Constellation Energy Reports Strong Q4 Earnings, Surpassing Expectations

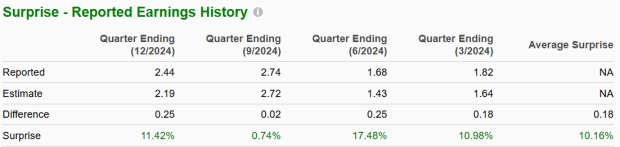

Constellation Energy Corporation CEG announced earnings of $2.44 per share for the fourth quarter of 2024, exceeding the Zacks Consensus Estimate of $2.19 by 11.4%. This marks a significant turnaround from a loss of 11 cents reported in the same quarter last year. The positive earnings were driven by favorable results from its nuclear PTC portfolio and favorable labor incentives, which helped offset challenges from market conditions and nuclear outages.

Stay updated on the latest earnings estimates and surprises on Zacks Earnings Calendar.

Constellation Energy has been consistent in its performance, exceeding expectations in every quarter for the past year, with an average earnings surprise of 10.16%.

Image Source: Zacks Investment Research

One Year Price Performance Overview

Image Source: Zacks Investment Research

Is now a good opportunity to invest in this alternate energy stock? To determine this, we will investigate the factors behind the stock’s price increase, review Q4 results, and evaluate its overall investment potential.

Key Highlights from Q4

In the fourth quarter of 2024, Constellation Energy recorded a nuclear operating capacity factor of 94.8%, ensuring a reliable supply of clean energy for its customers.

The company remains committed to returning capital to shareholders, successfully repurchasing $1 billion of its shares in 2024, alongside another $1 billion remaining authorization for share repurchase.

Total operating expenses decreased to $4.48 billion, down 23.6% from $5.86 billion the previous year. The operating income rebounded to $972 million compared to an operating loss of $67 million in the same quarter last year.

Following the end of Q4, Constellation Energy announced a definitive agreement to acquire Calpine Corporation. This acquisition will combine the largest producer of clean, emissions-free energy with Calpine’s reliable natural gas assets, establishing the top competitive retail supplier in the nation to meet increasing customer demand. The deal consists of 50 million shares of CEG’s common stock along with $4.5 billion in cash.

Rising Earnings Estimates for Constellation Energy

The Zacks Consensus Estimate for Constellation Energy’s earnings per share in 2025 and 2026 has increased by 1.9% and 2.8%, respectively, in the last 60 days.

Image Source: Zacks Investment Research

Reasons Behind CEG Stock’s Success

Constellation Energy’s strong performance is attributed to its strategic investment plans and a commitment to enlarging its renewable portfolio. The company expects to invest between $3 billion and $3.5 billion in capital expenditures for 2025 and 2026, with approximately 35% earmarked for nuclear fuel acquisition to increase inventory levels.

Operating nuclear-powered units provide a distinct advantage, as they can consistently deliver carbon-free energy around the clock, capable of running for up to two years without refueling. This capability makes them ideal for meeting the rising demand for clean energy, especially from AI-driven data centers.

With data center demand on the rise, Constellation Energy is well-positioned to capitalize on this trend. A Business Insider report predicts that major tech companies will invest $1 trillion in data centers over the next five years. In September 2024, CEG secured a 20-year PPA with Microsoft Corporation MSFT to support operations at the Three Mile Island Unit 1, now known as the Crane Clean Energy Center. Through this agreement, Microsoft will purchase the output from this updated facility.

CEG Stock Outperforms Industry

Constellation Energy’s trailing 12-month return on equity stands at 21.96%, outperforming the industry average of 8.44%. This profitability measure highlights how effectively the company uses shareholder funds to generate income.

Image Source: Zacks Investment Research

CEG Stock’s Premium Valuation

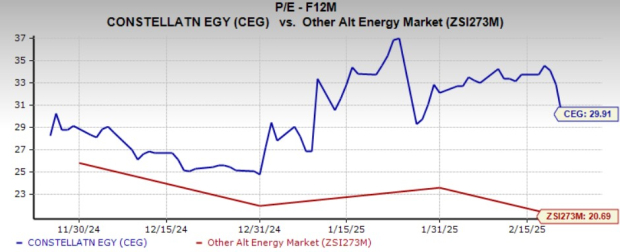

Currently, Constellation Energy is trading at a premium compared to its industry on a forward 12-month price-to-earnings basis.

Image Source: Zacks Investment Research

Comparatively, another competitor, Vistra Corp VST, is also trading at a premium on a forward 12-month P/E basis.

Conclusion

Constellation Energy is well-positioned to meet the growing demand for clean energy, bolstered by its high nuclear capacity factor and production capabilities. The company has consistently reported positive earnings surprises in recent quarters.

For investors considering a new addition to their portfolio, CEG, with a Zacks Rank #2 (Buy), could be an attractive option, offering potential dividends, share buybacks, and improving earnings forecasts.

You can explore the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recently Released: Zacks Top 10 Stocks for 2025

Don’t miss out on Zacks Director of Research Sheraz Mian’s selection of top stocks for 2025. This recommended portfolio has notably outperformed expectations—gaining +2,112.6% since its launch in 2012, far exceeding the S&P 500’s +475.6%. Sheraz meticulously analyzed 4,400 companies to identify the top 10 stocks to buy and hold into 2025, and you could be among the first to learn about these exciting prospects.

Discover New Top 10 Stocks >>

For the latest recommendations from Zacks Investment Research, download the report on the 7 Best Stocks for the Next 30 Days now.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Constellation Energy Corporation (CEG): Free Stock Analysis Report

Vistra Corp. (VST): Free Stock Analysis Report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.