Investors have their eye on the horizon as Costco’s COST stock prepares to unveil its fiscal fourth quarter results on Thursday, September 26. This impending reveal signifies a critical juncture for the food and general merchandise giant, prompting stock analysts to scrutinize its performance against counterparts such as Walmart WMT and Amazon AMZN.

What to Expect from Costco’s Q4

Costco has amped up its digital presence, akin to Walmart, to stay afloat in Amazon’s shadow. E-commerce sales surged by 21% last quarter, with a projected 12% increase in Q4. The sales outlook for Q4 stands at around $79.75 billion, marking a 1% surge from the preceding quarter.

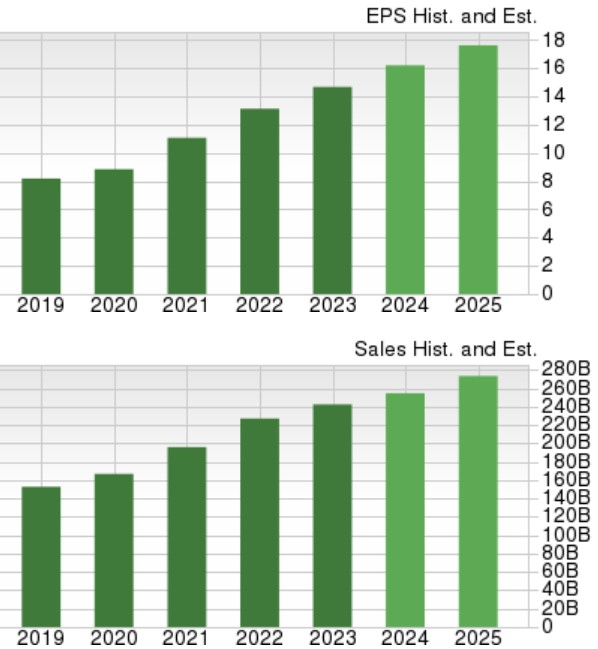

Perceptive market watchers anticipate a 4% uptick in Q4 EPS to $5.05. Impressively, Costco has outdone Zacks EPS Consensus for six consecutive quarters, boasting an average earnings surprise of 2.32% in its recent four quarterly updates.

Image Source: Zacks Investment Research

Gauging Costco’s Growth Trajectory

Analysts at Zacks project Costco’s total sales to ascend by 5% in fiscal 2024, with a further 7% hike expected in FY2025, reaching the impressive tally of $273.26 billion. In terms of annual earnings growth, estimates peg a 10% surge this year and a further 9% leap expected in FY2025, resulting in earnings per share of $17.65.

Image Source: Zacks Investment Research

Performance & Valuation Faceoff

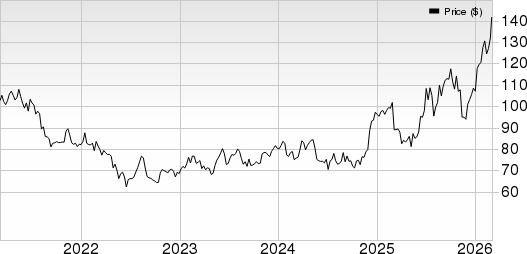

Costco stocks have ascended by 36% year to date, slightly trailing Walmart at 53% but outpacing Amazon at 27% and the S&P 500 at 20%. Over a three-year span, COST has zoomed skyward by close to 100%, distinctly overshadowing both Amazon’s modest 14% and Walmart’s 70% upticks.

Image Source: Zacks Investment Research

Despite its robust rally, COST is perched at a forward earnings multiple of 51.1X, exceeding the benchmark’s 24.2X. Notably, Costco’s stock holds a premium over Walmart and Amazon, which flaunt forward earnings multiples of 33.1X and 40.8X, respectively.

Image Source: Zacks Investment Research

The Verdict

Following an emphatic YTD run, Costco’s stock currently sits at a Zacks Rank #3 (Hold). While the retailer’s growth story remains enticing, discerning investors may wish to hold off for more opportune buying moments, considering the company’s valuation. Nevertheless, Costco continues to present a compelling long-term investment, particularly if it can meet or surpass its Q4 projections.

7 Best Stocks for the Next 30 Days

Experts have curated a list of 7 top-tier stocks from the pool of 220 Zacks Rank #1 Strong Buys. These stocks, labeled “Most Likely for Early Price Pops,” have historically outshone the market by over 2X, boasting an average annual gain of +23.7% since 1988. Keep a close watch on these handpicked gems for potential quick wins.

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Explore this article on Zacks.com by clicking here.

The thoughts and viewpoints expressed in this piece are solely those of the author and may not mirror the opinions of Nasdaq, Inc.