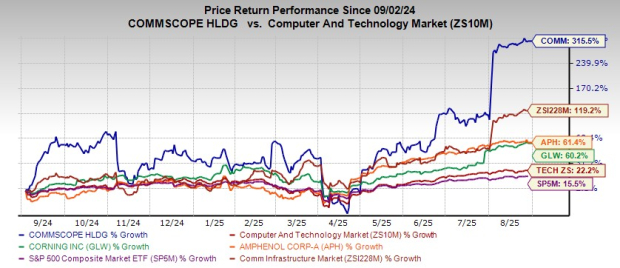

CommScope Holdings Company, Inc. (COMM) has seen a significant increase of 315.5% in stock value over the past year, outperforming the Communication Infrastructure industry growth of 119.2% and competitors like Corning, which gained 60.2%, and Amphenol, which gained 61.4%. This growth is attributed to innovations in communication infrastructure technology and strong market demand.

In Q2, CommScope’s Access Network Solutions (ANS) segment generated $322 million in net sales, a 65% year-over-year increase from $195 million, driven by high demand for DOCSIS 4.0 products. The company is also optimizing its portfolio through divestitures, including a $10.5 billion deal with Amphenol for its Connectivity and Cable Solutions segment, which aims to enhance liquidity and competitiveness.

Furthermore, earnings estimates for CommScope have seen a positive upward trend, with a 47.73% increase for 2025 to $1.3 and a 42.61% increase for 2026 to $1.64 in the past 60 days. The stock currently trades at a price/sales ratio of 0.63, lower than the industry average of 0.95.