Deckers Reports Mixed Q4 Results, Stock Drops Despite Revenue Growth

Deckers (NYSE: DECK) experienced a significant stock decline last week after releasing its fiscal fourth-quarter results. Although the results exceeded expectations, the company provided disappointing guidance.

Deckers reported a 6.5% year-over-year revenue increase to $1.02 billion. This growth included a 3.6% rise in Ugg brand sales and a 10% increase for Hoka. However, this growth represents a marked deceleration compared to earlier quarters.

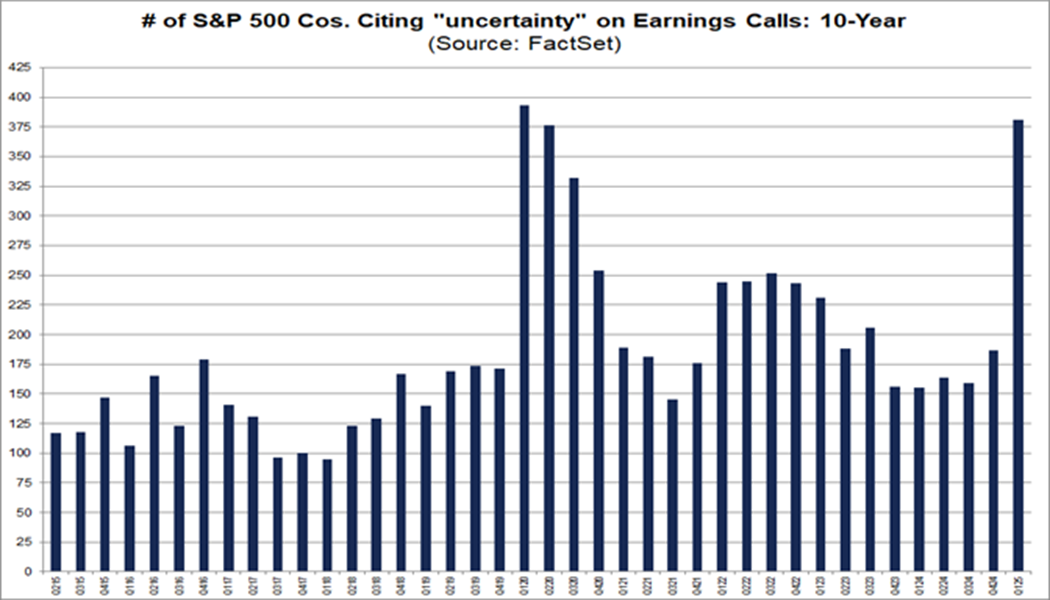

For the full fiscal 2025 year, revenue rose 16.3% to $4.99 billion, with Ugg sales increasing by 13.1% and Hoka by 23.6%. Management refrained from providing full-year guidance, citing macroeconomic uncertainties. For the fiscal 2026 first quarter, the company anticipates 9% revenue growth but expects a decline in earnings per share due to rising costs from tariffs, freight, and promotional efforts.

Deckers has captured market share from Nike (NYSE: NKE) in recent years, with a five-year revenue growth rate of 19%. In fiscal 2025, Hoka’s revenue reached $2.23 billion, making it a significant player, though still slightly below Ugg’s $2.53 billion.

Nike’s Sales Trends and Recovery Signs

While Deckers reports growth, Nike has faced revenue declines for several quarters. Its revenue has decreased to levels similar to three years ago, missing a post-pandemic boom in running.

However, CFO Elliott Hill noted that sales in the running category grew mid-single-digits in Nike’s fiscal 2025 Q3, an improvement compared to the overall 9% decline. Nike’s revenue growth in running was supported by successful shoe models, including the Pegasus 41 and Vomero 18.

Despite Hoka’s 10% revenue growth in the fiscal fourth quarter, it remains unclear if Nike can regain market share until its next earnings report in late June. Jefferies analyst Randal Konik noted Hoka’s slowing growth could indicate a shift back to Nike in the running market and sees potential improvement through heightened sales channels like Amazon.

Jefferies maintains a buy rating for Nike, with a price target of $115, which is approximately 85% above its current level.

Nike’s Competitive Positioning

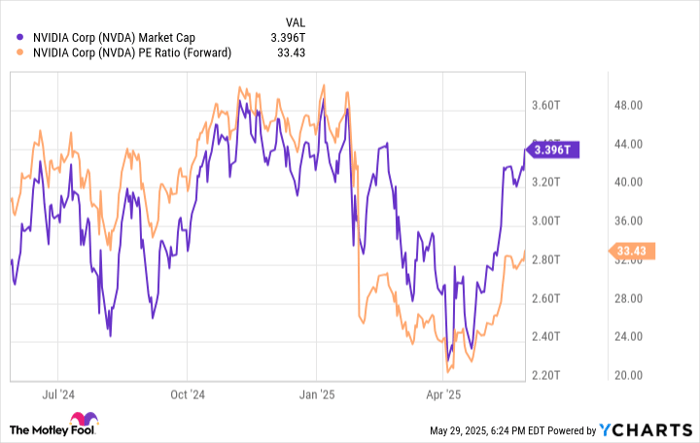

The analyst also highlighted that Nike is trading at its lowest enterprise-value-to-sales multiple in 15 years, primarily due to its declining stock price. While Nike’s competitiveness may be improving, it still faces similar challenges as Deckers, including tariff-related pressures.

However, due to its strong brand recognition, a turnaround remains feasible, although it may be gradual given the current economic challenges.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.