D-Wave Quantum’s Stock Soars 59.6% Amid Strong Q1 Results

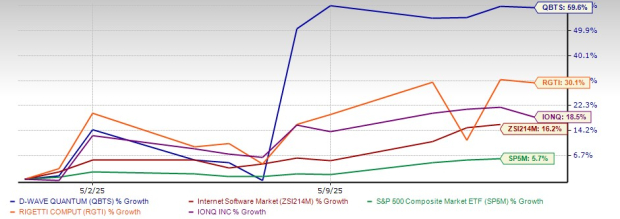

D-Wave Quantum Inc. (QBTS) has experienced a remarkable surge in May, with its stock climbing 59.6%. This performance significantly surpasses the broader Internet Software industry, which has gained 16.2%, and the S&P 500’s 5.7% increase. Additionally, D-Wave outperformed key players in quantum computing, like Rigetti Computing (RGTI) and IonQ (IONQ), whose stocks rose 30.1% and 18.5%, respectively, during the same timeframe.

This rally has largely been driven by solid first-quarter 2025 financial results and significant technological advancements. Moreover, D-Wave CEO Dr. Alan Baratz’s recent discourse on the company’s notable quantum supremacy demonstration has fueled investor interest.

Share Price Performance

Image Source: Zacks Investment Research

After this significant rally in May, a question arises: Is D-Wave Quantum still a wise investment, or has the stock reached its peak? A closer examination can provide insights.

Strong Q1 Results With Record New Clients

D-Wave Quantum achieved a remarkable 509% year-over-year increase in first-quarter 2025 revenues, primarily due to the sale of its Advantage2 system to the Julich Supercomputing Center. Consequently, GAAP and non-GAAP gross profits increased by 736% and 644%, respectively. Although bookings declined by 64%, the company expanded its customer base to 133, including 69 commercial clients, among which are several Forbes Global 2000 companies.

The net loss narrowed to just 2 cents per share, down from 11 cents per share in the first quarter of 2024. This marks the lowest loss since D-Wave’s public debut in 2022. The adjusted EBITDA loss also decreased by 53% year over year.

Successful Demonstration of Quantum Supremacy

The market is buzzing about D-Wave Quantum’s successful demonstration of quantum supremacy on a real-world problem. Its 1,200-qubit Advantage2 prototype was able to simulate complex magnetic materials in minutes—a task that would take Oak Ridge National Laboratory’s exascale supercomputer nearly a million years. This achievement substantiates the effectiveness of D-Wave’s quantum annealing systems, setting the company apart in an industry often rife with theoretical claims.

On May 9, 2025, CEO Dr. Alan Baratz discussed this milestone on Fox Business’ The Claman Countdown. He highlighted the growing interest from supercomputing entities and national laboratories. Baratz also emphasized D-Wave’s high-value system sales, often ranging from $20 to $40 million, noting that although sales cycles are lengthy, there is increasing momentum as enterprises and governments seek quantum-powered solutions. He stated that annealing quantum computing is crucial for commercial adoption, particularly for real-world optimization challenges.

Significant Commercial Progress Paving the Way for Long-term Growth

D-Wave stands out as the only company offering production-level quantum applications in active real-world usage. Major global firms such as Ford Otosan, NTT DOCOMO, and Japan Tobacco are leveraging D-Wave’s technology for essential tasks including manufacturing scheduling, logistics optimization, and early-stage drug discovery. While many competitors remain confined to laboratory research and experimental setups, D-Wave’s advancements are increasingly drawing investor attention.

At its Qubits 2025 conference, D-Wave reported record attendance, with in-person attendance up 23% and virtual engagement nearly doubling year over year. The event featured real-world use cases from several customers, including Davidson Technologies, Japan Tobacco, Julich Supercomputing Center, and NTT DOCOMO.

D-Wave Quantum Stock Trading Trend

Technical indicators show a promising outlook for D-Wave Quantum. Notably, the 50-day Simple Moving Average (SMA) remains above the 200-day SMA, indicating a bullish trend. This technical strength reflects positive market sentiment and bolsters confidence in QBTS’s financial health and prospects.

Conclusion: D-Wave Quantum Presents Strategic Investment Opportunity

D-Wave Quantum has demonstrated a record-breaking first quarter, highlighted by a remarkable 509% increase in revenues and the lowest net loss since going public. The company also achieved a technical milestone with its quantum supremacy demonstration. Furthermore, the global quantum computing market is projected to reach $125 billion by 2030 at a Compound Annual Growth Rate (CAGR) of 36.9%, pointing to strong long-term potential. Given the rising adoption of quantum technology and D-Wave’s competitive advantage over firms like Rigetti Computing and IonQ, this Zacks Rank #2 (Buy) stock represents an appealing investment opportunity. Investors may want to consider adding QBTS to their portfolios as advances drive the share price higher.