Ford Invests Nearly $5 Billion to Strengthen European Operations

Ford F aims to revitalize its struggling European business with a significant investment plan to inject up to €4.4 billion ($4.8 billion) into its German operations. This move is critical as Ford-Werke, the company’s German subsidiary, carries €5.8 billion ($6.3 billion) in debt. The investment seeks to improve competitiveness amidst pressures from rising costs, declining demand, and increased competition from Chinese electric vehicle (EV) manufacturers like BYD Co Ltd.

The automaker has faced financial losses in Europe for several years, prompting cost reductions and a restructuring plan. Last November, Ford announced an additional 4,000 job cuts by 2027, citing sluggish EV demand and intense competition. With this latest cash infusion, Ford hopes to stabilize its German division and foster a multi-year recovery plan.

Ford is not alone in its challenges. Volkswagen VWAGY is also downsizing, even considering plant closures to maintain competitiveness. The rapid expansion of Chinese EV brands necessitates a strategic reassessment for traditional automakers. Will Ford’s capital injection successfully revive its European operations, and is it a good time to consider investing in its stock?

F stock has fallen 20% over the past year, currently trading around $10. Investors may wonder whether it’s prudent to buy Ford now or wait due to ongoing tariff disputes and economic uncertainties. Let’s take a closer look.

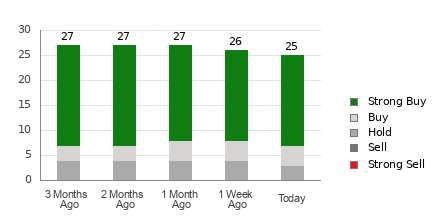

1-Year Price Performance Comparison

Image Source: Zacks Investment Research

Segmentation Analysis: Challenges and Opportunities

Ford’s business segments display mixed performance. While the Model e and Ford Blue segments are under pressure, Ford Pro shows promise.

The Model e division, responsible for Ford’s EVs, reported a loss of $5.07 billion in 2024, exceeding its $4.7 billion loss in 2023. Issues such as fierce competition and high costs for next-generation EVs continue to impact profitability, with forecasts predicting another loss of $5-5.5 billion this year. In contrast, Ford’s rival, General Motors GM, is managing to cut EV losses and enhance profitability.

The Ford Blue segment, which includes traditional gasoline-powered vehicles, is also showing signs of weakness. The company anticipates a decline in EBIT for 2025 to $3.5-4 billion from $5.3 billion in 2024, driven by lower sales of internal combustion engine vehicles, changes in product mix, and foreign exchange challenges.

Conversely, Ford Pro, the commercial vehicle segment, excelled in 2024, achieving a 15% revenue increase to $67 billion. EBIT rose from $7.2 billion to $9 billion, with a 13.5% margin, fueled by strong demand for Super Duty trucks and Transit vans, alongside growth in software and service subscriptions. Ford’s emphasis on technology and software services may prove to be a vital growth driver going forward.

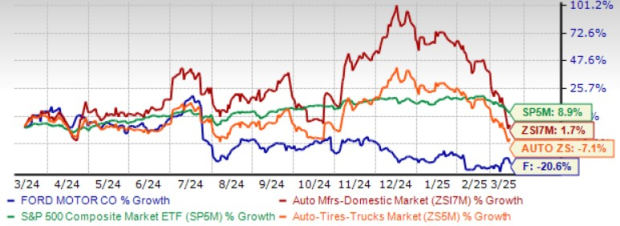

Financial Stability and Dividend Performance

As of 2024, Ford holds $47 billion in liquidity, including $28 billion in cash, establishing a strong financial foundation for its Ford+ strategy. The company is committed to cost reduction, having saved $500 million in the second half of 2024 and targeting $1 billion in further product design cuts for 2025. With a dividend yield exceeding 6%, significantly higher than the S&P 500’s average of 1.31%, Ford maintains a strategy that may reassure investors.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Ford plans to return 40-50% of its free cash flow to investors, providing stability amid stock volatility. Its strong liquidity and focus on cost-cutting could aid its recovery, although market uncertainties remain a significant concern.

Tariff Implications and Market Outlook

Ford faces significant challenges due to the anticipated 25% tariffs on imports from Mexico and Canada, effective April 2 under the Trump administration. CEO Jim Farley cautioned that these tariffs could introduce “a lot of cost and a lot of chaos” to the U.S. auto industry. Increased raw material costs could elevate vehicle prices, negatively impacting demand and profitability.

Moreover, Ford expects its first-quarter 2025 adjusted EBIT to break even, a stark contrast to $2.7 billion in Q1 and $2.1 billion in Q4 of 2024. This forecast is based on reduced volumes, a 20% production cut, and expenses related to plant launches. The full-year adjusted EBIT is estimated to be between $7 billion and $8.5 billion, down from $10.2 billion in 2024, with rising warranty and incentive costs likely threatening margins.

Importantly, Ford’s guidance does not account for potential changes in policy under a Trump administration, indicating the possibility of further deterioration.

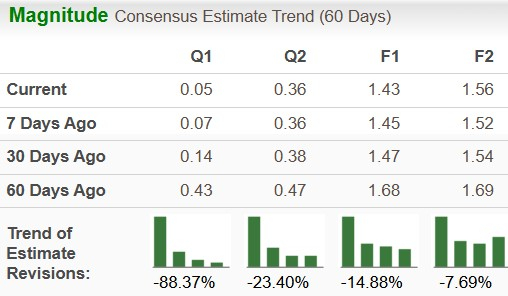

Zacks Consensus Estimates for Ford

The Zacks Consensus Estimate indicates a 4% decline in sales and a 22% drop in EPS for 2025. However, projections for 2026 suggest a rebound, with sales and EPS growth of 2% and 9%, respectively. Unfortunately, Ford’s EPS estimates have trended downward in the past 60 days, raising concerns among analysts.

Image Source: Zacks Investment Research

Investment Outlook: Buy, Hold, or Sell F Stock?

While Ford’s restructuring in Europe and strong performance of Ford Pro provide a favorable outlook, the company faces near-term hurdles. Weak consumer demand, fierce competition, and substantial losses in the EV sector may strain profitability. Furthermore, the proposed tariffs, coupled with production cuts and lower earnings guidance for 2025, add to the uncertainty.

For current investors, Ford’s liquidity and substantial dividend yield present a level of security, suggesting it may be wise to hold. Conversely, new investors might consider waiting for clearer insights regarding tariffs, EV profitability, and overall market conditions before making a purchase. The stock could experience further challenges before any meaningful turnaround occurs.

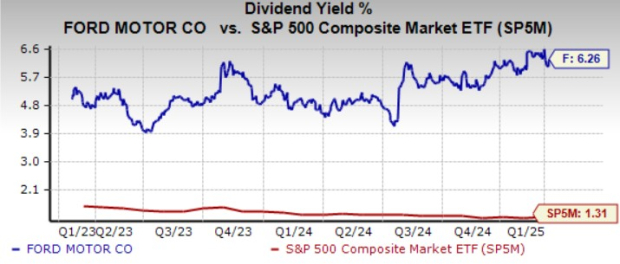

Ford currently holds a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

7 Best Stocks for the Next 30 Days

Just released: Experts have highlighted 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They believe these tickers are “Most Likely for Early Price Pops.”

Since 1988, this curated list has outperformed the market by more than 2X, averaging a gain of +24.3% annually. Be sure to check out these 7 stocks.

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days today. Click for your free report.

Ford Motor Company (F): Free Stock Analysis report.

General Motors Company (GM): Free Stock Analysis report.

Volkswagen AG Unsponsored ADR (VWAGY): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.