Bloom Energy: A Rising Player in Sustainable Energy Solutions

Energy demand in the U.S. continues to trend upward, propelled by the relentless energy requirements of data centers and their power-intensive artificial intelligence (AI) applications. Faced with this surge, companies are actively pursuing sustainable methods to fulfill their energy needs. This is where Bloom Energy (NYSE: BE) enters the picture. The company’s fuel cell technology provides a scalable, dependable option for organizations aiming to meet their energy demands while lowering their carbon emissions.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy now. Learn More »

In the past year, Bloom has secured several significant contracts. Here’s what investors should know about this emerging energy company and the investment opportunities it offers.

Bloom Energy’s Technology: Addressing Rising Energy Demands

Bloom Energy focuses on designing, manufacturing, and deploying solid oxide fuel cell systems. Its Bloom Energy Servers utilize solid oxide technology to transform various fuels, such as natural gas, biogas, and hydrogen, through an electrochemical process that avoids combustion. The servers can be clustered to generate on-site electricity for commercial, industrial, or data center usage.

This technology not only promotes cleaner energy production but is also ready for immediate deployment. The company can install its systems in under 50 days, making it a reliable complement to traditional grid energy. Moreover, companies can opt to install these servers for independent operation, thereby reducing their reliance on the grid.

Image source: Bloom Energy.

Given the growing data demands, Bloom’s products attract technology firms looking for immediate solutions. According to estimates from Goldman Sachs, power consumption by data centers could increase by 15% annually through 2030, potentially comprising 8% of total U.S. power consumption.

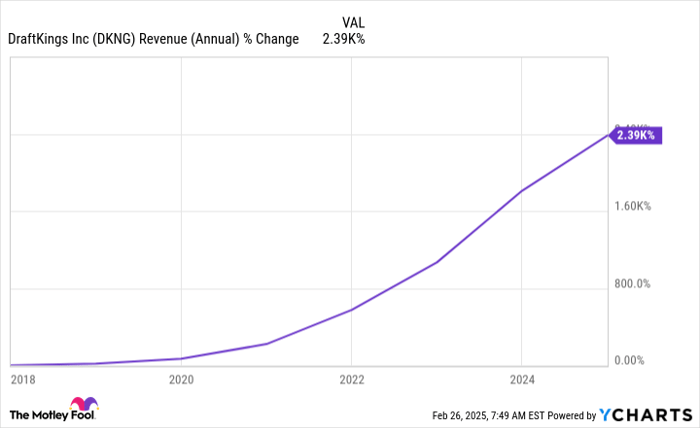

This surge in energy demand coincides with Bloom Energy’s financial challenges post-2018 public offering. Over the last fiscal year, the company reported a loss of $129.5 million against revenues of $1.26 billion. Nevertheless, improvements in margins and new client contracts demonstrate validation of its offerings, providing a pathway for future growth.

BE Revenue (TTM) data by YCharts

Major Contracts Secured in the Past Year

In May, Bloom secured a power capacity agreement with Intel, ensuring the installation of additional megawatts of its Energy Servers at Intel’s Santa Clara data center. This collaboration will lead to the largest fuel-cell-powered high-performance computing data center in Silicon Valley.

The company also partnered with Nvidia-backed AI hyperscaler CoreWeave to supply on-site energy using its fuel cells, set for installation in the third quarter of this year.

Earlier, Bloom signed a contract with American Electric Power Company, which includes purchasing up to 1 gigawatt (GW) of its fuel cells for data centers and large energy consumers. American Electric is one of the largest electric utility providers in the U.S., with a vast transmission network spanning 39,000 miles. Morningstar described the agreement as “a potential game changer for Bloom.”

Analysts Project Growth for Bloom Energy

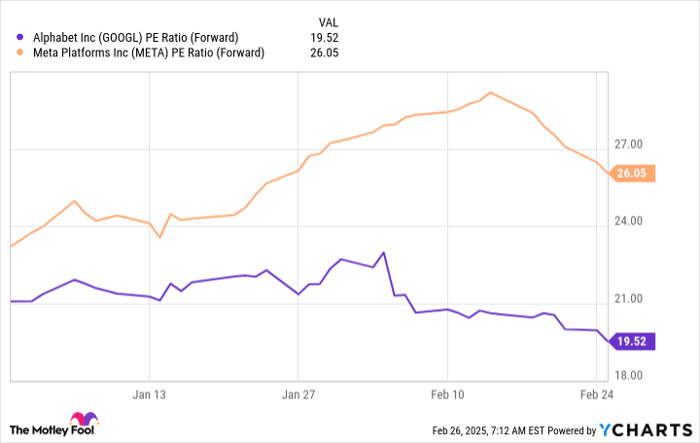

The stock is currently considered somewhat pricey, trading at three times its forecast sales for the year and 50 times its projected earnings. However, successful partnerships with well-known companies add credibility to its offerings, positioning Bloom for solid growth in the upcoming years.

Analysts predict that Bloom will achieve a net profit by 2025, with generally accepted accounting principles (GAAP) earnings per share (EPS) expected to reach $0.11. This would mark the first full-year profit for the company since its public debut. They forecast revenue growth of 18% to $1.67 billion in 2025, and a further increase of 21% in 2026, surpassing $2 billion.

Investment Considerations for Bloom Energy

Bloom Energy’s recent agreements with American Electric and tech firms signify major advancements. These partnerships validate its quick-to-deploy, scalable energy solutions. Particularly noteworthy is the collaboration with American Electric, which anticipates a 20% annual growth rate in commercial energy demand over the next three years.

As is the case with many growth stocks, investing in Bloom Energy carries inherent risks, especially if contracts do not materialize. Its high valuation renders the Stock susceptible to volatility. However, the company is making significant progress and appears to be an attractive option for long-term investors looking to capitalize on the evolving energy landscape shaped by AI demand.

Is Now the Right Time to Invest $1,000 in Bloom Energy?

Before making an investment in Bloom Energy, potential investors might want to consider the following:

The Motley Fool Stock Advisor analyst team recently compiled a list of what they believe are the 10 best stocks to purchase at this time… and Bloom Energy did not make the cut. The selected stocks have the potential to generate substantial returns in the coming years.

For context, consider that when Nvidia was listed on April 15, 2005, if you had invested $1,000 at that time, you’d have $736,343!*

Stock Advisor provides investors with a straightforward approach to portfolio building, regular analyst insights, and two new Stock recommendations each month. The Stock Advisor service has significantly outperformed the S&P 500 since 2002, more than quadrupling its returns.* Don’t miss out on the latest top 10 list, available when you join?

*Stock Advisor returns as of February 28, 2025

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Goldman Sachs Group, Intel, and Nvidia. The Motley Fool recommends the following options: short February 2025 $27 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.