In a January 24 Barchart article, it was noted that Bitcoin’s price surged after the approval of eight spot Bitcoin ETF products by the SEC. However, the excitement was short-lived as the approval came with no endorsement and numerous warnings.

Bitcoin prices had been rallying into the January 10 announcement, reaching over $49,000 per token on January 11, the highest price since December 2021. However, prices have decreased after eight spot ETFs began trading, as the approval came with no endorsement and many warnings.

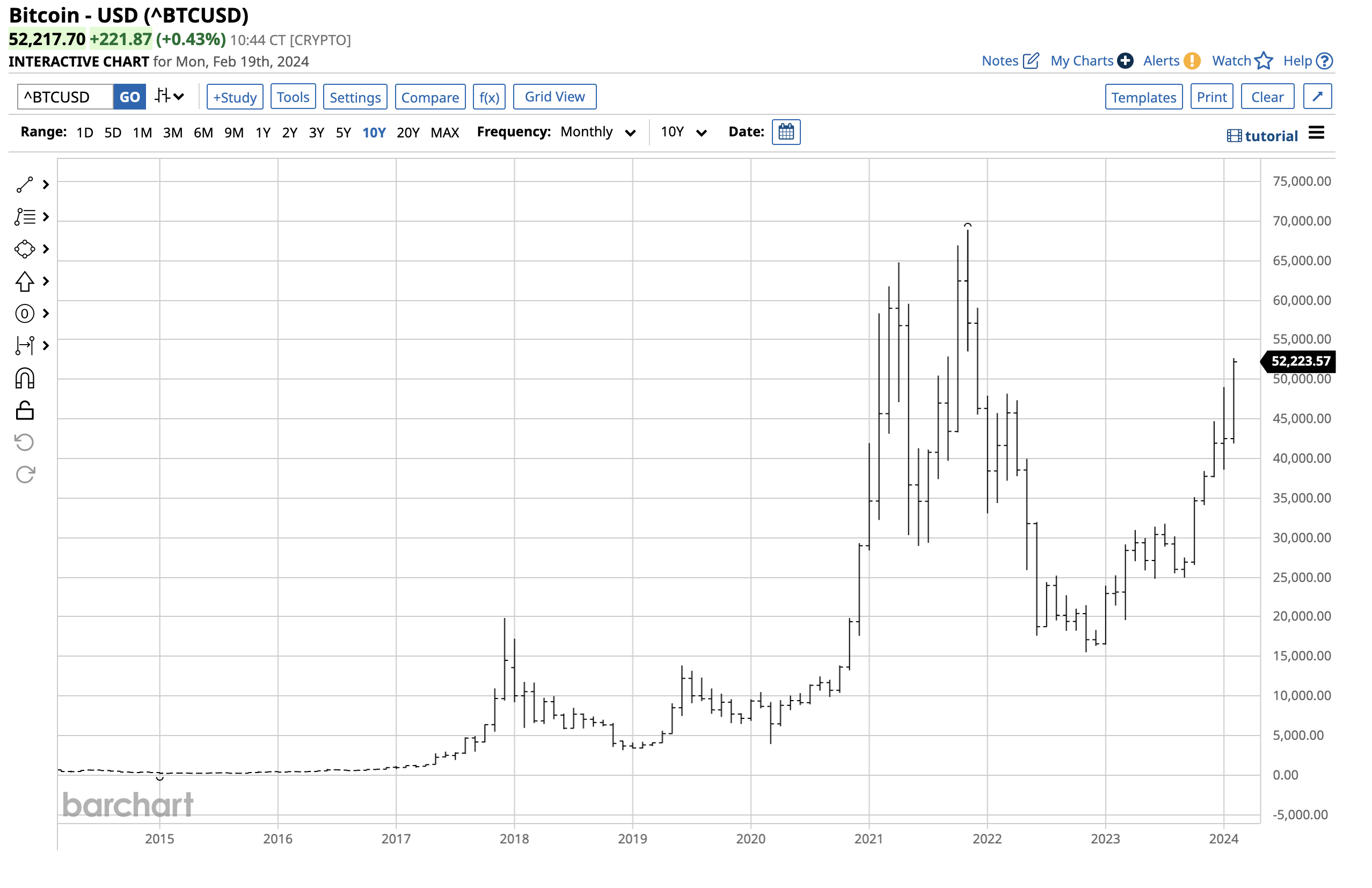

Spot Bitcoin experienced fluctuations, hitting a low of $38,589.97 on January 23 but then started to make higher lows and higher highs in the following weeks, arriving above the $52,000 mark on February 19.

Bitcoin’s 2023 Rally

In 2023, spot Bitcoin prices soared by 153%, surging from $16,581.61 at the end of 2022 to $41,945.15 on December 29, 2023.

As per the chart, on February 19, spot Bitcoin was 24.5% higher in 2024, reaching the $52,217.70 level.

Anticipating a New Record High

Analyzing a ten-year chart, it is evident that Bitcoin’s price surpassed the March 2022 high in January and February of 2024, with the next target being the record peak of November 2021 at $68,906.48.

Given its bullish trend and the increased accessibility through spot Bitcoin ETF products, challenging the November 2021 high seems likely. Notably, these products enable investors to obtain Bitcoin exposure in standard equity accounts, eliminating reliance on platforms that have historically encountered significant issues such as hacking and bankruptcies.

Aiming for $100,000

During the run-up to Bitcoin’s November 2021 high, many enthusiasts anticipated a surge to $100,000 per token. In correlation with this, it’s important to note that at approximately $52,200 on February 19, the market cap of Bitcoin exceeded $1 trillion, constituting 51.6% of the cryptocurrency market’s $1.98 trillion value.

Source: companiesmarketcap.com

Comparatively, while the value is substantial, it remains lower than that of leading U.S. companies such as MSFT and AAPL, highlighting the potential for further growth as a global currency instrument due to its limited supply.

Rising Concerns

As Bitcoin’s value continues to ascend, it is foreseeable that legislators and regulators will voice apprehensions regarding systemic risks associated with the asset class. This involves the collapse of an entire financial system or market, rather than the risk of individual entities or components.

Our banking regulators are also a part of this fight. Already, crypto-friendly banks like Silvergate have opened the banking system up to greater risk, raising the specter of a crypto collapse in which American taxpayers are left holding the bag. It’s the bank regulators’ job to insulate the banking system – and taxpayers – from the risk of crypto fraud. They have the tools and they need to use them.

Following the approval of spot Bitcoin ETFs, SEC Chairman Gary Gensler articulated a “highly qualified approval.” This indicates that as the market cap of the asset class grows, concerns are expected to intensify.

Exercising Caution

With Bitcoin’s characteristic price volatility, potential rewards are substantial but accompanied by commensurate risks. While the cryptocurrency seems poised to challenge the November 2021 high, investors must be wary of the potential for a precipitous price decline.

Bitcoin and other cryptocurrencies have exhibited unpredictable price behavior, akin to a game of financial musical chairs, where profits can be staggering but so can the losses. Hence, potential investors should cautiously assess risk-reward dynamics and exercise discipline.

As the ascent of Bitcoin looks promising, it’s essential to avoid getting caught unprepared should the music suddenly stop, leading to potential losses for investors.

More Crypto News from Barchart

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.