BlackLine Stock Soars by 33% in 6 Months

In the past six months, BlackLine (BL) shares have surged 33%, significantly outpacing the Zacks Computer & Technology sector’s growth of 6% and the Zacks Internet – Software industry’s increase of 13.5%.

This remarkable performance is largely due to BlackLine’s innovative financial automation solutions, strong strategic partnerships, and a rapidly expanding client base.

Stable Earnings Projections for BlackLine

Looking ahead to the fourth quarter of 2024, BlackLine projects total GAAP revenues between $167 million and $169 million. They anticipate non-GAAP earnings to fall between 47 cents and 52 cents per share.

For the entirety of 2024, the estimated GAAP revenues range from $651 million to $653 million, with non-GAAP earnings expected to be between $2.15 and $2.21 per share.

Currently, the Zacks Consensus Estimate for fourth-quarter revenues stands at $168.04 million, indicating a year-over-year increase of 7.91%. The earnings consensus remains at 50 cents per share, marking a decline of 27.54% from last year.

For 2024, the expected revenue is approximately $651.91 million, reflecting a 10.49% year-over-year growth. The earnings estimate is $2.18 per share, suggesting an 11.22% growth compared to the previous year.

BlackLine has consistently exceeded the Zacks Consensus Estimate over the last four quarters, averaging a 17.93% surprise.

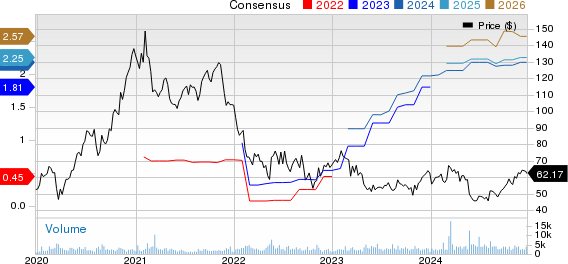

BlackLine Price and Consensus Overview

BlackLine price-consensus-chart | BlackLine Quote

Explore the latest EPS estimates and surprises on Zacks Earnings Calendar.

Strong Product Line and Strategic Partnerships Enhance Growth

BlackLine is benefiting from a diverse range of innovative solutions that cater to various financial processes, including automation, complex data management, transaction matching, and analytics. Their latest studio solution enhances their ability to organize and visualize financial data, supporting broader finance transformation objectives.

Key partnerships play a significant role in BlackLine’s strategy. Their collaborator network includes industry giants like SAP (SAP), Microsoft (MSFT), Amazon (AMZN), alongside firms such as Accenture, Ernst & Young, Deloitte, Cognizant, IBM, and Genpact. Notably, since partnering with SAP in 2018, BlackLine has effectively leveraged SolEx to integrate seamlessly with SAP ERP systems.

Moreover, BlackLine utilizes Microsoft’s Azure for its Rimilia clients and Amazon Web Services (AWS) for its FourQ customers, positioning them strongly in the cloud space.

An expanding client base serves as another key growth driver. BlackLine recently secured a significant contract with Kroll, a top financial and risk advisory firm, to optimize and automate its record-to-report processes.

Should Investors Consider BL Stock?

BlackLine is well-positioned for sustained growth and long-term success, fueled by its robust solutions portfolio, strategic partnerships, and expanding clientele.

Currently holding a Zacks Rank #2 (Buy) and a Growth Score of B, BlackLine presents a promising investment opportunity. You can find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Projected to Double

Experts from Zacks have highlighted a selection of stocks expected to gain +100% or more in 2024. Previous recommendations have shown remarkable returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks on this list are still under the radar for Wall Street investors, presenting a unique opportunity to invest early.

Discover These 5 Potential Investment Winners >>

Interested in the latest recommendations from Zacks Investment Research? You can download the report on 5 Stocks Projected to Double here at no cost.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

SAP SE (SAP) : Free Stock Analysis Report

BlackLine (BL) : Free Stock Analysis Report

For the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily represent those of Nasdaq, Inc.