“`html

Hims & Hers Health (NYSE: HIMS), a consumer-focused health platform founded in November 2017 and public since January 2021, reported a net income of $126 million for 2024, marking its first year of profitability. The company’s revenue surged 49.2% year-over-year, totaling $598.98 million in Q3 2024, despite missing earnings forecasts by 3 cents.

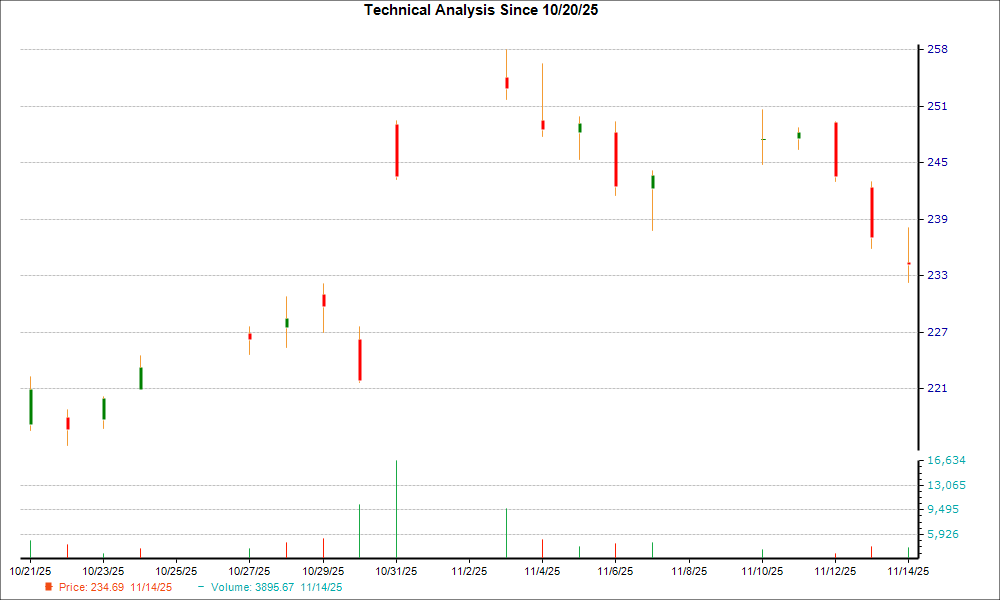

CEO Andrew Dudum noted a 50% year-over-year increase in personalized solution subscribers, which contributed to this revenue growth. Hims & Hers Health’s debt-to-equity ratio stands at 1.67, and its forward price-to-earnings (P/E) ratio has improved from 67.33 to 52.79, suggesting projected earnings growth of over 79% next year. The stock has experienced high volatility, with a 173% increase early in the year followed by significant retracements, but remains up nearly 139% since going public.

Hims & Hers operates within several high-growth industries, including telehealth and sexual health supplements, projected to grow at compound annual rates of 24.68% and 10.4%, respectively. Analysts maintain a consensus “Reduce” rating on the stock, with an average 12-month price target of $45.27, indicating a potential 24.51% upside.

“`