BYD Leads the Charge in Affordable Electric Vehicles

To become mainstream, electric vehicles (EVs) must be more affordable. Automakers are racing to reduce costs, and Chinese EV leader BYD Co Ltd (BYDDY) is ahead of the pack. With a vertically integrated business model that grants it full control over its supply chain, BYD is able to offer cars at significantly lower prices.

Recently, BYD announced a price cut for its most affordable model, the Seagull. The starting price for the 2025 Seagull is now 56,800 yuan (approximately $7,800), down from the previous price of 69,800 yuan ($9,500). This reduction applies to the non-Smart Driving Vitality Edition.

Despite ongoing price competition in the Chinese EV market, BYD remains committed to lowering prices. The company had previously stated that the launch of the Seagull marked the beginning of “a new era where electricity is cheaper than oil.” The 2025 Seagull has been well received, particularly after receiving an upgrade this year with the addition of the “God’s Eye” smart driving system at no extra cost, making it an appealing choice for budget-conscious buyers.

BYD’s innovations and efficient supply chain management have created a significant impact. In the first quarter of 2025, the company achieved sales of over one million new energy vehicles (NEVs), reflecting an impressive 60% growth year over year. With its ultra-low pricing, consistent updates, and strong sales momentum, BYD is solidifying its dominance in the affordable EV segment and intensifying competition for global rivals.

Competition Heats Up for Affordable Electric Vehicles

In response to this trend, Japanese auto giant Toyota (TM) has introduced its most affordable EV yet, the bZ3X, priced at around $15,000. This is 30% cheaper than its bZ3 sedan, which is a mid-to-high-end EV in China. Such high demand resulted in Toyota’s server crashing after receiving more than 10,000 orders in just one hour. With the bZ3X, Toyota directly challenges budget EV frontrunners like BYD.

Meanwhile, U.S. EV giant Tesla (TSLA) plans to unveil a more affordable EV in the first half of 2025. As overall sales growth slows and price sensitivity escalates among consumers, this strategy could recapture some market share for Tesla. Although details are still pending, adhering to this timeline may help Tesla appeal to a broader customer base.

Financial Overview of BYD

Shares of BYD have increased by about 21% year to date, contrasting with a 16% decline in the broader industry.

Image Source: Zacks Investment Research

In terms of valuation, BYD has a forward price-to-sales ratio of 0.85, slightly higher than its industry peers, and holds a Value Score of B.

Image Source: Zacks Investment Research

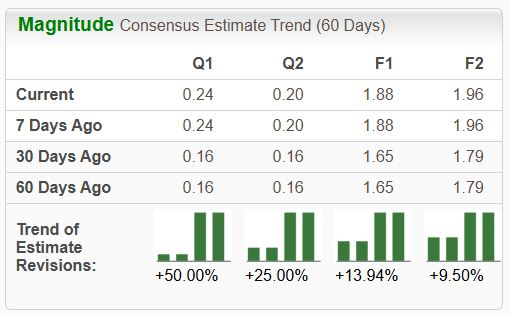

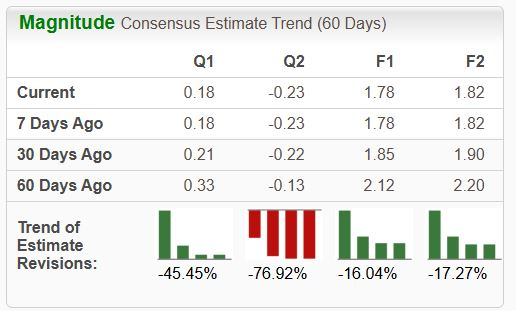

The Zacks Consensus Estimate indicates BYD’s earnings could rise by 33% in 2025 and 19% in 2026. While estimates for 2025 have improved in the past 60 days, the projections for 2026 have faced downward adjustments.

Image Source: Zacks Investment Research

Currently, BYD stock holds a Zacks Rank #3 (Hold). For those interested, you can check out the full list of Zacks’ #1 Rank (Strong Buy) stocks here.

Five Stocks Poised for Significant Growth

These stocks have been selected by a Zacks expert as top picks expected to grow by +100% or more in 2024. While not all investments succeed, past recommendations have yielded impressive returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Most stocks included in this report are under the radar on Wall Street, creating an opportunity for early investors.

For the latest recommendations from Zacks Investment Research, download the report on the 7 Best Stocks for the Next 30 Days. Click to get your free copy.

Toyota Motor Corporation (TM): Free Stock Analysis report

Tesla, Inc. (TSLA): Free Stock Analysis report

BYD Co., Ltd. (BYDDY): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.