Investors rely on the recommendations of Wall Street analysts to make informed decisions about stock transactions. However, the reliability of these brokerage-firm-employed analysts and their ratings is a subject of debate. Nonetheless, understanding what these financial experts think about Griffon (GFF) is crucial before delving into their analysis and how it can benefit potential investors.

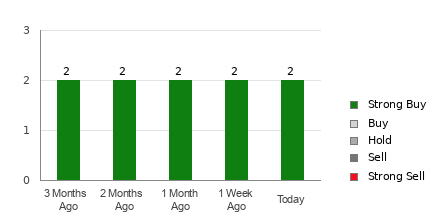

Griffon’s Average Brokerage Recommendation (ABR)

Griffon currently has an Average Brokerage Recommendation (ABR) of 1.00, translating to a Strong Buy rating, based on the input of four brokerage firms. This unanimous Strong Buy rating from all four recommendations implies an optimistic outlook for Griffon.

Brokerage Recommendation Trends

Although the ABR recommends buying Griffon, it is important to note that relying solely on this information might not be prudent. Research has shown limited success in using brokerage recommendations to predict stocks’ price increases. Brokerage firms often demonstrate a strong positive bias in favor of stocks they cover, making their recommendations less reliable for retail investors.

As such, it is advisable to use this data to complement your own analysis or consider more reliable prediction tools, such as the Zacks Rank, which is widely acknowledged for its accuracy in predicting stock performance.

Zacks Rank vs. ABR

It is crucial to distinguish between the ABR and Zacks Rank. While both are rated on a scale from 1 to 5, the ABR is solely based on brokerage recommendations, whereas the Zacks Rank is a quantitative model leveraging earnings estimate revisions to predict stock performance.

Unlike ABR, which may not always be up-to-date, the Zacks Rank responds promptly to analysts’ revisions of earnings estimates, ensuring timely and accurate projections of future stock prices.

GFF: A Worthy Investment?

Griffon’s impressive track record is underscored by a 3.9% increase in the Zacks Consensus Estimate for the current year, indicating growing optimism among analysts regarding the company’s earnings prospects.

The recent surge in consensus estimates has propelled Griffon to a Zacks Rank #1 (Strong Buy), reflecting a favorable outlook on the stock’s performance.

Unveiling Zacks’ Top Stock Pick

Zacks’ team of experts has identified a potential game-changing stock with a strong outlook, offering substantial upside for investors. This stock is backed by significant developments in the medical field, presenting a timely opportunity reminiscent of past successful investments in companies like Boston Beer Company and NVIDIA.

Get Our Top Stock Pick and 4 Runners Up for Free

Final Thoughts

Griffon (GFF) presents an intriguing investment opportunity, supported by a consensus Strong Buy rating and its robust earnings outlook. While brokerage recommendations may bear a positive bias, it is advisable to combine such insights with reliable models like the Zacks Rank for a more comprehensive investment decision.

Access Griffon Corporation (GFF) Free Stock Analysis Report

Read the full article on Zacks.com

The views and opinions expressed herein do not necessarily reflect those of Nasdaq, Inc.