Celestica Inc. (CLS) reported strong financial results for the fourth quarter of 2025, achieving an adjusted earnings per share (EPS) of $1.89, exceeding the Zacks Consensus Estimate of $1.74 and a year-ago EPS of $1.11. The company recorded quarterly revenues of $3.65 billion, surpassing the Zacks Consensus Estimate of $3.46 billion and reflecting a 44% increase year-over-year.

The Connectivity & Cloud Solutions (CCS) segment saw a remarkable 64% year-over-year revenue growth, driven by high demand in the communications market, contributing 78.3% of Celestica’s total revenue. Looking forward, Celestica projects first-quarter 2026 revenues between $3.85 billion and $4.15 billion, with non-GAAP EPS estimated at $1.95-$2.15.

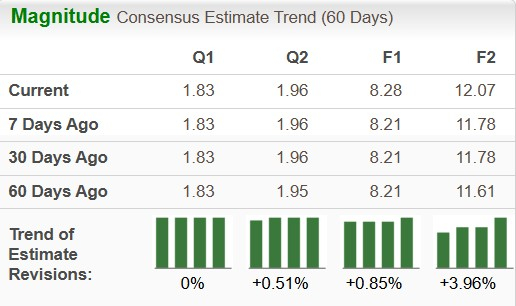

For the full year of 2026, Celestica anticipates total revenues of approximately $17 billion, and a non-GAAP EPS forecast of $8.75, an upgrade from previous estimates. The stock price currently presents a potential upside of 26.4%, with brokerage targets ranging from $410 to $230.