Ford Reports Q1 Earnings Beat, Faces Tariff Challenges Ahead

U.S. auto giant Ford (F) exceeded earnings expectations in Q1 2025. However, the company’s outlook for the rest of the year remains unclear due to ongoing tariff challenges. Ford has opted to suspend its financial guidance until there is greater clarity regarding the impact of retaliatory tariffs and consumer reactions to rising prices.

The company anticipates a $2.5 billion impact stemming from U.S. tariffs. To mitigate this loss, Ford aims to offset $1 billion through strategies such as utilizing bond carriers for vehicle transport from Mexico to Canada, pricing adjustments, and increasing production volumes. Nevertheless, the remaining $1.5 billion impact for 2025 continues to pose a concern.

The automotive sector is now grappling with a 25% tariff on imported vehicles, which took effect in early April, alongside similar levies on auto parts failing to meet the United States-Mexico-Canada Agreement (USMCA) standards, beginning recently. Ford has cited supply chain disruptions and additional potential retaliatory tariffs as contributors to an uncertain market environment. The expected tariff impact could reduce U.S. auto industry sales by approximately 500,000 units. Ford had previously projected EBIT between $7 billion and $8.5 billion, with free cash flow ranging from $3.5 billion to $4.5 billion.However, due to the macroeconomic challenges and tariff pressures, Ford’s financial outlook for 2025 is now in jeopardy, as these tariff-related issues continue to overshadow its goals.

General Motors, Harley-Davidson, and Tesla Also Affected

Ford is not alone in feeling the effects of these tariffs. Other automakers such as General Motors (GM), Harley-Davidson (HOG), and Tesla (TSLA) have similarly reduced, suspended, or retracted their financial guidance in light of increasing uncertainties.

General Motors has downgraded its 2025 earnings forecast, foreseeing potential losses of $4 to $5 billion due to new U.S. tariffs. It now expects adjusted EBIT for 2025 to fall between $10 billion and $12.5 billion, down from its previous estimate of $13.7 billion to $15.7 billion. Additionally, GM has temporarily halted its share buyback program amidst these uncertainties.

Similarly, Harley-Davidson has also withdrawn its guidance due to the economic climate and tariff implications. The motorcycle manufacturer expects its tariff costs to reach $175 million this year, despite primarily sourcing parts from U.S. suppliers. A portion of its components still comes from China, which now faces significant tariffs.

In the case of Tesla, CEO Elon Musk revised his 2025 vehicle growth goals from 20-30% to more conservative expectations during the Q4 earnings call. The company has not reaffirmed these adjusted targets in its latest quarterly update, opting instead to revisit its 2025 delivery volume guidance during the Q2 report.

Ford’s Stock Performance and Market Valuation

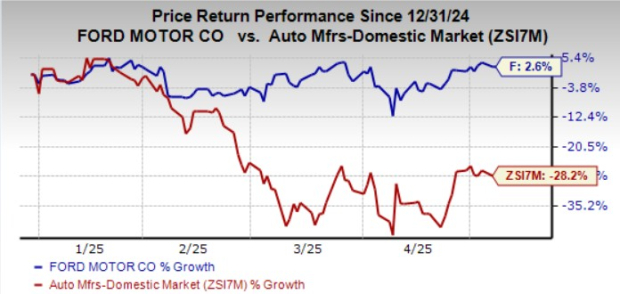

Despite these challenges, shares of Ford have risen about 3% year to date, contrasting with a 28% decline in the broader industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In terms of valuation, Ford trades at a forward price-to-sales ratio of 0.25, which is below the industry average. The company holds a Value Score of A.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

According to the Zacks Consensus Estimate, Ford’s earnings for 2025 indicate a projected year-over-year decline of 32.6%. The following chart outlines how EPS estimates for 2025 and 2026 have changed over the last 60 days.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Currently, Ford (F) holds a Zacks Rank #3 (Hold), indicating a cautious stance on its stock at this time.