CrowdStrike Holdings, Inc. CRWD has experienced significant ups and downs this year. After reaching a 52-week high on July 9, the stock dropped sharply to a 52-week low by August 5, primarily due to a global IT outage affecting millions of Microsoft Corporation MSFT Windows devices on July 19.

Despite this setback, CrowdStrike has made a notable comeback, with shares soaring 59% since August 5. Year-to-date (YTD), the stock has increased by 38.5%, outperforming the Zacks Computer and Technology sector and the S&P 500 index, which have risen 33% and 28.1%, respectively.

Performance Overview: YTD Gains

Image Source: Zacks Investment Research

The key question remains: Can CrowdStrike maintain this momentum? Here are reasons why holding onto the stock may be wise at this time.

Strong Financial Performance from CrowdStrike

Despite earlier challenges, CrowdStrike’s third-quarter fiscal 2025 results highlight its resilience. Revenues increased by 29% year-over-year, reaching $1.01 billion and exceeding the Zacks Consensus Estimate by 2.8%. Non-GAAP earnings per share were 93 cents, up 13.4% from last year, surpassing the consensus estimate by 14.8%.

Additionally, CrowdStrike’s annual recurring revenues (ARR) hit $4.02 billion, reflecting a 27% year-over-year increase. This strong growth in ARR shows ongoing demand for CrowdStrike’s cybersecurity solutions, even amid prolonged sales cycles caused by the July outage.

Continual Innovation and Strategic Growth Initiatives

CrowdStrike’s efforts to innovate played a crucial role in its recovery. Following the IT incident in July, the company rolled out automated recovery techniques and enhancements to its Falcon platform. These upgrades improved visibility, quality assurance, and overall security, strengthening customer trust.

The Falcon platform continues to expand with over 28 modules, including endpoint protection and identity security, driving both diversification and growth. Notably, businesses focused on cloud security, identity protection, and LogScale SIEM surpassed $1 billion in ARR during the second quarter, marking an impressive 85% growth compared to last year.

CrowdStrike’s proactive measures and commitment to innovation position it as a trustworthy cybersecurity partner for organizations facing a complex threat landscape.

Market Leadership and Customer Loyalty

CrowdStrike has maintained its reputation as a leader in the cybersecurity market, even amidst stiff competition. The company secured significant third-quarter contracts, including multiple eight-figure deals, showcasing a robust sales pipeline.

Their “Falcon Flex” subscription model has been pivotal for customer retention. This model allows for flexible adoption of security modules, simplifying procurement and nurturing long-term relationships with clients, all of which drive consistent revenue growth.

Challenges Ahead for CrowdStrike

Despite its many strengths, CrowdStrike faces some near-term challenges. The impact of the July outage is likely to prolong sales cycles, pushing some deals to future quarters. Although the company expects these issues to stabilize over the next year, they may temporarily hinder net new ARR growth.

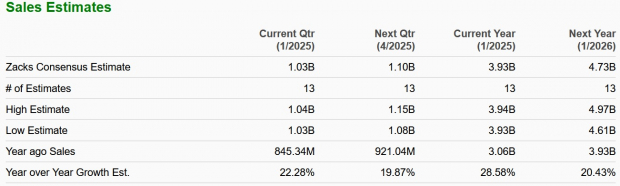

Compared to its growth yields in previous years, CrowdStrike’s growth rate has slowed. The Zacks Consensus Estimate indicates revenue growth in the 20% range for fiscal 2025 and 2026, a stark drop from the 50% plus rates observed in prior years.

Image Source: Zacks Investment Research

Legal repercussions from the July incident and increasing competition from firms like Palo Alto Networks, Inc. PANW and Fortinet, Inc. FTNT introduce further complexity to CrowdStrike’s outlook.

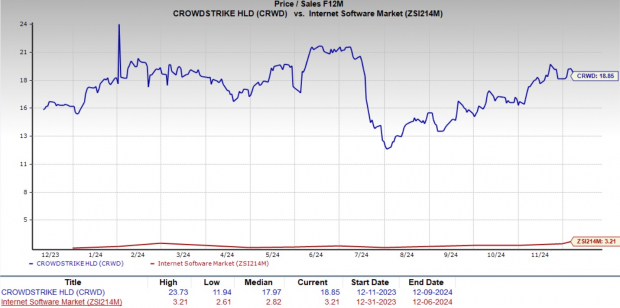

Valuation Concerns for CRWD Stock

Valuation remains a significant factor for CrowdStrike. The stock trades at a forward 12-month price-to-earnings (P/E) ratio of 82.78X, which is substantially higher than the Zacks Internet – Software industry average of 37.91X. Its forward 12-month price-to-sales (P/S) ratio stands at 18.85, compared to the industry average of 3.21.

Image Source: Zacks Investment Research

In contrast, competitors like Palo Alto Networks and Fortinet present more appealing valuations, with forward P/S ratios of 13.23 and 11.34, respectively. Regarding their forward P/E ratios, PANW trades at 58.49, while FTNT is at 41.47. Although CrowdStrike’s higher valuation reflects its strong market position and growth potential, it may also expose the stock to corrections if expectations are not met.

Conclusion: Hold CrowdStrike Stock for Now

CrowdStrike’s YTD achievements highlight its stability and solid market presence. The company’s innovative strategies, strong customer ties, and diversified offerings strengthen its long-term viability in the cybersecurity sector.

Nonetheless, challenges, including prolonged sales cycles, high valuations, and decelerated growth rates, call for a careful approach. For the moment, it seems prudent to hold onto the stock while taking advantage of CrowdStrike’s long-term potential amid short-term uncertainties.

As the cybersecurity field continues to evolve, CrowdStrike’s leadership and flexibility position it as a stock worth keeping a close eye on. CRWD currently holds a Zacks Rank #3 (Hold). You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Identifies Top 10 Stocks for 2025

Interested in early insights on our 10 top stock picks for 2025?

Historically, their performance has been remarkable.

Since 2012, when our Director of Research, Sheraz Mian, took charge, the Zacks Top 10 Stocks gained over +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Currently, Sheraz is evaluating 4,400 companies to select the best 10 stocks to invest in for 2025. Don’t miss the opportunity to consider these stocks when unveiled on January 2.

Be First to New Top 10 Stocks >>

Looking for the latest recommendations from Zacks Investment Research? Download **5 Stocks Set to Double** for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Fortinet, Inc. (FTNT): Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW): Free Stock Analysis Report

CrowdStrike (CRWD): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.