two new stock picks per month. Since 2002, the Stock Advisor service has surpassed the S&P 500’s returns threefold*.

Explore the 10 Stocks

*Stock Advisor returns as of February 12, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Alphabet, Amazon, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short February 2024 $47 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.