GameStop Prepares for Q1 Earnings Amid Strategic Transformation

GameStop Corp. (GME) will announce its first-quarter fiscal 2025 earnings on June 10 after market close, prompting investors to decide whether to buy or maintain their current positions.

With the earnings landscape shifting, assessing critical factors that will impact GameStop’s performance is essential to determine if the stock represents a viable entry point ahead of its earnings report.

The company is undergoing a strategic shift toward a more digital-centric business model, focusing on e-commerce and digital gaming to better align with emerging consumer preferences and industry trends.

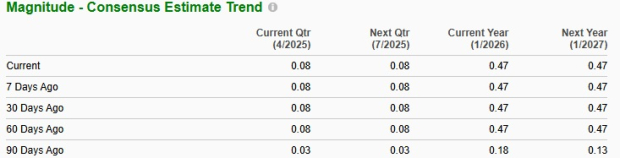

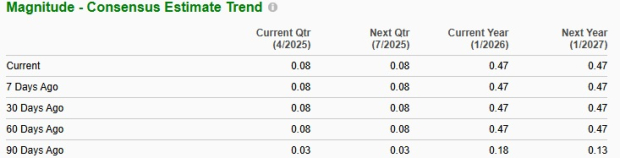

The Zacks Consensus Estimate anticipates first-quarter revenues of $750 million, reflecting a 16% decrease from the previous year. For earnings, analysts project a consensus estimate of 8 cents per share, indicating a 166.7% year-over-year increase.

Image Source: Zacks Investment Research

Over the last four quarters, GameStop has shown an average earnings surprise of 137.8%. In its last reported quarter, the company exceeded the Zacks Consensus Estimate by 233.3%.

GameStop Corp. Price, Consensus and EPS Surprise

GameStop Corp. price-consensus-eps-surprise-chart | GameStop Corp. Quote

Predictions for GME’s Q1 Earnings

As GME’s first-quarter results approach, uncertainty remains regarding whether the company will meet earnings expectations. Current analysis does not indicate a strong likelihood of an earnings beat, as GameStop holds a Zacks Rank #3 (Hold) and an earnings ESP of 0.00%.

The Zacks model emphasizes that a combination of a positive earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) increases the chances of an earnings beat, which is not applicable in this instance.

Key Factors Impacting GameStop

GME’s fiscal first-quarter outlook reflects ongoing transformation amid challenges in its traditional business. The company is expanding in higher-margin categories like collectibles, reducing reliance on gaming hardware and software.

In addition, GameStop focuses on cost-cutting, optimizing its store footprint, and enhancing profitability. Efforts include restructuring international operations, such as selling its units in France and Canada.

Conversely, the legacy revenue channels, particularly in Hardware & Accessories and Software, are expected to experience continued declines. The transition to digital downloads and subscription services lessens reliance on physical products, posing risks for revenue performance.

Market Performance of GameStop

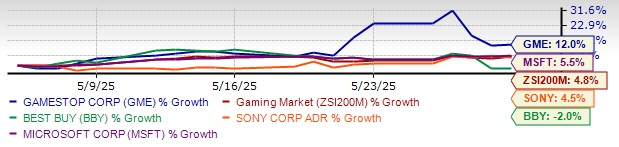

Over the past month, GameStop’s stock price has increased significantly. Closing at $29.80 last Friday, GME’s price surged 12%, outperforming the industry’s gain of 4.8%.

Compared to competitors, GameStop surpassed Best Buy Co., Inc. (BBY), Microsoft Corporation (MSFT), and Sony Group Corporation (SONY). Microsoft’s and Sony’s shares rose 5.5% and 4.5%, while Best Buy shares fell by 2% during the same period.

Image Source: Zacks Investment Research

Valuation of GameStop Stock

Currently, GME trades at a premium compared to its industry peers. Its forward 12-month price-to-sales (P/S) ratio is 4.10, exceeding the industry average of 3.22 and the sector’s average of 2.14, indicating market sentiment drives the premium rather than fundamentals.

GME’s valuation is higher than Best Buy, with a forward 12-month P/E ratio of 0.34, and Sony’s at 1.87, but lower than Microsoft’s ratio of 11.02.

GME Valuation vs. Industry

Image Source: Zacks Investment Research

Investment Considerations for GameStop

GME is undertaking crucial steps toward operational efficiency, a digital-first approach, and higher-margin markets, signaling potential long-term growth. However, the premium valuation may deter some investors. Current shareholders might consider holding while evaluating future entry points.

# GameStop Eyes Q1 Earnings Amid Operational Shifts

## GME: A Speculative Pre-Earnings Opportunity?

GameStop Corp. is undergoing significant changes as it heads toward its Q1 earnings report. The company’s efforts in collectibles, digital expansion, and cost reduction show potential for long-term stability. However, its main business continues to be impacted by industry changes and digital competition.

Recent stock performance indicates growing investor interest. Yet, with valuations exceeding fundamentals and no anticipated earnings boost, investors may consider a cautious approach.

## Notable Semiconductor Stock Recommended by Zacks

Zacks Investment Research highlights a new top semiconductor stock that is only 1/9,000th the size of NVIDIA, which has seen an 800% increase since its recommendation. This new stock has strong earnings growth and a growing customer base, aimed at meeting demand in Artificial Intelligence, Machine Learning, and IoT sectors.

Global semiconductor manufacturing is projected to grow from $452 billion in 2021 to $803 billion by 2028.