The Upgraded Recommendation

We have upgraded our assessment of Apple Inc. (NASDAQ:AAPL) stock from a Sell to a Buy after witnessing a remarkable turnaround following the lackluster performance in June 2023. The ramifications of Apple’s triumphant resurgence resonate positively, propelling our confidence in the company’s forthcoming sales and profitability.

Anticipating the highlights of 2024, the imminent release of the new iPhone 15 and the launch of their Vision Pro augmented reality glasses are pivotal forces poised to fuel Apple’s growth trajectory.

Fueling Growth in 2024

Our conviction in Apple’s potential surpassing the tepid projections rests on several factors. Firstly, the deployment of AI-powered innovations across Apple’s product spectrum is set to be a growth catalyst, enhancing the appeal of their offerings. Secondly, reprising its position as the leading smartphone vendor and the robust growth of its services business are instrumental in underpinning sustained revenue expansion.

Furthermore, the introduction of novel products and services is anticipated to yield operating efficiencies that accelerate earnings per share (EPS) growth, outpacing revenue increments. Lastly, Apple’s substantial share repurchase program is poised to deliver a favorable lift to EPS through prudent financial engineering.

Considering the tailwinds from AI products, service momentum, operational leverage, and capital management, it is evident that Apple’s growth potential transcends the conservative estimates currently prevailing in the analyst community. The narrative is more potent than convention suggests, and we anticipate unanticipated positive developments to unfold in 2024.

Furthermore, the forthcoming launch of Apple’s Vision Pro augmented reality headset on January 19th and its subsequent availability for shipment starting February 2nd piques our interest. Scrutinizing Vision Pro’s prospective impact can arm investors with valuable foresight to navigate its impending market debut. Despite being discounted by the market, we opine that the Vision Pro holds the potential to exceed prevailing expectations once it hits the market.

Innovatively designed to mitigate discomfort and dizziness concerns, the Vision Pro’s discrete battery configuration enables extended usage, expanding its utility beyond gaming into productivity applications. Additionally, Apple’s competitive standing vis-à-vis Meta Platforms, Inc. (META) is bolstered by VisionOS, allowing seamless access to an array of existing 2D iOS apps until their AR equivalents materialize.

Apple’s Recent Dominance in the Market

Amid the revelatory news of Apple usurping Samsung Electronics Co., Ltd. (OTCPK:SSNLF) as the foremost smartphone brand in 2023, as per IDC, a wave of exhilaration engulfed the market. It comes as no surprise given the palpable momentum behind the launch of the iPhone 15, substantiated by a surge in Google search interest exceeding its predecessor, the iPhone 14.

Eclipsing its contemporaries in smartphone shipments fortifies Apple’s negotiating leverage with suppliers, further consolidating its preeminent position in the market.

Apple’s Strategy and Evolving Culture

The tenure of Tim Cook at the helm heralded a paradigm shift in Apple’s corporate ethos, marking a departure from the innovative fervor hallmarking the Steve Jobs era. While subjected to ridicule during each iPhone launch, present-day Apple has metamorphosed into a profit-centric entity, iteratively refining existing technology. Consequently, securing premier components and manufacturing capacity has emerged as a linchpin of Apple’s operational strategy.

The Dawn of AI and Consumer Electronics in 2024

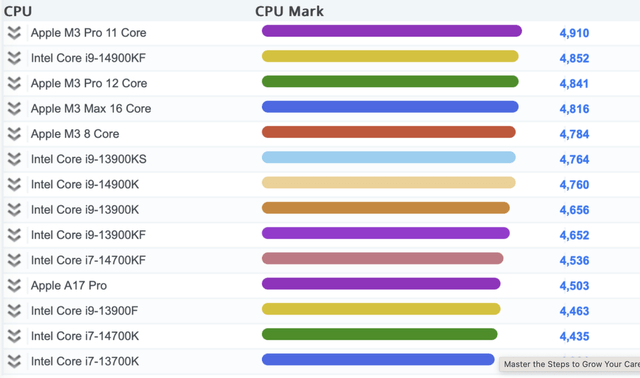

The consumer electronics landscape in 2024 is poised for a transformative overhaul, spearheaded by AI-infused phones and computers. Despite Alphabet Inc. (GOOG, GOOGL) and Samsung’s preemptive foray into AI gadgets, Apple’s potential to make a resounding entry remains undiminished. Leveraging its industry affiliations to procure state-of-the-art chips, such as the cutting-edge 3nm processors from Taiwan Semiconductor Manufacturing Company Limited (TSM) earmarked for the iPhone 15, catalyzes Apple’s competitive edge.

The impending surge in AI appliances portends a new cycle of consumer tech, accentuating Apple’s growth trajectory in 2024. Concurrently, amidst speculative murmurs surrounding its rumored augmented reality headset, Apple’s prowess in refining emerging technologies in an intuitive and aesthetically pleasing manner augurs well. Augmented reality, potentially metamorphosing into a mainstream computing platform, constitutes a pivotal inflection point to monitor. Importantly, we prognosticate that Vision Pro will not cannibalize iPhone or Mac sales but rather fortify incremental revenue, strengthening Apple’s ecosystem.

Comparative Analysis against Meta’s Quest 3

The prevailing market consensus appears remiss in fully factoring in the potential

Apple’s Vision Pro: Shaking Up the AR/VR/MR Market in 2024

Investors may not have fully explored the potential of Apple’s Vision Pro yet for two reasons: (1) it hasn’t launched yet, and (2) the current VR/AR market isn’t very active right now.

However, we believe Apple’s Vision Pro could really shake up and revive the AR/VR/MR market in 2024. It seems focused on solving some of the issues with current headsets and improving the overall customer experience.

Apple has a history of coming into emerging tech markets late, but then completely changing the game. The Vision Pro launch could spark a lot more mainstream interest and adoption of AR/VR tech.

To demonstrate how we believe Apple’s strategy can impact the AR/VR/MR market in 2024, we will utilize Meta’s Quest 3 as an example. We’ll also chat about Apple’s competitive edge in this market. Later, we want to talk about which types of users and scenarios seem the best fit for Apple’s product, and how the launch could impact Apple’s stock price.

Enhancing the VR Experience

VR headsets can offer a really convenient and visually engaging experience compared to current consumer electronics, especially for more passive activities like browsing, watching videos, and reading articles online. However, issues like dizziness and heavy weight have prevented VR from going fully mainstream so far.

Doing these more “passive” activities in the Quest 3 is easier and better than staring at a computer screen, phone, or even a 4K TV. The Quest’s screen size and resolution either match or blows those other devices out of the water. And you can adjust the virtual screen size and distance to customize it perfectly for you.

What we love is the transparent mode that lets you see the real world while using the headset. We can be watching a YouTube video then get up and walk to the kitchen for coffee, stop on the couch, or even use the bathroom without taking the headset off or pausing what we’re doing. That’s huge for multitasking and avoiding interruptions if you’re deep into research or focused work.

The virtual keyboard works surprisingly well too for light typing needs. You can also use hand-tracking gestures to navigate. Overall, the typing and input experience feels slightly inferior to using a real keyboard or touchscreen. But it’s good enough for casual use.

We think the Quest 3 really nails convenience and flexibility for productive at-home use cases. Once you free yourself from a fixed screen and can move around freely, it’s hard to go back. We’re excited to see how Apple pushes the envelope further with the Vision Pro glasses.

Apple’s Refinement of AR/VR Technology

So let’s chat about Apple and the new Vision Pro glasses. This is a new product for Apple, but it utilizes existing mature AR/VR technologies.

To provide some perspective, let’s look at Meta CEO Mark Zuckerberg’s recent comments on the Vision Pro:

“There’s no kind of magical solutions that they have to any of the constraints on laws of physics that our teams haven’t already explored and thought of.”

He’s right that companies like Meta, Samsung, Microsoft, and Sony have been leading in AR/VR, steadily advancing the core technologies over the years. Apple wasn’t first – they’ve never been shy about being late adopters when it comes to the latest tech, whether it’s photography, charging, or other innovations.

But what Apple excels at is refinement and fine-tuning. Rather than inventing brand-new tech, they focus intensely on performance, stability, and polish. We’ve seen this movie before.

Additionally, by controlling both the hardware and software, Apple faces far fewer compatibility issues compared to the fragmented Android landscape.

Anticipating the Vision Pro Experience

Quote from Bill Gates:

“Your most unhappy customers are your greatest source of learning.”

So what lessons acquired from Meta can Apple apply to the improvement of MR headsets? Let’s look at a couple of areas:

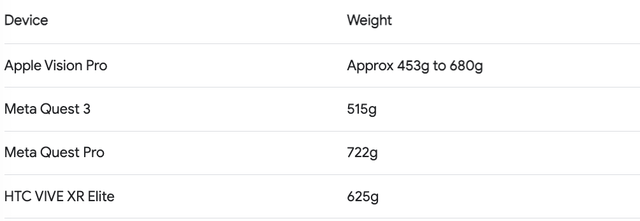

1. Reducing Weight

After using the Quest 3 for about an hour, we definitely felt the weight on our necks and shoulders even while changing positions. Early reviews suggest it’s around 453g, including 200-300g for the separate battery pack. Compared to Quest 3, the experience is enhanced by moving the battery off the head. Thus, in theory, it may partially resolve the weight problem.

2. Increasing Resolution/Adopting AR to Solve Dizzy Issues

Mark Zuckerberg seemed to dismiss the benefits of higher-resolution displays:

“They went with a higher resolution display, and between that and all the technology they put in there to power it, it costs seven times more and now requires so much energy that now you need a battery and a wire attached to it to use it. They made that design trade-off and it might make sense for the cases that they’re going for.”

We agree that Quest 3’s resolution is good enough for media viewing. But the see-through VR mode is pixelated and blurry. That’s because it’s not true transparency – the cameras capture your surroundings and project it on the screens. While you’re focused on the virtual content most of the time, the low VR visual quality causes eye strain and dizziness with prolonged use. It seems like Mark Zuckerberg and Meta have been laser-focused on building a virtual world that connects everyone. That’s why their VR technology prioritizes creating a completely immersive and visually stunning alternate reality you can share with others.

But in Meta’s rush to build this virtual universe, they may have neglected some vital aspects of user comfort and practicality. Apple’s Vision Pro may address these issues and provide a more user-friendly immersive experience.

Apple’s Vision Pro Augmented Reality Headset: A Potent Tool for Investors to Analyze

Apple’s ambitious foray into augmented reality (AR) with the Vision Pro headset is bound to create ripples in the tech sphere. In a world where digital experiences are increasingly intertwined with reality, this device appears to be a forerunner in seamlessly blending the two worlds. The Vision Pro, touted to provide a more natural and less disorienting experience, is expected to trump Meta’s Oculus Quest 3 in integration with the real world. With its competitive edge, the Vision Pro holds promising potential for investors seeking long-term success in the AR market.

Apple’s Developer Community Dominance Over Meta

Apple’s extensive pool of app developers places it at a distinct advantage for the integration of AR into its ecosystem. In comparison, Meta’s Oculus Quest, despite being a top-selling headset, lacks a rich assortment of productivity tools, which could hinder its market appeal. The introduction of Vision OS, enabling the downloading of iPhone and iPad apps onto the headset, sets Apple apart. The abundance of apps available on the App Store for iOS gives the Vision Pro a competitive edge, potentially widening its market reach and ensuring long-term success.

Targeting the Business Traveler Market

The Vision Pro’s user experience is tailored to cater to the needs of knowledge workers and creatives, enhancing media viewing and reading. The device is poised to appeal to senior managers seeking to boost productivity while working remotely. Despite concerns regarding its design, the Vision Pro’s potential to elevate reading and focused work experiences cannot be overlooked. Moreover, the premium pricing strategy deployed by Apple aligns with its historical approach of targeting affluent early adopters, laying the groundwork for mainstream adoption. The exclusivity associated with the high price could ignite demand and cultivate a aspirational aura, similar to the strategy employed during the launch of the original iPhone.

Promising Market Opportunities

The Vision Pro’s potential impact on Apple’s bottom line is undeniably vast. Its appeal to business travelers, both in the U.S. and globally, has the potential to drive substantial revenue. Additionally, the device’s allure for affluent consumers as a home entertainment option and status symbol presents yet another avenue for revenue growth. These market opportunities position the Vision Pro as a significant catalyst for Apple’s continued success.

Valuation and Future Outlook

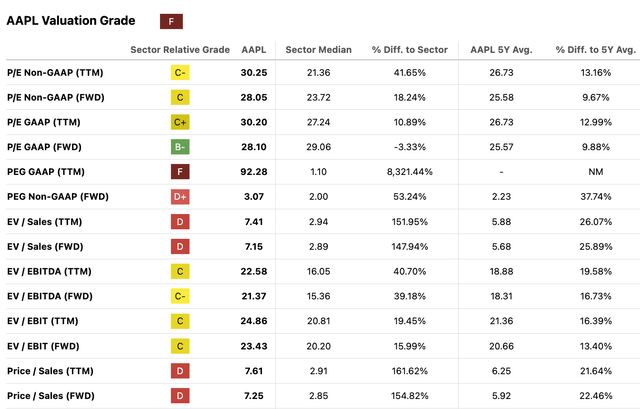

Despite Apple’s seemingly high valuation based on P/E and P/S ratios, the cautious estimates by analysts for 2024 fail to fully capture the potential impact of forthcoming AI consumer electronics. With the impending launch of new AI consumer electronics, including smartphones, PCs, and smartwatches, Apple’s growth trajectory could prove to be more robust than current projections suggest.

Apple’s Growth Trajectory on the Rise

Apple’s growth trajectory appears to be strengthening, according to a recent analysis by financial experts. The tech giant’s potential for revenue and earnings growth in 2024 seems to be underestimated by cautious estimates, with several factors poised to boost performance beyond expectations.

Positive Indicators for Apple’s Growth

Apple’s strategic positioning in the market suggests an upward trajectory, underpinned by multiple growth drivers. The company’s AI products, especially the anticipated Vision augmented reality headset, are anticipated to make a substantial impact in the latter half of 2024. As a premium brand, Apple is poised to grow at a pace that matches or even surpasses overall market trends.

Additionally, Apple’s services revenue experienced a commendable 15% growth in the last quarter of 2023, driven by a stable, recurring revenue stream linked to its extensive user base. Regaining the top spot in shipments adds to the momentum, indicating sustained service revenue growth.

Furthermore, industry experts believe that current estimates may not fully account for the potential uplift from the rumored Vision headset and associated services, signaling a significant growth opportunity for the company.

Given these promising prospects, there is a consensus that revenue growth assumptions for Apple are unduly conservative. If the company can escalate its top line, the subsequent operating leverage is expected to further amplify earnings growth. Notably, the aggressive share buyback program, leading to a reduction in outstanding shares by approximately 3% annually, is set to deliver a substantial portion of the baseline EPS growth as projected by analysts.

Moreover, Apple’s profitability has significantly expanded compared to historical levels, evident from a substantial increase in gross margins by 350 basis points and a remarkable return on equity (ROE) of 171%, far exceeding the 5-year average of 106%.

The company’s outstanding ROE positions it as a top performer among its large tech peers. This performance is particularly crucial in the current climate of concerns surrounding lofty valuations in the tech sector, affirming the company’s justified premium pricing based on its exceptional performance.

Risks and Concerns for Apple

Despite the positive outlook, Apple is not immune to risks, especially if its revenue growth encounters a slowdown or decline. Following a cautious stance on Apple in early June 2023 due to declining profitability indicators, including gross margin and operating income, there were concerns around the company’s performance amidst lower product sales in the April quarter. Nonetheless, recent quarters have seen a reversal in this trend, indicating a return to bottom-line expansion with growth across key performance metrics.

Apple has fortified its defenses to mitigate risks for investors seeking stock price growth. The stability of its service revenue streams, coupled with brand loyalty and a closed ecosystem, ensures high product margins. Diverse revenue streams, disciplined spending, and ongoing share buybacks also enhance the company’s position to deliver EPS growth despite potential headwinds, thereby allaying concerns around earnings contraction.

Conclusion

In light of the compelling indicators of Apple’s growth resurgence, financial experts have upgraded the rating on Apple stock to a Buy, reflecting confidence in the company’s improved growth trajectory. Analysts believe that Apple has successfully navigated past the profit downturns experienced in the previous year and anticipate stronger revenue and earnings performance in 2024.

Looking ahead, Apple’s focus on innovation, sustained momentum in services revenue, operating leverage from new products, and capital allocation strategies position the company to outperform conservative projections for 2024 growth. With upcoming launches such as the Vision Pro AR glasses and the anticipated re-acceleration in iPhone sales, Apple is poised for a resurgence that is generating growing optimism among market observers.