Buffett’s Bold Move: Chubb’s Stock Sparks Curiosity

Late last year, Warren Buffett’s holding company, Berkshire Hathaway, began purchasing shares of an unknown company. Surprisingly, Berkshire secured an exemption from the SEC to avoid immediate disclosure. This mystery stock was later identified as Chubb (NYSE: CB) in early 2024.

This development raises questions. Chubb operates a business model strikingly similar to that of Berkshire. It’s unusual for Buffett to invest in a competitor instead of repurchasing Berkshire’s stock. Does this indicate Buffett believes Chubb has the potential to grow significantly, perhaps even becoming the next Berkshire?

Understanding the Similarities

Over the years, Buffett has transformed Berkshire into a colossal organization valued at nearly $1 trillion. While his strategies have evolved, the core approach has stayed the same. At the heart of Berkshire’s success lies a diverse range of insurance businesses that generate consistent cash flow through policy premiums. Interestingly, this money can be invested before any claims are paid out, allowing Berkshire to grow its capital effectively.

Chubb mirrors this model. Its operations include various insurance products, from property and casualty to health insurance, and it also participates in the reinsurance market. Like Berkshire, Chubb strategically invests its “float”—the cash generated from its insurance policies—into securities for additional returns.

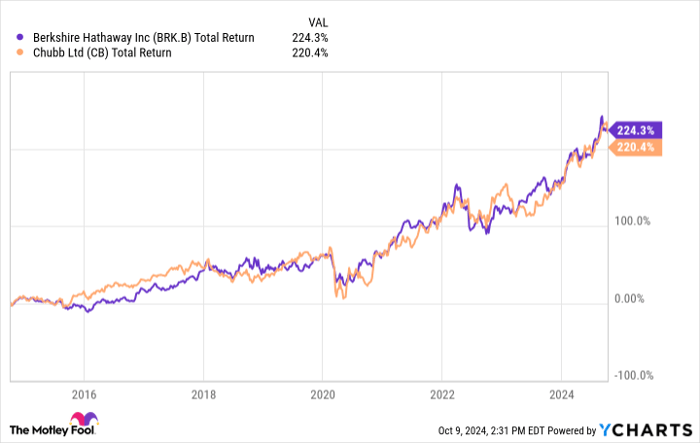

Both Berkshire and Chubb have demonstrated similar long-term performance. In fact, their total returns over the past decade have been almost identical. However, two key differences emerge that merit close attention.

BRK.B Total Return Level data by YCharts

What Sets Chubb Apart

The most significant difference between Chubb and Berkshire is their size. Berkshire’s market cap hovers around $1 trillion, while Chubb’s is only about $115 billion. If Chubb were to grow to the size of Berkshire, it could see nearly 900% potential upside in the long term.

This size disparity could intrigue investors. However, examining their performance reveals a cautionary tale. Over the past decade, Chubb has slightly lagged Berkshire in performance, despite being a smaller company that should theoretically have the capacity for higher growth rates. Berkshire has achieved an average return on equity of 10.6%, while Chubb’s stands at 9.9%.

A critical aspect is Berkshire’s edge through Warren Buffett’s investment strategy. Having one of history’s greatest investors guiding capital allocation is no small advantage. Buffett’s principles have steered Berkshire to monumental success, while Chubb primarily functions as a traditional insurance company with a narrower investment portfolio.

Could Chubb morph into the next Berkshire? It possesses several foundational elements for such a transformation. However, it’s important to note that Buffett’s expertise significantly contributed to Berkshire’s ascent. Currently, Berkshire has invested nearly $7 billion in Chubb. Despite the excitement, Berkshire has consistently outperformed due to its more dynamic investment approach compared to Chubb’s traditional strategy.

A Timely Opportunity in the Market

Have you ever felt you missed the chance to invest in top-performing stocks? You may want to pay attention now.

Occasionally, our expert analysts categorize certain stocks as “Double Down” stocks, indicating they expect imminent gains. If you’ve been hesitant about investing, now could be the ideal time, as the numbers demonstrate remarkable growth:

- Amazon: A $1,000 investment made in 2010 is now worth $21,266!*

- Apple: A $1,000 investment made in 2008 would amount to $43,047!*

- Netflix: A $1,000 investment made in 2004 would have skyrocketed to $389,794!*

Presently, we are issuing “Double Down” alerts for three promising companies, and this opportunity may not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.