When it comes to investing, the advice of Wall Street analysts carries significant weight. But should it be the sole determinant of investment decisions? Let’s delve into the world of brokerage recommendations and explore what they reveal about Deere (DE).

Understanding Brokerage Recommendations for DE

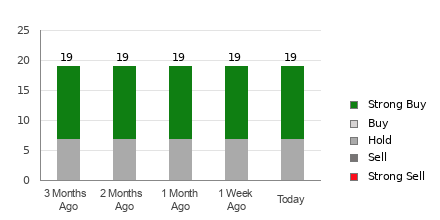

Deere currently holds an average brokerage recommendation (ABR) of 1.79, indicating a positive outlook. However, the reliability of such recommendations has been brought into question over the years.

Out of the 21 recommendations contributing to the ABR, a majority of 57.1% are Strong Buy, with the rest at Buy, totaling 4.8%. While these may seem encouraging, investors should exercise caution when solely basing decisions on this data.

Evaluating the Intricacies of Brokerage Recommendations

A common critique is the inherent bias of brokerage firms, positively skewing their ratings due to vested interests. Studies have revealed the prevalence of “Strong Buy” ratings compared to “Strong Sell”, reflecting the misalignment of interests with retail investors.

Contrastingly, the Zacks Rank assesses stocks based on earnings estimate revisions, presenting a more neutral and data-driven perspective. This model has demonstrated its effectiveness in predicting stock price movements over time.

Comparing ABR with Zacks Rank

While both measures utilize a scale of 1-5, they diverge in their underlying methodologies. The ABR leans heavily on brokerage recommendations, often influenced by biases, whereas the Zacks Rank is underpinned by quantitative analysis of earnings estimates.

Moreover, the timeliness and freshness of the Zacks Rank’s insights offer an advantage over potentially outdated ABR data, aligning with the dynamic nature of stock markets.

Insights into DE’s Prospects

Given the steady consensus estimate for Deere at $28.46, the Zacks Rank has designated it as a #3 (Hold). This indicates a cautious stance, highlighting the importance of considering multiple factors when evaluating investment opportunities.

Navigating Investment Decisions for DE

As investors navigate the landscape of brokerage recommendations, it’s crucial to supplement these insights with comprehensive analyses and alternative tools. A well-rounded approach, combined with a critical lens, can aid in making informed and profitable investment decisions.

Explore the complete list of today’s Zacks Rank #1 (Strong Buy) stocks for further insights.

Access the Free Stock Analysis Report for Deere & Company (DE) on Zacks.com.

Explore more from Zacks Investment Research.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.