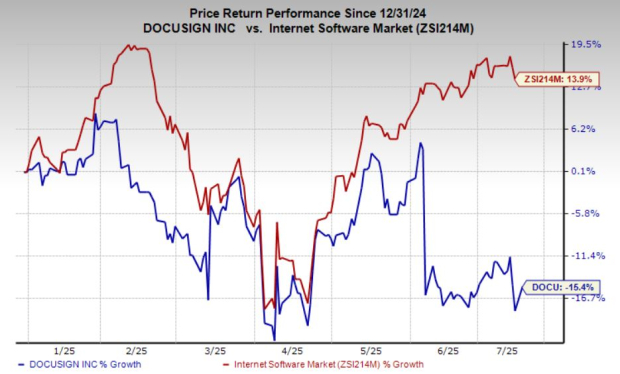

Docusign, Inc. (DOCU) has seen its stock decline by 15.4% year-to-date, contrasting sharply with a 14% gain in its industry and a 6% increase in the Zacks S&P 500 composite. Currently, DOCU’s stock is priced at $76.21, which is around 29% below its 52-week high of $107.86, and it is trading under its 50-day moving average, indicating bearish investor sentiment.

In its first quarter of fiscal 2026, Docusign reported total revenues of $764 million, an 8% year-over-year increase, with $746 million coming from subscriptions. Net revenue retention improved to 101%, and the company generated $228 million in free cash flow, reflecting a 30% margin. However, growth projections suggest more modest performance ahead, with expected revenue increases of 6% in fiscal 2026 and fiscal 2027.

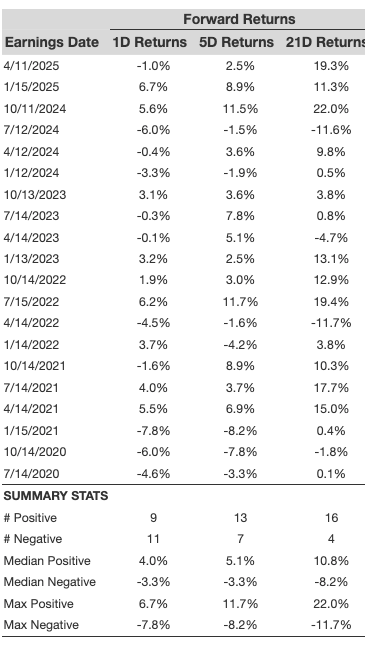

Despite these developments, analysts recommend a hold on DOCU, citing investor uncertainty and modest growth outlooks. Docusign’s current rank is #3 (Hold) in the Zacks rankings, prompting investors to await clearer signs of acceleration before making purchasing decisions.