Heritage Insurance Posts Mixed Q1 2025 Results Amid Catastrophic Losses

Heritage Insurance Holdings, Inc. (HRTG) has released its first-quarter 2025 results, which show mixed performance. The company’s earnings exceeded the Zacks Consensus Estimate, while its revenue fell short. Net premiums earned increased by 11.5%, attributed to strong operating business performance. Additionally, the combined ratio improved by 950 basis points, reaching 84.5 compared to the prior year’s figure.

CEO Ernie Garateix emphasized that “the first quarter of 2025 marked the third consecutive quarter in which Heritage faced significant catastrophe losses while still generating returns for shareholders.” The insurer’s proactive underwriting and rate adequacy measures established over the past three years position it for future growth.

Q1 2025 Overview

In the first quarter of 2025, Heritage reported earnings per share of 99 cents, surpassing the Zacks Consensus Estimate by an impressive 115.2%. This marks a remarkable 110% increase year over year. Operating revenues totaled $212 million, reflecting an 11% year-over-year gain; however, this fell short of the consensus estimate by 1.1%.

Premiums-in-force reached $1.43 billion, a 3.3% increase from the previous year. Gross premiums written totaled $356 million, slightly down by 0.2% year over year due to trends in personal lines exposure management.

Improvements in the net combined ratio were driven by reductions in both the net loss ratio and the net expense ratio. The company’s return on equity climbed 1430 basis points to 39.3%.

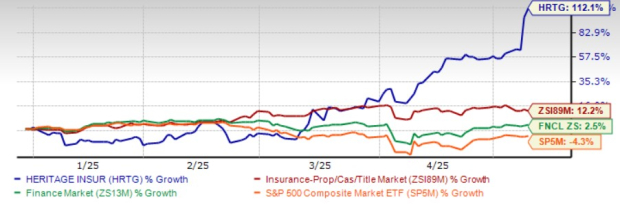

HRTG’s Year-to-Date Performance

HRTG shares have surged 112.1% year to date, significantly outperforming the industry’s growth of 12.2%, the Finance sector’s return of 2.5%, and the Zacks S&P 500 composite’s decline of 4.3%.

Heritage Insurance Outperforms Industry, Sector & S&P YTD

Image Source: Zacks Investment Research

In comparison, HCI Group (HCI) and Universal Insurance Holdings (UVE) also demonstrated strong performance in Florida, with respective increases of 32.1% and 20.8% during the same period. HCI Group is expanding into the commercial residential sector and forming strategic partnerships to ensure diverse revenue streams and improve risk management. Likewise, Universal Insurance is leveraging technological advancements and maintaining a diversified portfolio to bolster growth.

Trading Performance of HRTG

Currently, HRTG shares are trading above their 50-day simple moving average (SMA), indicating a short-term bullish trend and appealing to technical-focused investors.

Image Source: Zacks Investment Research

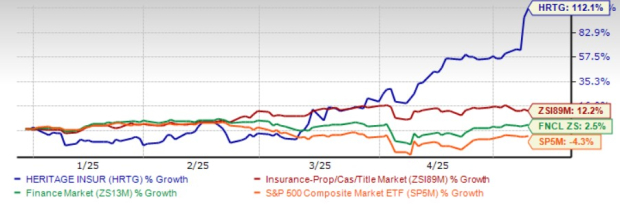

Analysts’ Target Price Suggests Caution

The Zacks average price target for HRTG, according to two analysts, is set at $19.50 per share, indicating a potential upside of 24% from the last closing price.

Image Source: Zacks Investment Research

Growth Projections for HRTG

The Zacks Consensus Estimate indicates year-over-year growth rates of 20.9% for 2025 and 28.6% for 2026, assigning HRTG a Growth Score of A.

Strategic Initiatives at HRTG

Heritage Insurance is focusing on profitability by ensuring rate adequacy, implementing profit-focused underwriting, and limiting new business in underperforming markets. In December 2022, the company ceased the issuance of new personal lines policies in Florida and the Northeast in response to declining returns and a tighter reinsurance market.

For 2025, the planned initiatives include reallocating capital to sustain profits, re-opening profitable areas, and continuing to leverage data analytics for exposure management. Heritage is also exploring expansion into more states within the excess and surplus (E&S) segment while enhancing its reinsurance strategies for better protection against catastrophic events, such as hurricanes.

Capital investments in technology and high-margin segments are central to Heritage’s long-term growth strategy. Additionally, the board has approved a $10 million share buyback program to increase shareholder value.

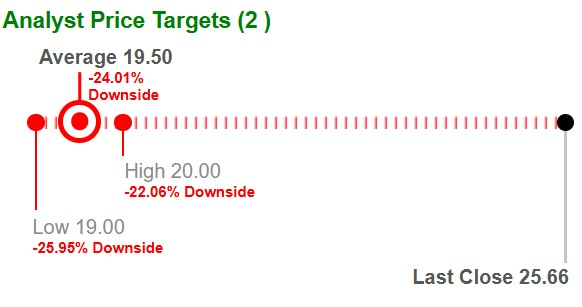

Return on Capital Metrics

Heritage Insurance’s return on equity stood at 28.7%, well above the industry average of 8.3%. This metric illustrates the company’s efficiency in using shareholder equity to generate profit.

Image Source: Zacks Investment Research

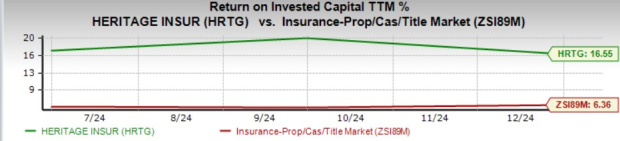

The company’s return on invested capital (ROIC) has also shown a positive trend, reaching 16.6% in the trailing 12 months, surpassing the industry average of 6.4%.

Image Source: Zacks Investment Research

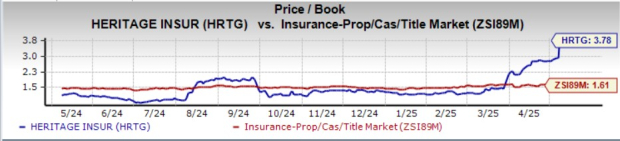

Valuation Concerns for HRTG

Currently, HRTG shares are considered overvalued in comparison to their industry peers. The stock trades at a price-to-book multiple of 3.78, which is significantly higher than the industry average of 1.61. The company holds a Value Score of A.

Image Source: Zacks Investment Research

Other notable insurers such as HCI Group and Universal Insurance have similarly been trading at valuations above the industry average.

Heritage Insurance (HRTG) Shows Promising Growth Potential

Overview of HRTG’s Financial Performance

Heritage Insurance (HRTG) is experiencing strong growth, driven by its expanding commercial residential business, steady improvements in its Excess & Surplus (E&S) division, and better pricing strategies. The company’s increasing revenue, along with expanding profit margins and solid earnings, points to a favorable outlook. HRTG holds a VGM Score of A, which underscores its commitment to accelerating growth.

Investment Considerations

Although HRTG may appear to have a premium valuation, many analysts believe it could be a valuable addition to a portfolio. The stock currently holds a Zacks Rank #1 (Strong Buy), indicating strong market support. Investors may want to consider adding HRTG to their investment strategies.

Highlighting Future Opportunities

In recent reports, Zacks’ Research Chief identified a stock anticipated to have significant growth potential. This stock is recognized for its innovative financial solutions and has already attracted a customer base of over 50 million. Given its diversified offerings, this company is poised for impressive gains in the near future, making it an interesting prospect for investors.

Noteworthy Stock Recommendations

Zacks continues to monitor elite picks for potential high returns. Previous recommendations, like Nano-X Imaging, have seen substantial gains of over 129.6% in less than nine months. Investors may be curious about the array of promising stocks featured in recent analyses.

Discover Our Top Stock and Four More Recommendations

For additional insights and analyses, you may consider the following stock analysis reports:

- HCI Group, Inc. (HCI): Free Stock Analysis Report

- Heritage Insurance Holdings, Inc. (HRTG): Free Stock Analysis Report

- Universal Insurance Holdings Inc. (UVE): Free Stock Analysis Report

For further analysis and insights into Heritage Insurance and other relevant stocks, please refer to Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.